Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer choose to receive the emails.

Yesterday’s correction was a normal consolidation within an uptrend that did no technical damage (S&P > 3600, NASDAQ > 12000, Russell > 1800). Here were the returns for the major indexes:

S&P -0.46% NASDAQ -0.06% Russell -1.91%

In fact, the Futures currently suggest the S&P and NASDAQ will more than recoup yesterday’s losses today while the Russell will recoup most of them.

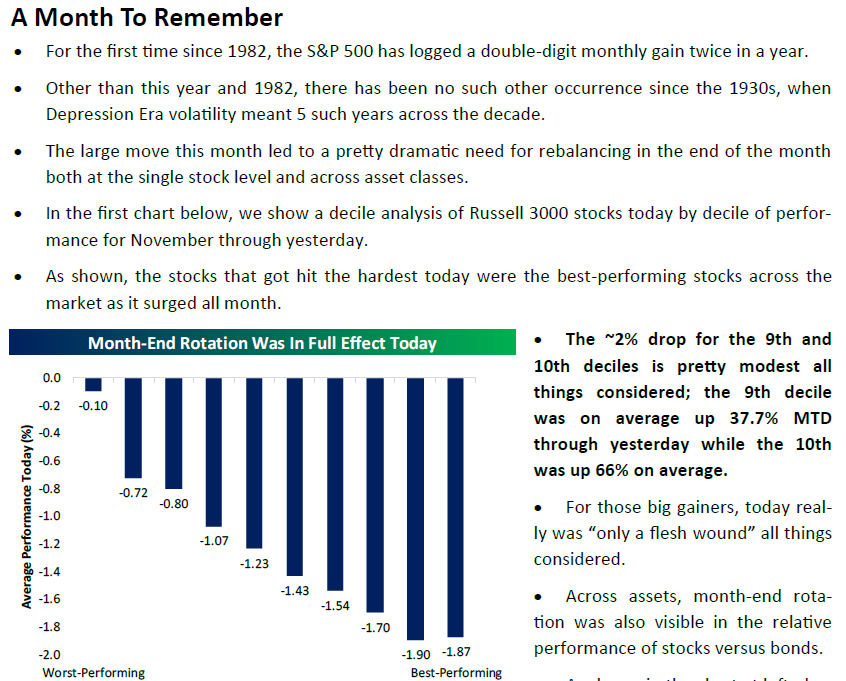

BeSpoke had an excellent chart breaking down yesterday’s returns for the Russell 3000, which includes the Russell 1000 of large cap stocks plus the Russell 2000 of small cap stocks, by performance decile in November through Friday November 27. The better a stock had performed through Friday, the worse it did on Monday with the two best performing decilies each off about 1.9%. This is normal profit taking and should be of no concern to bulls.

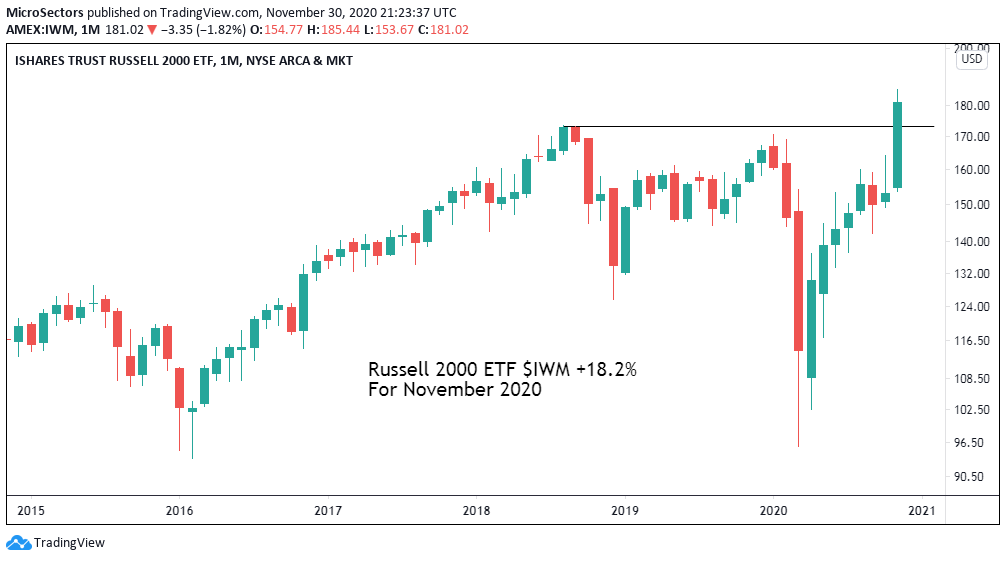

The prospect of vaccines returning life to normal injected wild hope into many of the least popular assets. Exxon Mobil is up 23% so far in November, putting it on track for its best month since at least 1972. The Russell 2000 index of small stocks, up 21%, is heading for its best month since at least 1988.

The lockdown losers hit the worst this year are doing incredibly well this month, with 9 S&P stocks up more than 50%. Boeing, cruise lines Carnival and Royal Carribean, several airlines, mall owners, hotels and entertainment stocks, and Citigroup are up more than a third. The VIX gauge of implied volatility has plunged from a pre-election high of 41 to flirt with the summer lows just above 20.

Junk bonds, rated as close to default, or triple-C, have returned 7.3% so far in November, on track for their best month since the panic about shale oil in 2016.

Cyclical stocks sensitive to the economy have done very well, while defensive stocks able to ride out recessions are in less demand. In particular, some of the stocks that won as we stockpiled groceries and worked from home have lagged behind badly this month: disinfectant company Clorox, Newmont and Spam maker Hormel Foods are all down, even as the market is up. The haven of gold has fallen, too.

The message is clear: things are looking better.

– James Mackintosh, “Recovery Hopes Fail to Rally Bonds”, Monday, November 30, WSJ B1

James Mackintosh did such a good job summarizing November’s action that I decided to quote from his column in yesterday’s WSJ at length. My concern is that November’s action appears to me to have already #PricedIn a return to normal in 2021. Therefore, even if that optimistic scenario comes to bear, stocks may not go higher given the moves we saw in November.

The best example of the extremity of the action in November is the Russell 2000 index of small caps. It had its best month on record while breaking through the previous all-time high of 1740 from 2018 on its way through 1800.

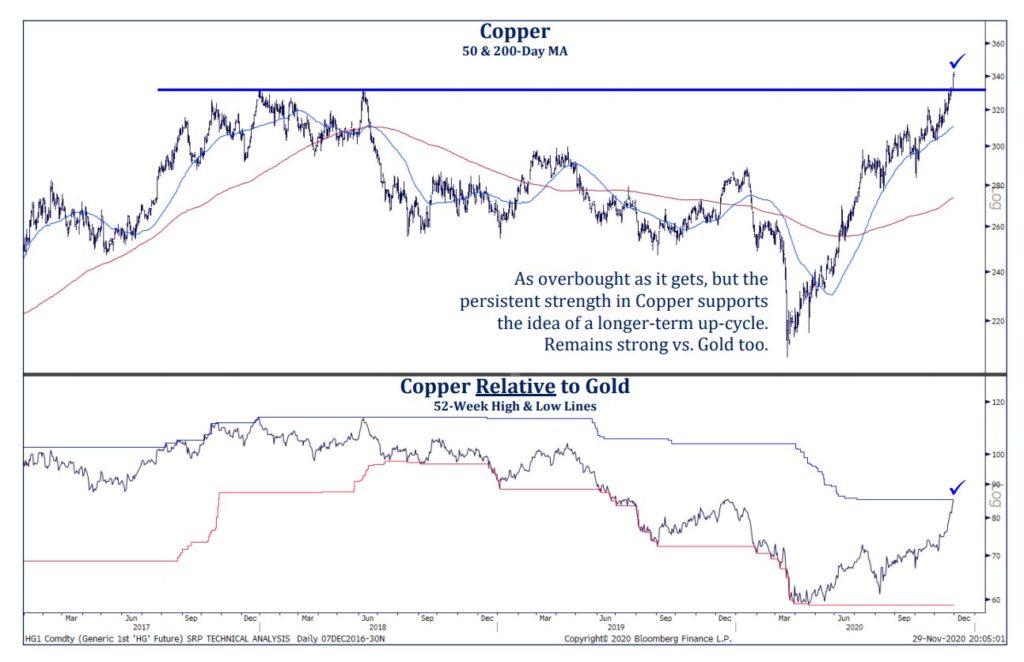

Also reflecting the widespread belief in a 2021 normalization is copper, the metal with a Phd in Economics due to its correlation with economic activity, which broke out of a multi year range.

As I wrote on Sunday morning, the market can actually top when things look the best as all of the good news is priced in. We may be at one of those moments right now.

Investors are almost universally bullish. It’s very hard to find a bear on 2021 – Mike Wilson, Chief US Equity Strategist, Morgan Stanley (Source: CNBC.com, Monday November 23)

Stock prices have reached what looks like a permanently high plateau – Economist Irving Fisher, October 1929

Invest at the point of maximum pessimism and sell at the point of maximum optimism – John Templeton

Be fearful when others are greedy and greedy when others are fearful – Warren Buffett

This feels to me like the point of maximum optimism or Euphoria phase of The Cycle of Market Emotions. While everybody is scrambling to get long for the 2021 reopen and the anticipated next leg up in a new bull market, I’ll take the other side. I think this is a time for extreme caution and taking chips off the table as such a scenario now appears to me to be #PricedIn It’s very hard for me to see a scenario in 2021 that justifies higher stock prices.

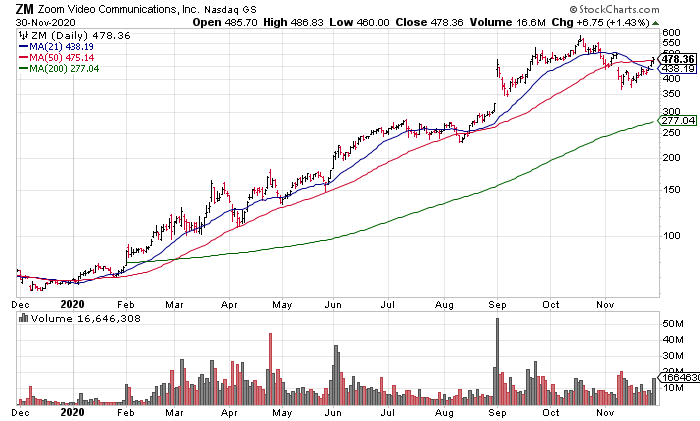

Lastly, a word about Zoom (ZM) earnings from yesterday afternoon.

While the numbers looked good with Revenue +367% from a year ago and 99 cents Non-GAAP EPS, the stock finished the after hours -5.04% and is currently down more than 7% in the premarket.

I believe this is a function of extreme valuation (167x current year guidance based on Monday’s closing price) and concern about the implications of reopening for its business. ZM is the purest #Lockdown #PandemicBenificiary stock and so with the vaccines and a 2021 reopen, it is probably not the right place to be right now.