This past July, I did a post arguing that Donald Trump would be the primary beneficiary if there were an overly expansionary monetary policy. At the time, the internet was full of pundits denying that too much stimulus was even possible. After all, employment was down by over 5 million from pre-Covid levels. Here’s what I said:

I don’t expect a recession to occur in the next few years, but recessions are almost impossible to predict. It’s more interesting to think about the sort of policy mistakes (were they to occur) that might lead to a recession within a few years.

One mistake would be an excessively tight money policy, which could trigger a recession in 2022 or 2023. That’s possible, but seems quite unlikely at the moment.

A slightly more likely scenario would involve excessively expansionary monetary policy, which drove wage growth to levels inconsistent with 2% inflation over the long run. To get the inflation rate back on target the Fed would then need a tight money policy, which might trigger a recession.

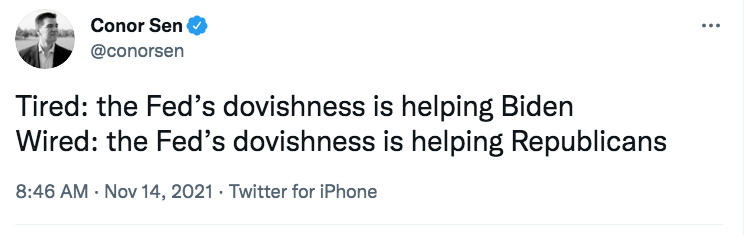

Correct me if I’m wrong, but opinion seems to be shifting in my direction. In a political sense, the biggest threat to the Dems is now too much demand stimulus. Matt Yglesias recently linked to this Conor Sen tweet:

Since July, the evidence has gradually shifted in the direction of the Fed being a bit too expansionary. (Widening TIPS spreads, etc.) That’s not to say that the Fed’s overall policy under Covid has been bad—they succeeded in the very important goal of quickly getting the price level and NGDP back to the trend line. And much of the inflation is transitory. But now there is some risk of overshooting.

PS. I’m not claiming that I predicted any of this (I don’t predict, I infer market forecasts), rather that I warned that overstimulus was a potential concern for Dems.