Wednesday morning, storied consumer goods company Procter & Gamble (PG) reported 4Q21 earnings. PG is a $400 billion behemoth and you likely use many of its products everyday like Crest toothpaste, Charmin toilet paper, Tide laundry detergent and Head and Shoulders shampoo.

And PG – like all other companies – has a problem: Inflation. In its 4Q21 – despite Organic Sales +6% – PG’s Gross Profit actually declined marginally. Its Gross Margin was down 400 basis points to 49.1% compared to 4Q20. And that increase in costs was entirely due to higher commodity prices.

So PG faces a dilemma. It can raise prices to maintain its margins. Or it can hold prices stable to keep market share and sales at the expense of profitability. This is a dilemma that companies across the economy are going to be reckoning with and the ones that will thrive are the ones with Pricing Power. Pricing Power is the ability to raise prices without drastically reducing sales.

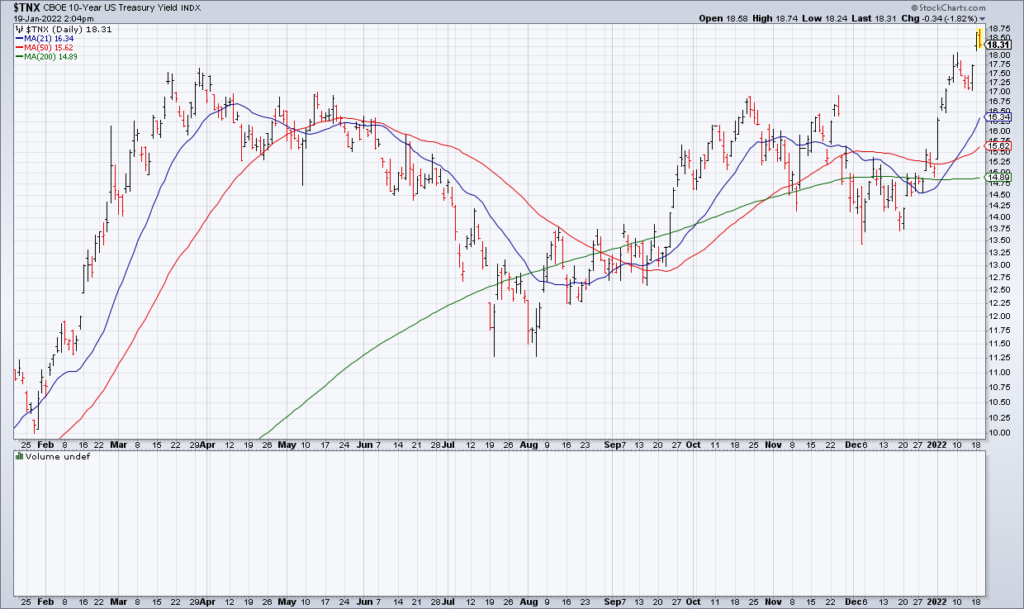

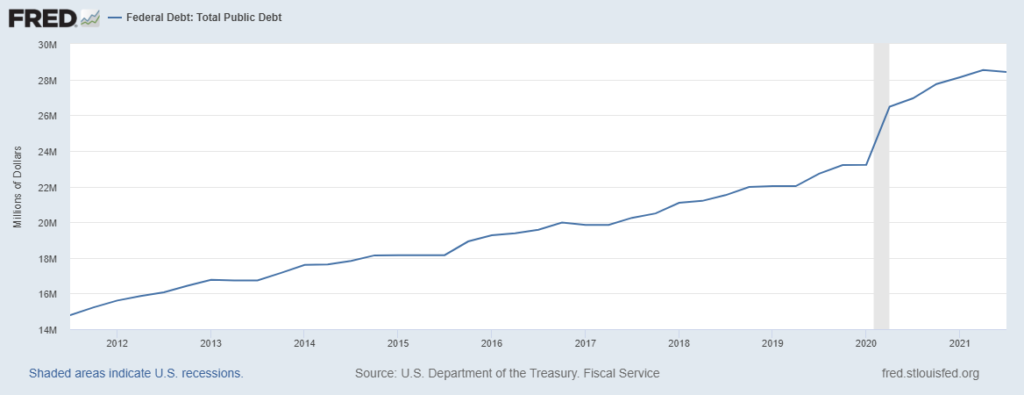

But inflation has broader implications than corporate profitability. It makes no sense to lend money at 3% when inflation is 10% because you’d be getting back less in terms of purchasing power than you lent out. Therefore, higher inflation is inevitably going to lead to higher interest rates. Indeed, it already is. For an economy as indebted as ours across all sectors, this increased debt service cost is potentially catastrophic.

Most importantly from the standpoint of making money, investors are starting to price all this in. Expensive tech stocks – as represented by the Software ETF (IGV) – are getting crushed as their future earnings are being discounted at a higher rate. At the other end of the spectrum, the precious metals are catching a ferocious bid this morning as investors try to find havens from inflation. The bill from decades of reckless policy is coming due and a regime change is at hand.