To say the labor market is “strong” would be an understatement. The unemployment rate is now 4.2%. Only 3 of the previous 50 years saw lower unemployment rates (2000, 2018, 2019). Firms are desperately short of workers, despite fast rising wages. Service sucks almost everywhere I go.

Inflation is also above target, whether you look at a 1, 2, 3 4, or 5-year time frame.

So why is the Fed currently doing QE? What is the goal of this program?

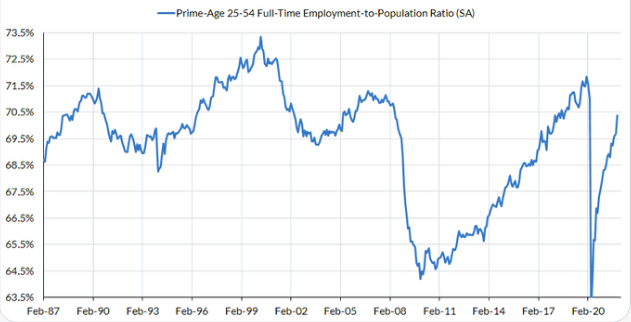

PS. David Beckworth directed me to a Skanda Amarnath tweet showing the amazingly quick recovery in the job market, compared to the Great Recession (for prime age workers):

PPS. Total employment in the US remains nearly 4 million below pre-Covid levels, while in Canada the previous peak has already been surpassed:

The unemployment rate fell to 6% — very near pre-pandemic levels — from 6.7% in October. Employment is now 186,000 jobs beyond where it was in February 2020. Hours worked rose 0.7%, fully recouping Covid losses for the first time.

Whatever factors are depressing US employment do not seem to be operative in Canada.