A new superfuel duo backed by the U.S. Department of Energy is preparing to upend the energy sector…

It could make or break heavy industry.

It could rule the high seas.

It could completely overshadow lithium.

One of the superfuels is already a crowded space packed with big money.

The other is a retail investor’s back door into the next commodity supercycle.

And the advantage goes to a company that isn’t even on Wall Street’s radar.

It’s headed by a former NASA engineer who is pioneering this new DoE-backed energy transition push.

The superfuel duo is hydrogen and ammonia, and their “green” versions are positioned to be the only earthly fuels that produce zero emissions when burned. That makes them the emerging keys to the world’s carbon emissions goals …

The little-known pioneer behind the greening of ammonia is AmmPower Corp. (CSE:AMMP; OTC: AMMPF).

With its NASA background and a major head start, this small-cap company appears to be the furthest ahead in this particular superfuel game.

The global ammonia market was at $48 billion in 2016, and in less than 4 years, it’s set to hit $76 billion. That’s a huge leap for a gas that we have long associated primarily with the fertilizer market. Why? Because now we know how to use it commercially in a safe and cost-effective way for massive industries far beyond the food supply chain.

And the first to the finish line, especially if it’s a small-cap company with tons of room to run, stands to increase its stock by multiples.

HYDROGEN IS THE NEW LITHIUM AND AMMONIA MAKES THE HYDROGEN REVOLUTION POSSIBLE

Hydrogen is several times more powerful than gas …

It’s cleaner …

It blows lithium away for heavy industry.

The lithium ‘boom’ never really unfolded as everyone expected. Demand for lithium is likely to continue to rise as EVs become increasingly mainstream, but as an energy transition fuel, it has its limitations. It won’t be the ‘superfuel’ powering heavy industry, or even bigger vehicles or sea-faring vessels.

It shows no promise of replacing oil and gas in these realms. That’s because it has far lower energy density than any of the fossil fuels.

So, lithium is our energy transition superfuel only for small vehicles.

Hydrogen fuel cells have an energy to weight ratio ten times greater than lithium-ion batteries, leading to far greater range and lighter vehicles. And while lithium batteries have a limited lifespan, hydrogen fuel cells don’t degrade. That’s a huge environmental benefit.

Now, hydrogen is shaping up to be the gas of gases that dominates heavy industry, shipping and even energy.

It is now emerging as a strong possibility that ammonia will end up being the king of renewables.

Which would make AmmPower a major beneficiary of the energy transition.

How, exactly?

Hydrogen has far more energy density even than gasoline, but it’s immensely challenging to store and transport.

That’s where ammonia comes in to enable a true energy revolution.

Scientists have now found a way to safely store and transport hydrogen, using ammonia.

AmmPower Corp. (CSE:AMMP; OTC: AMMPF) is helping to pioneer the technology for this soon to be $80-billion opportunity.

Here’s how it works:

Despite hydrogen’s ultra-high energy content, it has low volumetric energy density, which means it must be stored at extremely high pressure. Hydrogen occupies three times more volume than gasoline for the same amount of energy, so it needs heavy, highly fortified tanks to store it. That’s a huge cost and a huge challenge.

At least it was, until very recently…

The answer now appears to be liquid ammonia, which comprises one nitrogen atom and three hydrogen atoms, and has a volumetric hydrogen density about 45% higher than liquid hydrogen, according to the US Department of Energy .

It can be stored safely, transported and then the hydrogen can be “cracked”.

This key technological breakthrough made by companies like AmmPower that are seeking to ensure the success of our trillion-dollar energy transition.

But it’s more than just storage, transportation and hydrogen cracking. AmmPower is building modular, scalable, stackable green ammonia-producing units.

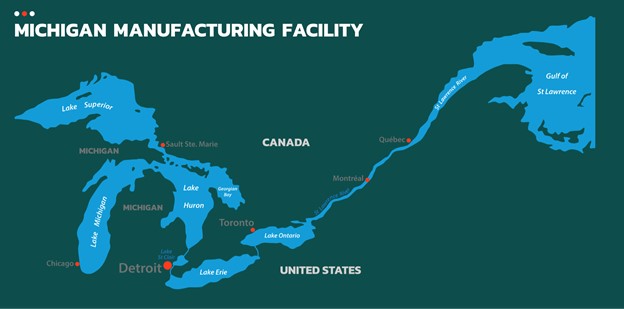

AmmPower is in the process right now of securing a state of the art manufacturing facility in Michigan:

That facility would boast large-scale production capabilities and also house a research and development lab. Phase I units will produce up to 1 tons of green ammonia per day, while Phase II units will produce up to 25 tons a day. And both phases will feature three different sizes of modular units to fit the needs of a wide variety of customers.

In less than two years, AmmPower expects to deliver its first production units and ramp up production to facility capacity.

HUGE MARKETS WITH IMPRESSIVE DEMAND

There are several huge markets for this, with demand coming from the food value chain, shipping, the power sector and heavy industry.

The multi-billion-dollar fertilizer market is the starting point, but there’s a huge offtake market here for green ammonia: utilities and renewables developers.

Norway’s Statkraft AS utility company is already going green with ammonia. It plans to convert fertilizer giant Yara International ASA’s Porsgrunn ammonia production site into green hydrogen.

Utilities are just starting to board the green ammonia and green hydrogen trains, but Wall Street radar will also be pinging the multi-trillion-dollar global transportation and logistics industry.

Hydrogen and ammonia are positioned to completely disrupt shipping as we know it.

And AmmPower isn’t just developing green ammonia storage and hydrogen cracking solutions…

It’s also working to produce carbon-free green ammonia, and for the shipping industry, this is proving to be yet another way to comply with fast-changing emissions rules. In fact, AmmPower recently announced the formation of AmmPower Marine Corp. (“AMC”) specifically focused on opportunities in the marine industry.

Tankers can run on green ammonia, and some hydrogen/ammonia tankers are about to hit the high seas …

Germany’s MAN Energy Solutions and Korean shipbuilder Samsung Heavy Industries are developing the first ammonia-fueled oil tanker. It will be ready by 2024. That same year, the Viking Energy supply vessel, which will run on an ammonia fuel-cell system, will set sail in a world first.

Norway’s state-run energy giant Equinor has an offshore supply vessel that runs on LNG now but will also be tweaked to run on green ammonia.

Over 120 global ports that accept ammonia currently, with more in the works.

The World Bank has now definitely sidelined LNG as the new maritime fuel. The global institution is calling for hydrogen and ammonia, instead.

Ammonia is the missing link in the hydrogen revolution because it has 9X the energy capacity of lithium and is 1.8X the energy density of liquid hydrogen.

So, if you’re an investor looking for the back door to the hydrogen boom, look no further than ammonia–a space far less crowded.

Ammonia has become the key to our hydrogen revolution, which now appears to be unstoppable.

Indeed, it’s projected to become an $11-trillion market by 2050.

And soon enough the fuel of our future could be a globally traded commodity.

FIRST-MOVER ADVANTAGE IN GREEN AMMONIA RACE

This space has very little competition–so far. There are only a few companies in the world doing what AmmPower is doing.

Only Iceland’s Atmonia and Colorado’s Starfire Energy come close.

Because of its R&D background, AmmPower will be doing much more than building facilities and ramping up production … it intends to be a leader in research for enhancements in the green ammonia production process.

We’re talking about proprietary green ammonia production processes for a gas that could enable our biggest capital flow into energy in decades.

AmmPower is developing a process that can break water down into hydrogen and oxygen and then add nitrogen from the atmosphere to create ammonia. It’s mobile, scalable units would also enable hydrogen cracking near the end-consumer, which would be a major logistics coup for the burgeoning hydrogen market.

And its first prototypes are expected by the end of this year, with sales launching next year.

THIS IS THE BEGINNING OF THE REAL HYDROGEN REVOLUTION AND AMMPOWER COULD BE WAY AHEAD

AmmPower (CSE:AMMP; OTC: AMMPF) is working at whirlwind speed. In only a year and a half, it’s first green ammonia production units are slated for delivery and it plans to be producing at full capacity.

At the company’s helm is a former NASA research scientist who also has a multi-billion-dollar business track record–a combination that is hard to beat.

Former NASA research scientist Dr. Gary N. Benninger, is the CEO of AmmPower. He’s a former Ford engineer, as well, and a former senior executive of the $40-billion Magna International Inc. automotive parts supplier, the third-largest in the world. A former U.S. Army Captain with a PhD in physics, Benninger has quietly built up a pioneer in what is potentially the most disruptive space in energy.

With tons of money pouring into hydrogen and ammonia, and huge nods from both the World Bank and the Department of Energy, the pioneers of these disruptive new processes are the best bets for ROI. AmmPower has around a $120M market cap, yet it’s got first-mover advantage on a segment that could potentially dominate multiple industries and set the pace for our energy transition. The upside potential of this ground-floor play seems as limitless as clean energy itself.

Other companies looking to capitalize on the energy transition:

Suncor (TSX:SU) might be known mostly for its oil production. But it’s one of the few majors really pushing the boundaries. In fact, it has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. But that’s just one part of its business, however. Suncor is also a world leader in renewable energy innovations. Recently, the company invested $300 million in a wind farm located in Alberta. Additionally, as Canada moves away from oil, Suncor is well positioned to take advantage of another one of the country’s resource reserves; Lithium. The best part? It doesn’t even have to move very far. In fact, Alberta’s oil sands are super rich with lithium.

Like other energy majors, Suncor has had a very strong year. Since January, the company has seen its share price rise by over 50%. And as it continues to diversify, it could go even higher in the years to come.

Cenovus Energy (TSX:CVE) is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years. This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a fantastic pick for Canadian energy investors.

Cenovus has had a standout year, rising from the $6 range to today’s price of $10.41, representing a near-70% return. While the increase was largely due to oil prices recovering, investors do appreciate its approach to sustainability.

Westport Fuel Systems (TSX:WRPT) isn’t a resource company, but it is an important play to watch as new fuels and new forms of energy emerge to become part of the mainstream. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene. Westport Fuel has been making major moves in the market over the past year, and its efforts are finally being realized .

From May of last year to now, the company has seen its stock price rise by 300%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock could climb even higher as the global energy transition accelerates.

While alternative fuels are worth watching, another mineral is set to play a critical role in the global energy transition. That’s right, it’s lithium. And a leader in that realm is Lithium Americas Corp. (TSX:LAC). It is one of North America’s most important and successful pure-play lithium companies. With two world-class lithium projects in Argentina and Nevada, Lithium Americas is well-positioned to ride the wave of growing lithium demand in the years to come.

It’s not ignoring the growing demand from investors for responsible and sustainable mining, either. In fact, one of its primary goals is to create a positive impact on society and the environment through its projects, making it a sound choice for impact investors. For these reasons, Lithium Americas could catch fire, especially with lithium demand soaring.

Celestica (TSX:CLS) is a major company in the global lithium boom due to is role as one of the top manufacturers of electronics in the Americas. Celestica’s wide range of products includes but is not limited to communications solutions, enterprise and cloud services, aerospace and defense products, renewable energy and enough health technology. Thanks to its exposure to the renewable energy market, Celestica’s future is tied hand-in-hand with the green energy boom that is transforming the world.

Celestica has had a wild year, constantly fluctuating. But if you zoom out a bit, you’ll see that the company’s share price has risen by nearly 35% since June of 2020. That’s some good momentum by any means.

By: Alex Kimani

** IMPORTANT NOTICE AND DISCLAIMER — PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by AmmPower Corp. (“AmmPower” or “AMMP”) to conduct investor awareness advertising and marketing. AmmPower paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of ninety thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by AmmPower) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares in the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Forward looking statements in this publication include that the global demand for ammonia and hydrogen as commodities will continue to increase; that the research and development in the energy sector will lead to adoption of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future; that governments will continue to implement initiatives supporting reduced carbon emissions and that ammonia and hydrogen will gain traction and commercial viability as potential carbon-free or low carbon fuel alternatives; that AMMP will be able to develop an efficient process and proprietary intellectual property for the production of green ammonia and that AMMP’s process, if developed, will be adopted commercially to allow use of green ammonia and/or hydrogen as viable fuel sources; that AMMP will meet its proposed development program and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP will be able to complete and establish its proposed manufacturing facility and produce ammonia power units which will be sold as commercially viable fuel alternatives; that investors will continue to seek opportunities for investment in green technologies and that hydrogen and ammonia will be considered as viable investment opportunities in the future; and that AMMP can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the global demand for ammonia and hydrogen may not actually continue to increase if other energy alternatives such as solar, wind or hydroelectric are favored over ammonia and hydrogen; that the research and development in the energy sector may lead to rejection of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future, and that research may find that other fuels or energy sources provide safer, more cost efficient and/or more viable fuel alternatives; that governments may not implement the anticipated funding and initiatives to support reduced carbon emissions sufficient for ammonia and hydrogen to gain necessary traction or commercial viability as fuel alternatives; that AMMP may be unable to develop an efficient process or any unique proprietary intellectual property for the production of green ammonia or, even if developed, may ultimately fail to be adopted as commercially viable for any reason; that AMMP may be unable meet its proposed development timeline and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP may be unable to establish its proposed manufacturing facility and produce ammonia power units, or if such units are developed, that they may not be sold as commercially viable fuel alternatives; that investors favor other clean energy opportunities than hydrogen and ammonia or that other fuel alternatives such as solar, wind and hydroelectric may be considered more commercially viable; and that AMMP may, for any number of reasons, fail to carry out its intended business plans. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.