Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Stocks entered Tuesday’s session extremely overbought after two big up sessions on Thursday (4/1) and Monday. 89% of S&P components were trading above their 50 DMAs at the open yesterday. So it’s no surprise, in fact it’s technically healthy, that yesterday was a low volume “snoozefest” with the S&P -0.10%, NASDAQ -0.05% and Russell -0.25%.

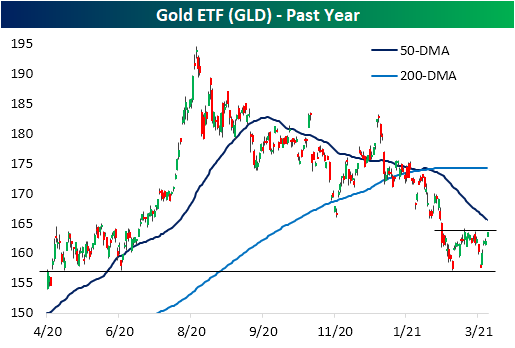

One asset class that has caught a bid in recent days is the precious metals and their miners. The Gold ETF (GLD) was +0.80%, The Silver ETF (SLV) +1.08%, The Gold Miners ETF (GDX) +1.69%, The Junior Gold Miners ETF (GDXJ) +2.55%, The Silver Miners ETF (SIL) +2.57% and the Junior Silver Miners ETF (SILJ) +3.53% yesterday. As a result of this recent strength, they are all starting to look technically healthier (see “Precious Metals Finding Support and Eyeing Breakouts”, BeSpoke, Tuesday April 6).

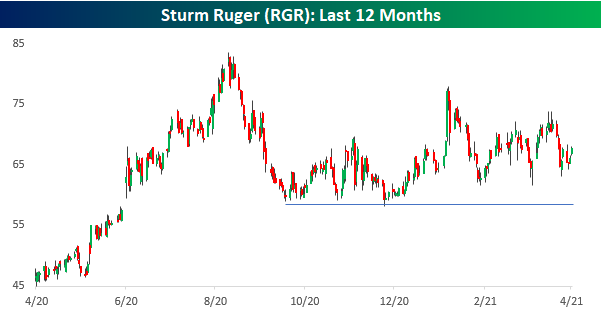

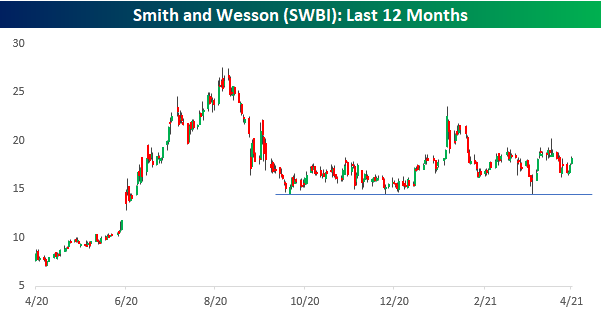

Another data point from BeSpoke I found interesting yesterday was that gun background checks continue to surge (see “Another Record in Gun Background Checks”, BeSpoke, Monday April 5). Gun sales at the two leading publicly traded gun manufacturers, Sturm & Ruger (RGR) and Smith & Wesson (SWBI), are surging as well (Top Gun is long RGR and SWBI). Why? Because of all the civil unrest we’ve seen during the pandemic i.e. Black Lives Matter, The Capitol Riot, etc.. However, the stocks continue to be held back by fear of gun control legislation from the Biden Administration.