We are, and have been, in a secular shift away from physical living towards online. I recently read a tweet that said COVID-19 has massively accelerated this trend. Earnings reports from the last couple of weeks have borne this out. Let’s take a look at four stocks to illustrate what’s going on: Amazon (AMZN), Shopify (SHOP), CSX (CSX) and Caterpillar (CAT). The former are going gangbusters while the latter are barely surviving.

Let’s start with AMZN, which reported earnings Thursday afternoon. It was one of the best quarters I’ve ever seen with revenues up 40% and EPS 97%. I know that I am buying a lot more from AMZN during COVID-19 and clearly so is everyone else.

The same thing applies to SHOP, which sells online store platforms to businesses. Revenues were up 97% and they reported their first quarter of real net income with EPS of $1.05.

Now, let’s turn to the real economy stocks, starting with railroad CSX which reported earnings two Wednesdays ago. Volume was down 20% and Pricing 7% resulting in a 26% decline in revenue and a 43% decline in net income.

CAT’s report last Friday morning looked similar to CSX’s. Revenues were down 31% (40% in North America) and EPS 70%.

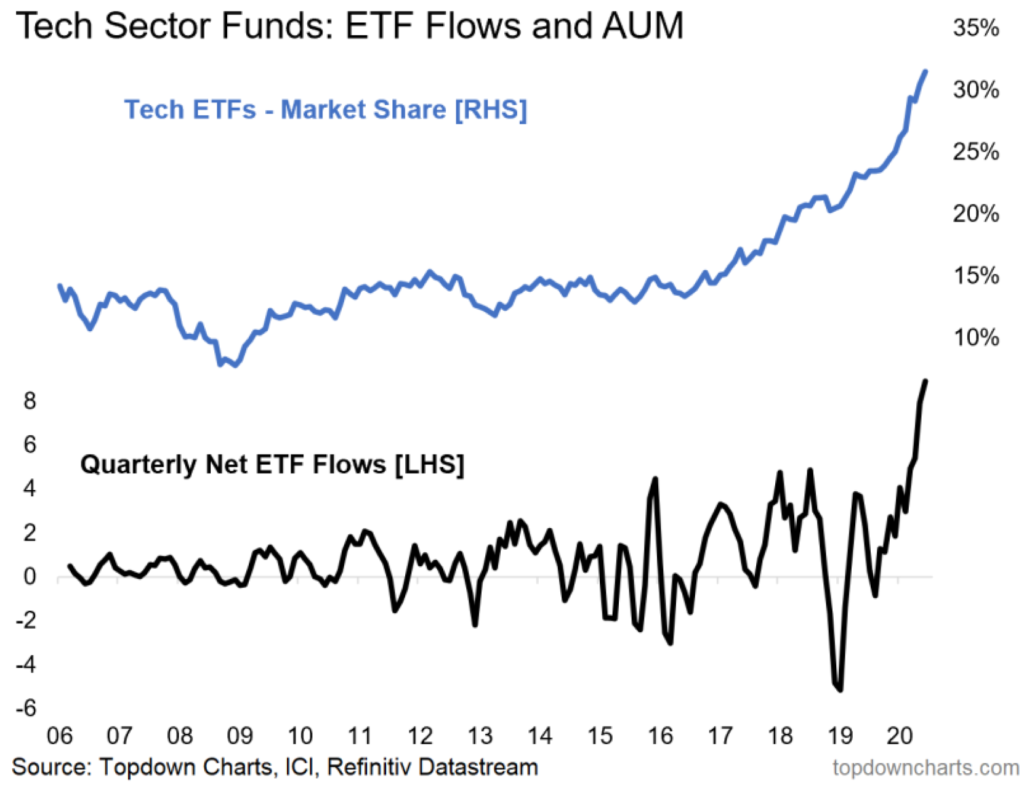

And, as we all know, Tech is leading this market because of its stellar fundamentals. QQQ is up more than 20% YTD compared to the S&P which is flat. As a result, investors are piling into Tech.

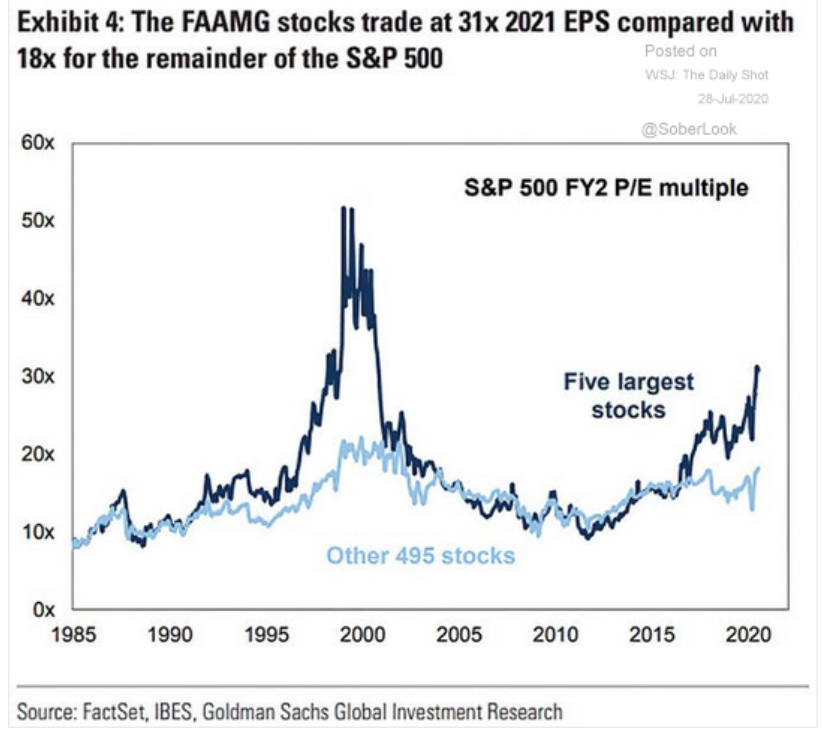

The problem with Tech is valuation. The Big 5 are now trading at 31x 2021 EPS estimates. AMZN and SHOP are even more extreme. Even giving AMZN credit for its net cash position (cash plus cash-like securities minus debt), it’s trading at an EV / TTM EPS multiple of ~120. I love Amazon. I shop there all the time. I even have an AMZN credit card to maximize my points when I shop there. But that valuation cannot be justified. It means that it would take you 120 years at the current rate of earnings to get your investment back.

SHOP’s valuation is even more insane. Also giving SHOP credit for its net cash position, it is trading at an EV / TTM Revenues of ~60x. That means that, assuming SHOP had no expenses, it would take 60 years to get your money back! Of course, the assumption of no expenses is ludicrous as SHOP has to pay employees, rent, taxes, etc.. This kind of valuation is pricing in not world but galactic domination!

That’s why I think this market is uninvestable right now. Either you buy Tech stocks with stellar fundamentals benefiting from an accelerated secular shift to online at valuations that can never be justified or you buy real economy companies whose businesses are being decimated. Head you lose, Tails you lose IMO. That’s why I’m shorting this market. It’s the only thing that makes rational sense.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

P.O. Box 837

San Carlos, CA 94070

(916) 224-0113