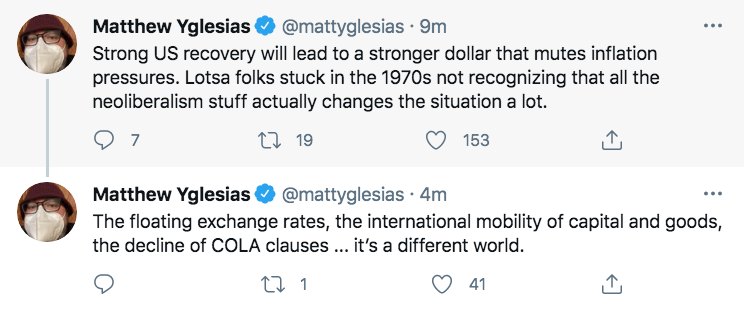

Probably not, at least if the Fed sticks to its 2% AIT. But I’m not reassured by the arguments being offered:

Actually, things like globalization and a lack of COLAs don’t matter it all. It mostly boils down to NGDP growth (a variable that globalization and COLAs do not significantly impact.)

If we have fast NGDP growth during the 2020s, say 5% or more, then we’ll likely have high inflation. If we hold NGDP growth below 4% then we’ll have moderate inflation. Below 3% and we’ll fall short of the Fed’s target. (These are decade average claims; 2020-22 will be unusual.)

It’s all about monetary policy. When it comes to inflation, fiscal policy doesn’t matter. Globalization doesn’t matter. Unions and minimum wage laws don’t matter. It’s completely up to the Fed.

Are they going to give us roughly 2% inflation on average, as they promised, or are they a bunch of liars? I trust them, but will “verify”.

PS. Off topic, I highly recommend Razib Khan’s new post on Italian history, which is comparable to his masterful posts on Indian history. If he did a half dozen more such posts, then turned them into a book, it would be one of the best books of 2022.

PPS. Give Business Insider credit for this prescient March 6, 2020 article.