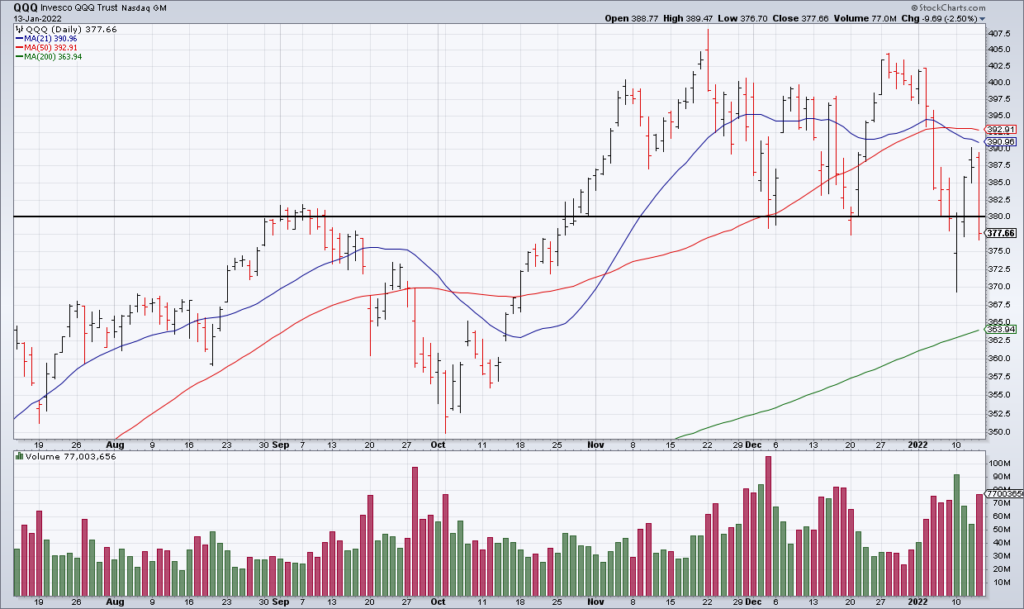

On Thursday, the bears got to the generals, breaking many of them down below key support levels. The QQQ closed below the crucial $380 for the first time since late October 2021.

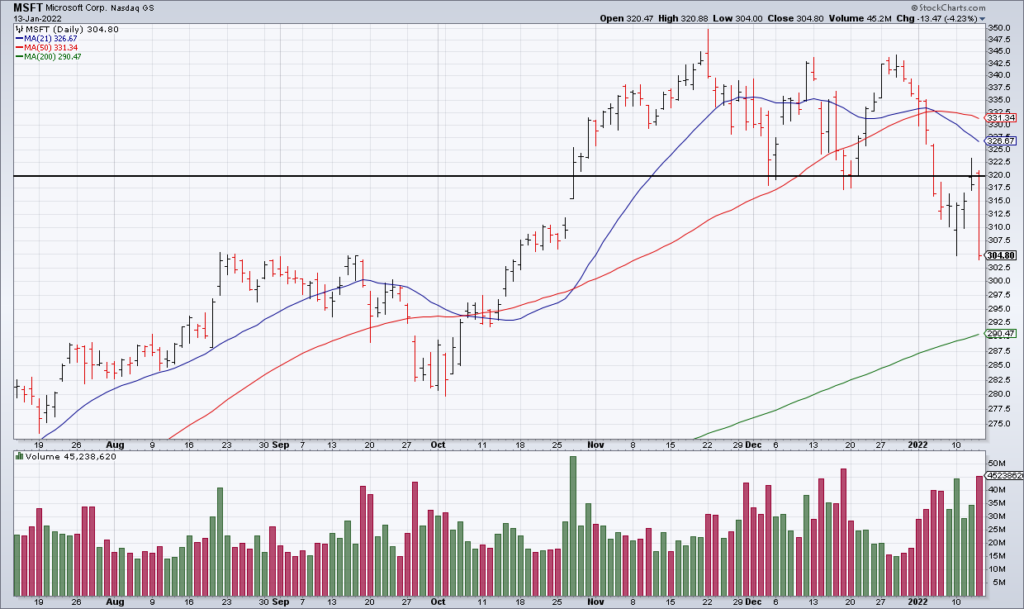

Microsoft (MSFT) – the 2nd largest stock in the market – crashed below key support at $320 and appears to have topped.

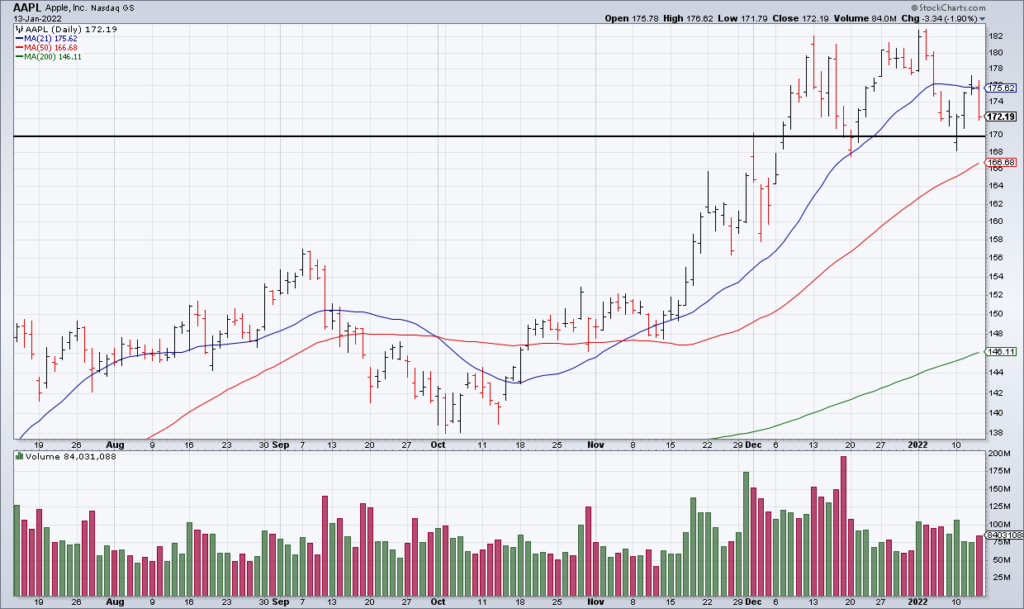

Apple (AAPL) – the largest and most important stock in the market – is a tougher nut to crack and held above $170 support. As I’ve written numerous times, AAPL is likely to be the last stock to top in this bull market. Below $170: Watch out!

Moving on to some of the important but not leading tech stocks, the iShares Software ETF (IGV) – home to many of the most expensive cloud software stocks in the market – closed at a 6 month low today. Cathie Wood’s Ark Innovation ETF (ARKK) – 2020’s darling – closed at a 52 week low.

You might wonder why I’m so focused on Tech. Couldn’t the market keep going higher even if Tech tops? No. The S&P 500 is approximately 1/3 tech and the headwind from a tech sector meltdown would be too much for the overall market to withstand.