Yesterday, the great Howard Marks came out with one of his memos. I consider Marks one of the Top 15 investors of all-time and I try to read most of his memos. Yesterday’s memo, “Coming Into Focus” (https://www.oaktreecapital.com/docs/default-source/memos/coming-into-focus.pdf), was one of his best ever in my opinion and I want to touch on some of the points he made.

First, he made the point I made a couple months ago in “A Tale of Two Stock Markets – The Internet Economy Versus The Real World Economy” (https://www.topgunfp.com/a-tale-of-two-stock-markets-the-internet-economy-versus-the-real-world-economy/) about the bifurcated nature of the current stock market. The pandemic has accelerated a shift towards technology and online and away from brick and mortar and in person services: “The adoption of technology has been pulled forward by the pandemic. Thus virtual meetings, ecommerce and cloud computing are now commonplace, not the exception” (8). In my Client Note, I went on to say that tech stocks were uninvestable because of valuation despite great fundamentals while real world stocks were uninvestable because of terrible fundamentals.

Marks picks up on the former point about tech stock valuations, comparing them to the Nifty Fifty:

Fifty years ago, the Nifty Fifty appeared impregnable too; people were simply wrong. If you invested in them in 1968, when I first arrived at First National City Bank for a summer job in the investment research department, and held them for five years, you lost almost all your money. The market fell in half in the early 1970s, and the Nifty Fifty declined much more. Why? Because investors hadn’t been sufficiently price-conscious. In fact, in the opinion of the banks they were such good companies that there was “no price too high”. Those last four words are, in my opinion, the essential component in – and the hallmark of – all bubbles. To some extent, we might be seeing them in action today. Certainly no one’s valuing FAAMG on current income or intrinsic value, and perhaps not on an estimate of EPS in any future year, but rather on their potential for growth and increased profitability in the far-off future (9)

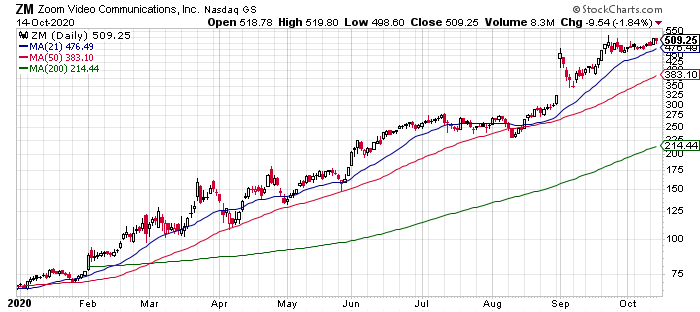

Yesterday, the WSJ’s ace tech stock reporter Dan Gallagher wrote a column about Zoom (ZM), which is the poster child for “no price is too high”. ZM closed today (Wednesday 10/14) at $509, up 638% YTD (ZM YTD Chart with 21, 50 and 200 DMAs 10.14.20 Attached). ZM now has a market cap of $151 billion and is trading at 63x this year’s sales guidance and 209x this year’s EPS guidance given on 8/31 (https://investors.zoom.us/news-releases/news-release-details/zoom-reports-second-quarter-results-fiscal-year-2021). I don’t really know that to say about those metrics. They are beyond insane.

The last point Marks makes in his 16 page memo that I want to touch on is the potential consequences of the government’s massive stimulus response. Here’s the list of things he’s worried about (12):

– federal deficits and debt

– rising interest rates

– inflation

– $ weakness

– downgrade of US credit rating

– the loss of reserve currency status of the $

Unfortunately, Marks is not wholly consistent in drawing out the conclusions of his analysis . For one, he called the policy response “brilliant” (13) despite his list of long term concerns. How is the policy response brilliant when it’s increasing the probability of all these potentially dire long term consequences? What a ridiculous thing to say in light of his previous analysis. Yes: the policy response has worked to prop up financial markets in the short term. But what about the long term consequences? “The art of economics consists in not looking merely at the immediate but at the longer effects of any act of policy” – Henry Hazlitt, Economics in One Lesson. I can’t believe Marks thinks the policy response was “brilliant”.

Second, he says that the policy response has created “the lowest prospective returns in history” (15) but argues against going to cash and waiting for a better environment because such an action is “extreme and certainly not called for now” (15). How is going to cash an extreme response to “the lowest prospective returns in history”?

Along the same lines, despite his analogy of tech stocks today to the Nifty Fifty, he concludes by writing: “The case isn’t extreme – prices aren’t grievously high” (16). What? He just argued that they were, writing that “no price is too high” seems to be the current attitude towards tech stocks.

In conclusion, Marks is one of the Top 15 investors of all-time and this is one of his best memos but he seems loathe to draw the full conclusions of his analysis.

*****

Next, I want to talk a little about this week’s bank earnings. JPM C WFC BAC and GS all reported earnings the last two days (Tue 10/13 and Wed 10/14) and the market reaction has not been good. Why? Each of the Big 4 commercial banks reported greatly reduced provisions for credit losses – but that was widely expected. What was not expected was the hit they are taking on net interest income. Net interest income decreased by 9% at JPM, 10% at C, 17% at BAC and 19% at WFC. That’s because, with interest rates so low, banks simply can’t earn a good spread on the interest they must pay for money and the interest they receive on their loans. JPM is down more than 2% since reporting earnings and C BAC and WFC more than 5%. GS’s results were the best received as investment banking remains strong in this rip roaring market – though the stock was only up 0.2% today.

*****

Those of you with margin accounts will be happy to know that, as of last Friday’s open (10/9), I have covered all of our stock shorts. That’s because even though this is a massive bubble, I don’t believe it is ready to pop yet. I’ll be looking for a spot to reenter on the short side but will be practicing much tighter risk management next time around should I do so.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

PO Box 837

San Carlos, CA 94070

(916) 224-0113

Stocktwits (55K followers)/Twitter: @TopGunFP

Instagram: topgunfinancialria