Last week, news broke that Russia walked out of the OPEC meeting.

Saudi Arabia was pressing its fellow oil producing nations to cut an additional 1 to 1.5 million barrels of daily oil production.

Russia walked.

Saudi unleashed the taps.

Russia said, we can do that too.

You might be thinking, there must be more to this than just ego. And yes – there’s much more at play here.

The Black Swan Is Covered in Oil

Oil prices cratered on Sunday night on news that Saudi Arabia was opening the floodgates. Saudi Arabia stated they were going to produce 12.3 million barrels per day (bpd) by April, with state-owned oil producer Saudi Aramco asked to raise their production capacity to 13 million bpd.

In the past few months before this, the Saudis had been holding steady at 9.7 million bpd.

Russia responded within minutes, with their energy minister stating that the nation could add 500,000 barrels of production.

Not to be outdone, Iraq plans to increase its oil production by 350,000 bpd.

I’ve talked ad nauseam about the “cut to kill” strategy playing out in uranium (where Kazakhstan could ramp up or cut production to kill their competition in the uranium markets)…

And now the Russians and Saudis are using the same “cut to kill” strategy to dominate the oil markets. In turn, it will kill their competition.

Then Meltdown Monday happened.

The Dow Jones fell 2,000 points with energy stocks taking massive beatings. Chevron shares fell over 15%, more than any other time since October 1987.

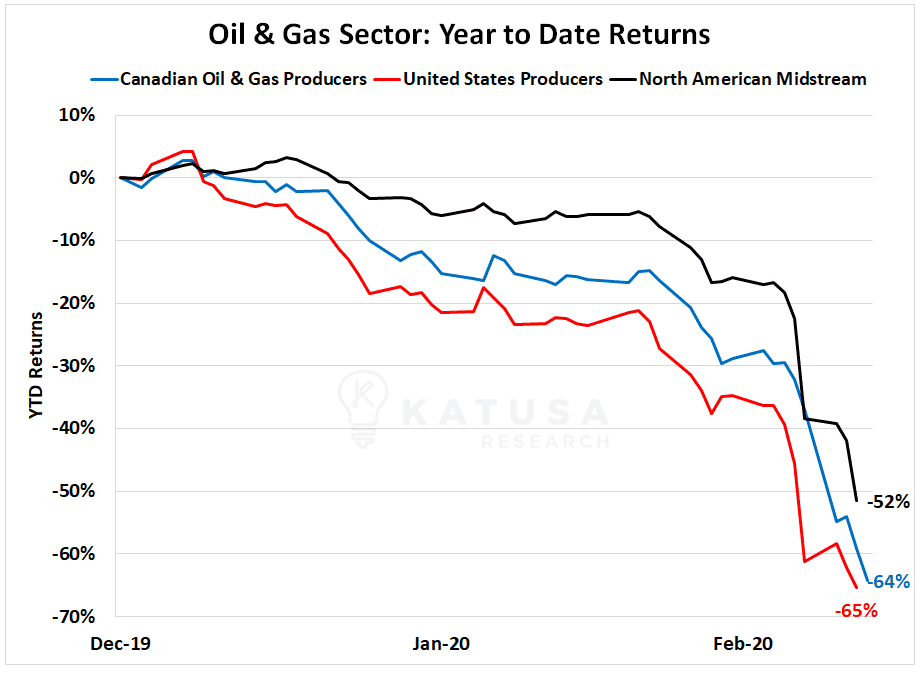

On a year to date basis, oil related stocks have been decimated.

Canadian oil producers were crushed… down an average of 58% YTD.

US oil producers were decimated…down on average, 54% YTD.

And even major pipeline companies took hits not seen in decades…they’re down 39% year to date.

It’s chaotic out there.

It’s chaotic out there.

Alligator investors that have held onto strong cash reserves are salivating at the opportunities. But the million-dollar question is: should we keep waiting, or is now the time to buy?

Many of you know that I don’t like to catch a falling safe. In one of my education pieces, I wrote:

“During a crash, terrified investors sell assets with no regard for their underlying values or ability to produce cash flow. During a crash, the price of assets becomes “decoupled” from the value of assets. If you can keep a level head while others are losing theirs, you can buy at fire-sale prices.”

Instead, wait for the safe to hit the ground. Crack open. And then you can go and collect the valuable contents inside.

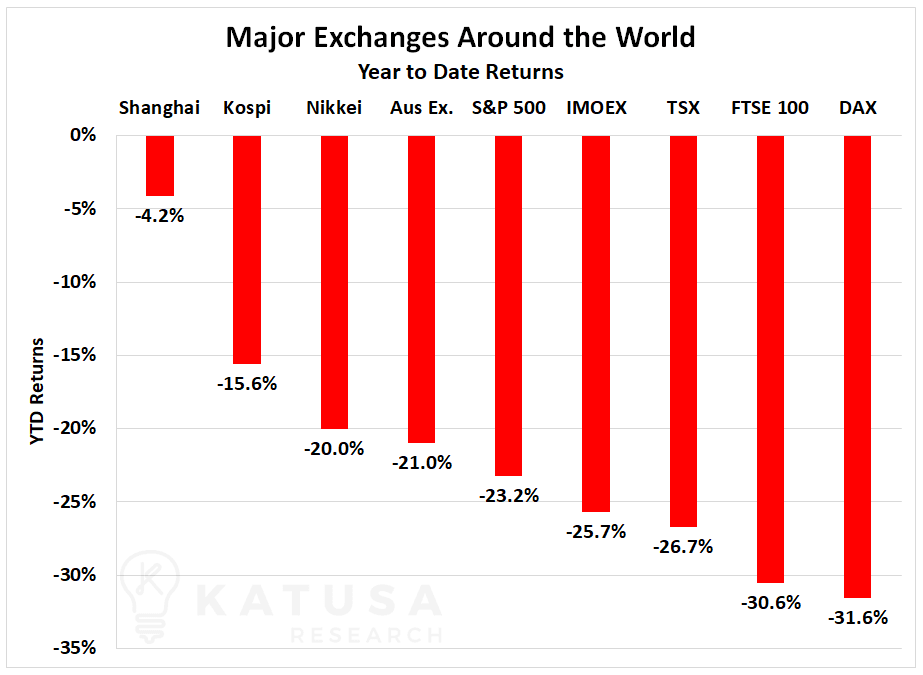

But while some markets are correcting sharply and in borderline bear territory, one market is doing surprisingly well. And right at ground zero of the coronavirus outbreak.

While you may be blurred by the daily 1,000 point moves in the Dow Jones…

China’s Stock Market is Holding Up Rather Well

Has the worst passed in China?

Has the worst passed in China?

No.

Iran’s also in bad shape. Not just because of the virus, but also because the Saudi increase in production is directly aimed at Iranian oil market share.

The Saudis are hitting the Iranian economy and regime at their weakest moment in decades.

If there’s a regime in the world that’s most vulnerable for a downfall right now, it’s Iran’s current one.

What About Europe?

If you have to pick a place to be quarantined, Italy would be at the top of the list.

Great food, great wine, great culture and great people.

If you’re a foreigner (Katusa Research has subscribers in over 120 countries) and you’re stuck in quarantine in Italy, this is what you do:

Try to get away from the big cities. For the most amazing Italian experience, find any small town or village away from the tourist traps. The food and wine will be incredible. The people are amazing.

Our thoughts are with all those who are ill, quarantined or have loved ones in either situation.

Italy is a look through the time machine for the rest of the developed world. Unfortunately, this isn’t just a normal flu, and it’s going to have severe economic knock-on effects.

- More importantly, every EU member will use the virus as grounds for extreme funding for the EU.

What other choice does the ECB have? The current 25 billion euro proposal is less than 1% of the Eurozone’s GDP. When this is all said and done, every European nation will be in line for funding from the ECB.

And that gets me back to Financially Transmitted Diseases (FTD’s).

Interest rates are going lower for longer.

The V vs. U vs. L Recovery

“Buy the dips” has been such a successful mantra over the last 12 years. That’s all most money managers and market participants know and preach.

Few even know how to use fundamental value analysis.

I’ll explain with a personal story—one that I perhaps shouldn’t share, but will.

I personally know a director of one of Canada’s largest wealth management firms.

About six months ago he called me asking if he could come to discuss a few things with me at my office.

I’ve known him for over a decade.

He’s a product of loose monetary policies and the bull market.

Basically, he told me that he thought I was crazy for having such a high cash position, and for not using any debt to maximize my exposure to the markets.

Yet, the fact that my performance over the last decade outperformed any one of his firms’ accounts or funds was irrelevant. He felt I was too conservative.

Think about that—a director of one of Canada’s largest wealth management firms thought I was too conservative. That’s too funny, as there’s nothing riskier than resources—or at least that’s what I thought, until I saw what products they were selling.

This was a major signal to me that the money management business had lost all sanity.

I asked him for his best ideas.

Remember, this was coming from one of Canada’s largest “wealth management firms”, so you’d expect uber-conservative strategies.

His pitch was zero cash, maximize my leverage and go into speculative U.S. stocks. Zero bonds or yield generating products.

And when I asked him about the stocks that were his Top Picks, he couldn’t tell me the name of the CEO, corporate address, nor any details about the financials (cash, debt etc…).

My point here is that this wasn’t some schmuck working at a junior brokerage. This was an experienced, well to do director of a preeminent Canadian money management firm.

This is what investors with money at the “conservative” shops are getting.

This will shift. And along with the shift, massive losses will occur.

The L Recovery:

More importantly, few in the sector are prepared for “The L Recovery”. The L recovery is a big drop followed by zero growth in a sideways market.

The L Recovery is what Japan has experienced over the last 30 years.

The market is expecting massive liquidity from Central Banks.

The recent 50 basis point cut by the U.S. Fed wasn’t enough and we saw a massive drop in markets.

I believe another 50 basis point cut is coming, but it’ll also amount to disappointment from the market as it won’t be enough. The point is, nothing the Fed can do will be enough. The markets are transitioning.

As I’ve been saying, the world economy is tired, and the full depth of coronavirus’s impact isn’t well understood yet.

But over the next 10 days, we’ll see the updated coronavirus numbers from the U.S. and Europe, and I don’t think they’ll be positive.

I’ve stated for a while now that ‘Cash is King’. Here’s why…

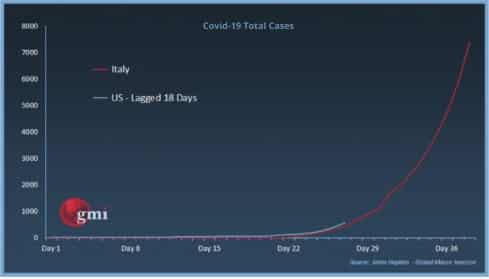

The scariest chart I’ve seen in a long time is the chart below created by Remi Tetot and my friends over at GMI. It’s still early, but if the U.S. cases of coronavirus follow the Italian curve, watch out—the market will go down a lot lower.

The blue line is an 18-day lag of U.S. coronavirus cases compared to Italy’s current cases of the virus.

The difference is, the U.S. has a population over 500% larger.

I’m not trying to be a fear monger. But I look at data and apply common sense to everything.

I’m not trying to be a fear monger. But I look at data and apply common sense to everything.

Things don’t look good and I’m pricing in that risk accordingly, with my Alligator Cash Fund ready to deploy when the time is right.

And the opportunities are becoming ripe.

We’ve done a good job managing our Katusa’s Resource Opportunities portfolio through the last 12 months and by locking in Katusa Free Rides on some of our positions, we are cashed up.

Just yesterday I issued a flash alert revealing my PANIC WATCHLIST to all premium subscribers that once-in-a-decade fire sale type of opportunities are now showing up in many sectors. These are the stocks I have been waiting to own for years and want to build a position in.

We will send any updates when it’s time to get active in the markets.

Fortune Favors the Bold,

Marin Katusa

The post Market Bloodbath: The End of Oil? appeared first on Katusa Research.