Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

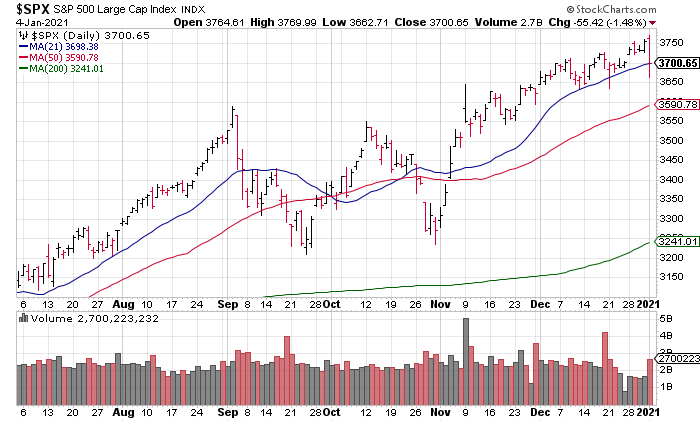

Good Morning ladies and gentlemen and welcome to 2021! Monday was an exciting day and not what the bulls had in mind. After opening up, the markets sold off hard before a late day rally. The S&P was -1.48% on the day while the NASDAQ and Russell were -1.47%. Volume in the major index ETFs (SPY, QQQ, IWM) as well on the NYSE and NASDAQ on a whole was significantly higher than average.

Does it mean anything? Nobody knows. The legendary short term trader Scott Redler put it this way in an annotated chart of the S&P he posted to Twitter at 12:05pm PST: “It’s hard to tell if “THAT” was the shakeout. Or is this a Day #1 down that leads to more of a corrective phase. Usually the day or so after tells the real story. I don’t take on more risk into a a Day #1 down, just in case there’s #2, #3, #4 thereafter. I’d rather see some market discovery with less risk” (Chart and Quote Source: Scott Redler Twitter, Monday January 4, 2021, 12:05pm PST).

The last thing I want to say about Monday is that the S&P closed right on its 21 DMA – which it hasn’t closed below since Tuesday November 3 (pre-vaccine). Bulls will want to see that level hold.

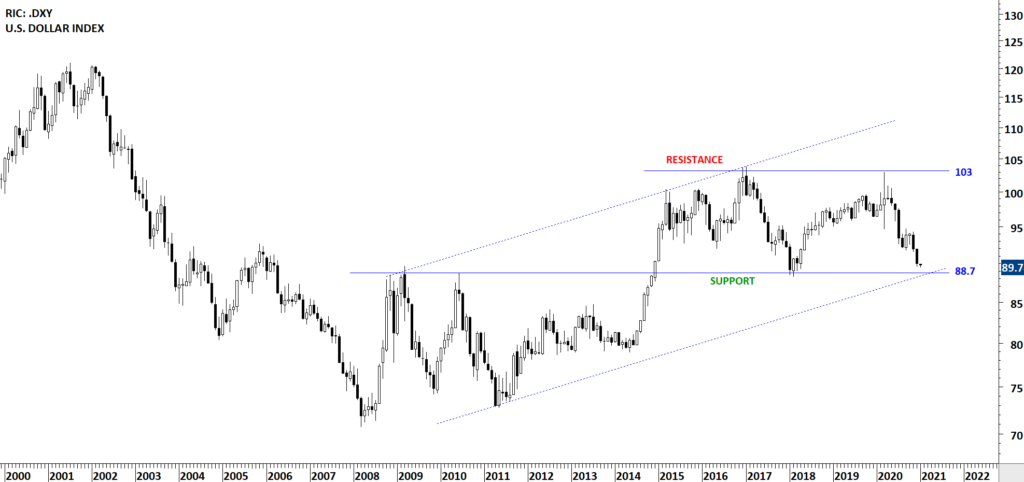

Moving on, I want to discuss the crashing dollar and how to play it. The dollar index is currently at 89.81 – just above major support from early 2018 (Chart Source: Aksel Kibar Twitter, Monday January 4, 8:17am PST).

If that level doesn’t hold, we could have a certified dollar crisis on our hands with little support until the 2008 lows in the low 70s. Obviously, the cause of this is the extremely loose monetary policies of The Federal Reserve. While other major central banks are creating tremendous amounts of money, they are not creating as much as the Fed, in a race to the bottom among fiat currencies.

Investors are playing this in one of two ways: Gold and Bitcoin. In a lot of ways, it’s a generational thing. The old timers like me (I’m 43!) like gold because of its proven history while the Millenials like Bitcoin because of its volatility and their belief that digital currency is the way of the future.

For whatever reason, investors piled into gold and the gold miners on Monday, sending shares of the major gold miner ETFs, GDX and GDXJ, up ~7% on more than 2x average volume. GDX is now poking its head above a 5 month downtrend (Chart Source: Greg Rieben Twitter, Monday January 4, 2021, 6:37am PST).

Historically, the other safe haven asset besides gold was US treasuries. However, investors are preferring gold over Treasuries, correctly IMO, because of concerns about the dollar and inflation, I believe (Chart Source: Rafael Marulanda Twitter, Monday January 4, 2021, 11:57am PST).

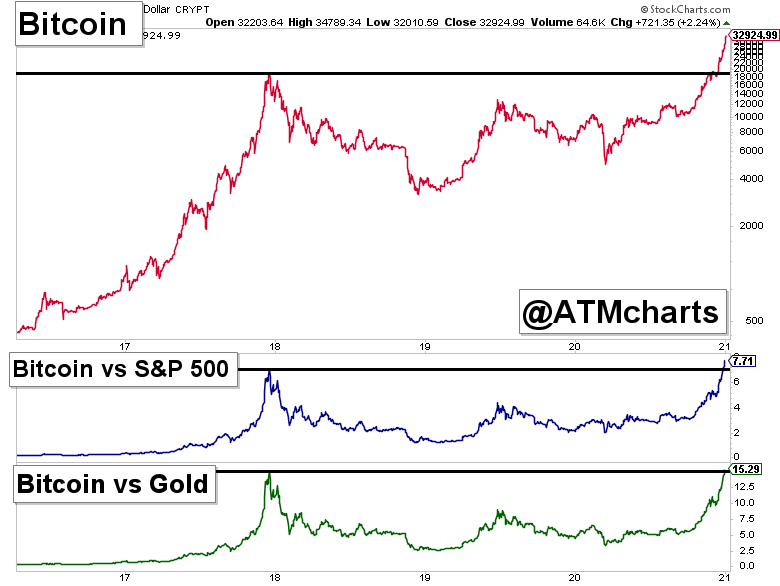

Nevertheless, the Millenials are quick to remind you, Bitcoin is far outperforming gold (Chart Source: Aaron Jackson, “21 Charts for 2021”, January 3, 2021).

Here’s the Millenial Jackson on Bitcoin: “Bitcoin’s breakout heard round the world could just head to 100K. The size of the base suggests 125K isn’t out of the question. It’s not going to happen overnight or in a straight line, but the action couldn’t be much better”.

I prefer gold because it’s proven but there’s no reason you can’t split your positioning in this part of your portfolio between gold, Bitcoin (and silver as well). They’re all aimed at doing the same thing: protecting you from the race to the bottom among fiat currencies.

Because of my view that we are in a massive bubble, Top Gun is defensively positioned which worked perfectly yesterday. Our largest positions, GDX and GDXJ, were up ~7% each as mentioned earlier and our three defensive stocks were up 3.18%, 2.36% and 1.13%, respectively – not bad considering the market’s overall performance. Top Gun was +2.81% on the day despite being almost 50% cash.