China reports its RGDP growth rates in several ways. There is quarterly data, which is reported in “year-over-year” terms. In contrast, the US reports quarterly growth rates over the previous quarter, which are then annualized by multiplying by roughly 4.

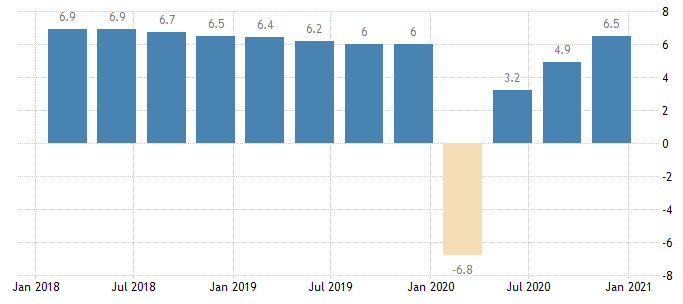

China also reports growth for the entire year, as compared to the previous year. In 2020, RGDP grew by 2.3% over 2019, whereas in 2020:Q4, the growth rate was 6.5% over 2019:Q4:

In the past, commenters always tell me the Chinese data is fake. I provide detailed explanations as to why the data should be taken seriously. Commenters then ignore my detailed explanations, and keep repeating the same claims. So I’m going to treat the Chinese data as being roughly accurate.

But this post is not about China. It’s about the US and Europe. Most experts seem to expect our RGDP to remain well below trend for years. But why? The vaccine is being distributed and the pandemic may be mostly over by mid-2021. So why won’t things go back to normal at that point?

I’ve been asking myself this question for the past 12 months. Am I crazy to think that an economy might be able to bounce back quickly from this sort of shock? Given that almost all the experts think I’m wrong, that seems likely.

But the Chinese figures give me a bit of hope for the US and Europe. China is not a small country like Iceland, where GDP figures bounce around randomly due to industry specific factors. It’s one of the three great economies of the world (along with the US and the eurozone.) Changes in China’s GDP reflect the decisions of more than a billion people, and hence are “statistically significant”. China didn’t just luck back to the previous trend line (actually about 0.5% above trend.) Maybe there is some reason that China can quickly bounce back and the US and Europe cannot. I may be missing something. I just don’t know what it is.

PS. Hong Kong stocks rose sharply on that “fake” Chinese GDP data.