This afternoon, dating app Bumble (BMBL) reported second quarter earnings. Last Tuesday, Tinder parent Match (MTCH) reported the same. If you want a date, check them out. But what about the stocks?

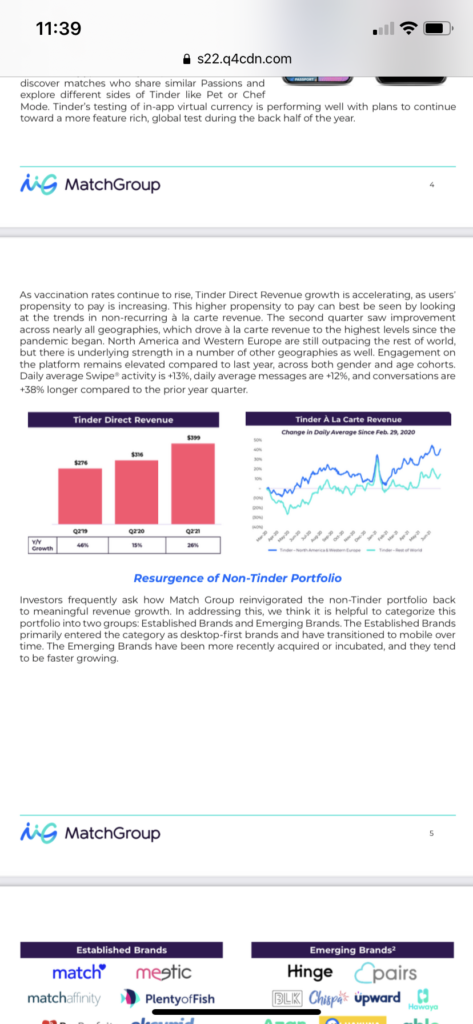

Let’s start with Tinder. Tinder is the leading dating app with 9.6 million paying users. As you can see in the above graphic, Tinder is growing revenue rapidly. It had $399 million in revenue in 2Q21, up from $316 million in 2Q20 and $276 million in 2Q19.

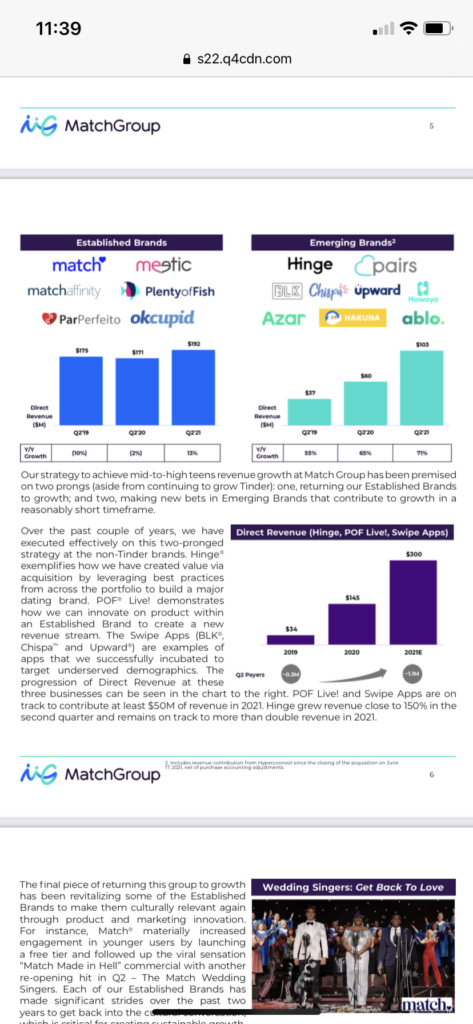

But Match is much more than just Tinder. As you can see in the above graphic, they have a number of other Established and Emerging Brands. The most interesting and one with the highest potential is probably Hinge, a relationship oriented dating app that is a direct competitor to Bumble. (Tinder has a reputation as being a place for hookups). While the Emerging Brands segment of which Hinge is a part only had revenue of $103 million in 2Q21 the growth rate from a year ago was 72%.

From a valuation perspective, Match guided 2021 Adjusted EBITDA to $1,045-$1,060 million. With a $44 billion valuation, Match isn’t cheap with a market capitalization to Adjusted EBITDA multiple in the low 40s. But they have great, established brands in a growing market. Between Match and Bumble, Match is surely the more conservative play and I think long term investors will do well.

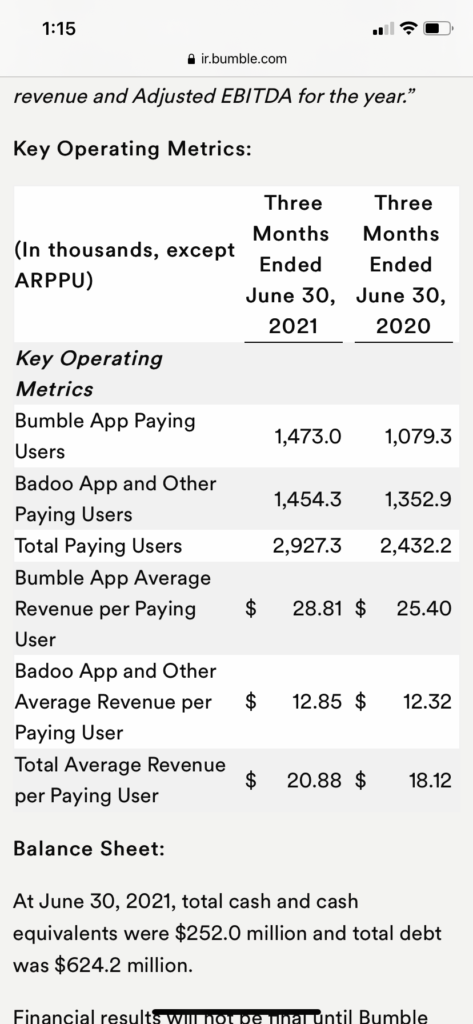

But I’m personally more intrigued by Bumble at the moment. Bumble reported an excellent quarter this afternoon, growing paying users 9% from 1Q21 to 1.473 million.

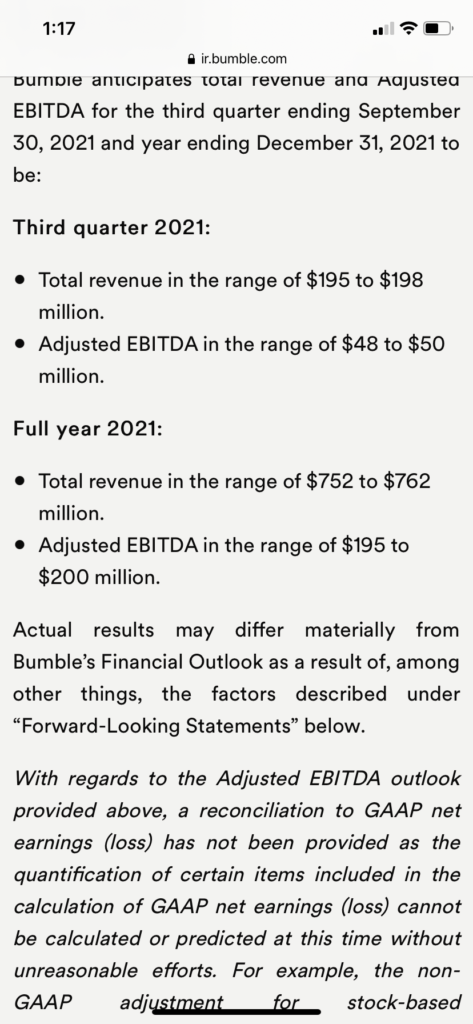

As a result of this strong growth, Bumble raised 2021 revenue guidance to $752-$762 million from $724-$734 million and Adjusted EBITDA guidance to $195-$200 million from $177-$182 million.

Frustratingly, I am unable to find a diluted share count for Bumble in its earnings report to calculate its market capitalization. Yahoo! Finance reports it as $8.8 billion. Therefore, Bumble’s market capitalization to Adjusted EBITDA multiple is similar to Match’s – but it’s growing significantly faster. Bumble is also cheaper on a market capitalization to revenue basis as well at ~12x versus ~15x for Match. I think Bumble’s singular focus on relationships over hookups and other types of relationships is also a positive as Generation Xers like myself and older Millennials look to settle down.