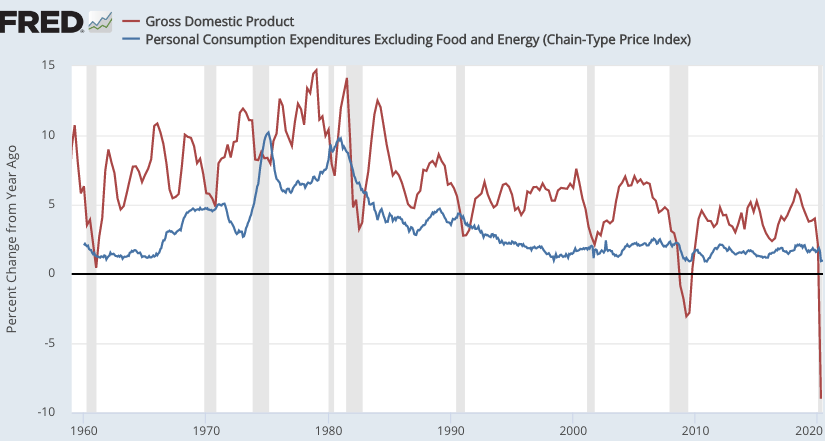

Here’s a conjecture. Core PCE futures targeting would look a lot like NGDP targeting. Not NGDP futures targeting, rather it would look like a monetary policy that stabilized current NGDP. In other words, a lot of the volatility of core PCE inflation is due to NGDP volatility, with NGDP impacting core PCE with a lag. Alternatively, stabilizing NGDP growth would provide quite stable core inflation, indeed even more stable core inflation than what we had during the “Great Moderation”, a period when the Fed was actually trying to stabilize inflation.

Just eyeballing the graph, it looks to me like core PCE inflation (blue line) typically starts falling about a year after NGDP growth (red line) begins to decline. (Focus on the NGDP slowdowns of 1979-80, 1990-91, 2000-01, and 2007-08.)

Think of core PCE as the part of the price level mostly made up of sticky prices, or alternatively those prices that are closely linked to wage costs. Thus wage costs do not determine oil or food prices in the short run, but do heavily influence the price of haircuts and restaurant meals.

[Note: There is a slight flaw in measured core inflation, as even the core includes some energy prices, which indirectly impact other production costs. Thus oil shocks slightly impact even core inflation, albeit much less than they impact headline inflation.]

When there is a tight money policy, both output and commodity prices immediately fall. Sticky goods prices (and wages) are not immediately affected.

A number of researchers have pointed out that monetary policy should try to stabilize the stickiest prices. That might be core inflation, or (as Greg Mankiw and Ricardo Reis argued) wage inflation. But that’s not easy to do, as sticky wages and prices respond slowly. It’s like trying to steer an ocean liner where the ship takes 15 minutes to respond after moving the steering wheel.

Thus you want to target the thing that is closely linked to future values of the sticky index that you are trying to target. That might be a futures contract linked to the core PCE, but it also might be current NGDP.

Of course even current NGDP is hard to control, which is why I’ve called for assistance from NGDP futures markets, notably my “guardrails” approach. But at least NGDP responds much more quickly than core inflation, and hence is a better target for avoiding short run instability. In mid-2008, there was an obvious NGDP problem, but no obvious core inflation problem. Keynesians rely on Phillips curve models to solve this problem, but NGDP is more reliable.

The (supposed) downside of targeting NGDP is that it allows a bit more variation in long run core inflation, even if it’s more stabilizing for the economy at cyclical frequencies. That “downside” is actually a feature not a bug, as George Selgin demonstrated in Less Than Zero. But even if it were a bug, it’s likely that the benefits of greater cyclical core inflation stability vastly exceed the downside of slightly bigger variations in the long run trend rate of core inflation, even if New Keynesian models are correct that PCE core inflation is the appropriate monetary policy target.

You want stable core inflation? Target per capita NGDP growth.

PS. This post does not apply to the Covid-19 economy. For that, you’d want to target NGDP at least 12 months forward, maybe 24 months.

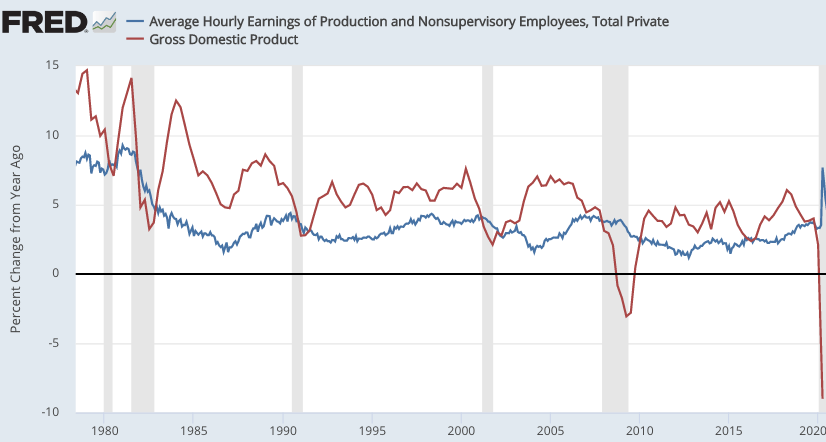

PPS. I could have written the same post, replacing core inflation with wage inflation (blue line). It also lags behind NGDP growth (red line):