$AAPL kicks off our weekly momentum scan, rallying from the depths of $103, and finishing the day +3% to close above $110. $ROKU was another name from today’s scan that never let up despite the indices tanking intraday. $NVDA, $PYPL, $CRWD, $JKS, $FSLY, & $ACI were the standouts Monday….here’s your look at today’s momentum scan: CLICK HERE FOR CHARTS

Other than today’s momentum candidates, here are some names I’m watching this week: $PINS should break to fresh all-time highs this week if bulls can push price through $37, the high from last fall (Zoom out). Every dip in recent weeks has been bought, I’m long for the $37 break:

__

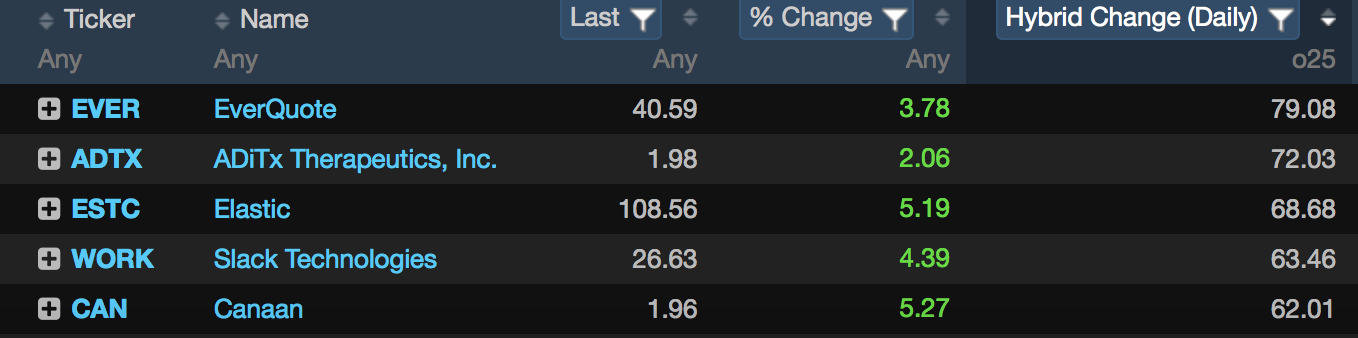

$ADTX a small cap, a very thin and beautiful small cap, is back on top the hybrid screen, moving +70% in score with little price movement Let’s see if today’s hybrid score is predicting anything under the surface. This is a Covid-19 antibody play:

__

$BA gets a big upgrade from $GS and reports on new orders over the weekend, all which seemed to be swept under the rug. I’m looking for entries for long term money on dips.

Boeing upgraded to Conviction Buy from Buy at Goldman Sachs$BA pic.twitter.com/39vLU6Z17p

— J-Swan (@swan1427) September 21, 2020

___

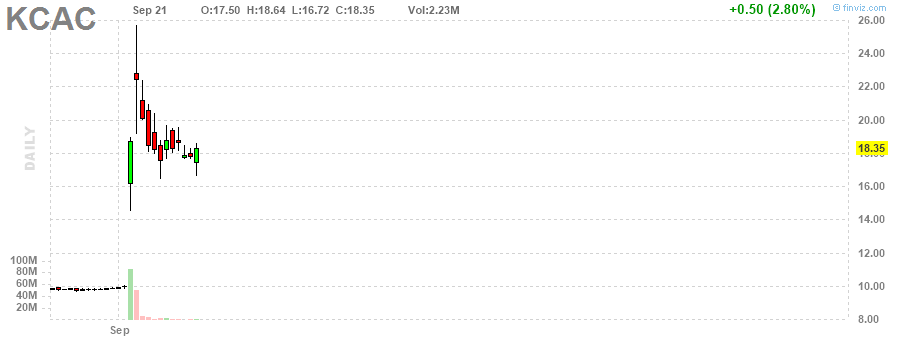

$KCAC the Battery SPAC into battery week. This trade may be too obvious, but I like the technical setup into a battery specific event for TSLA which should generate some headlines. We also got the VSA signal from stocklabs:

__

__