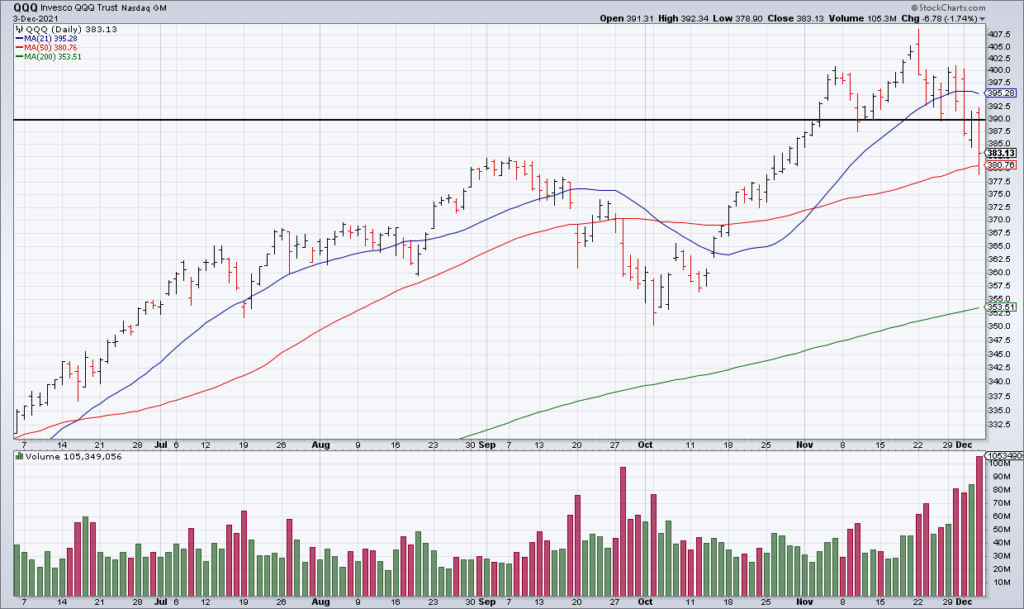

IMO a decisive break below and failure to reclaim $390 would mean that the bull market is likely over. I wouldn’t be surprised to see it happen this week – Top Gun Financial, Tuesday 11/30

Bears took control of the stock market this week as a result of Powell’s hawkishness, Omicron and a weak November Jobs Report. On Friday, the S&P was -0.84%, the NASDAQ -1.92% and the Russell -2.13%. Cathie Wood’s popular Ark Innovation ETF (ARKK) lost another 5.54%. NYSE + NASDAQ Advancers to Decliners was 1,965 to 6,055 and volume of 11.2 billion shares was strong.

However, I do expect bulls to make a stand next week – perhaps as early as Monday morning. While everything else is technically broken, the QQQ – home to the 7 stocks propping up the market – has not cracked yet. While QQQ did take out $390 last week, it found support at its 50 DMA on Friday. That seems like a natural spot for bulls to buy. However – if so – this will only be a brief respite in a new bear market.