This should be a time of celebration for monetarists. While many conventional economists and market monetarists did not express much concern about inflation (until recently), more traditional monetarists like Bob Hetzel and Tim Congdon correctly warned that excessive money growth would trigger high inflation. And yet I don’t expect them to get much credit and I don’t expect a revival of monetarism. To see why, let’s look at the data:

Here I’d like to compare annual growth rates from 2019:Q4 to 2021:Q4:

Nominal GDP: +5.16%

PCE inflation: +3.33%

Real GDP: +1.56%

(They don’t quite add up because I used the PCE inflation index that the Fed targets, not the GDP deflator)

M2: +18.8% (December 2019 to December 2021)

Given the dramatic fall in immigration during Covid, the 1.56% RGDP growth is basically right on trend (per capita.) But the relatively normal growth in RGDP actually reflects two rather dramatic shocks, which roughly offset each other:

1. Excessive growth in aggregate demand. Nominal growth should have been no higher than 4%/year, and instead averaged over 5%. That pushed output above normal.

2. Supply chain problems related to early retirements and the switch from services to goods. That reduced output relative to trend.

These two factors roughly offset, leaving (per capita) output close to trend. The extra 1.16% in NGDP growth mostly led to higher than target inflation.

In some respects the situation is even worse than these figures suggest. NGDP growth was at an annual rate of 14.3% in 2021:Q4, confirming that monetary policy in the second half of 2021 was far too expansionary, as many traditional monetarists claimed. I expect the overheating problem to get even worse in 2022, as NGDP growth is likely to continue running at a rate that is well above 4%. Monetary policy is still too easy.

So why won’t monetarism make a big comeback? The problem here is that while monetarism was correct in a directional sense, the actual rise in inflation and NGDP was dramatically different from the growth in the monetary aggregates. (I used M2, but other aggregates also grew rapidly.) This reflects the fact that velocity slowed dramatically in 2020-21. M2 rose by over 41% over two years, while NGDP rose by barely over 10%. Thus it is still true that monetary aggregates are not a reliable guide to monetary policy. To judge whether money is too easy or too tight you need to look at expectations of NGDP growth.

Recent inflation figures look even worse. For instance, the PCE index is up 5.73% from November 2020 to November 2021. But that still means that someone who predicted 2% inflation this year was more accurate than someone who predicted 10% inflation. Is that how you think about forecast accuracy? Be honest.

I would call 2021 a marginal success for traditional monetarism. It supports the argument that the monetary aggregates provide some useful information that is not captured in conventional macro models. And while it’s still early, I am pretty confident that 2022 will provide another marginal success for traditional monetarism. We are in for another year of high inflation. So don’t take this post as a criticism of monetarism—its reputation should be higher today than a year ago.

Nonetheless, I don’t see enough evidence to support the claim that the monetary aggregates can play a decisive role in policy formation—velocity is too unstable. Markets saw what happened this time, and I’d expect the next time we get a surge in the monetary aggregates you’ll see that data better incorporated into market forecasts. Markets will decide how much weight to put on the aggregates.

Market forecasts are still the best guide to policy. Recall that market forecasts were far more useful than the monetary aggregates during the Great Recession.

PS. Hypermind predicted 8.1% NGDP growth, whereas the actual figure was 11.7%, which represents a spectacular failure of the Hypermind market. (Hypermind forecasters implicitly expected Q4 NGDP growth of roughly zero, instead it was 14.3%.) I suspect that there is a flaw in the way Hypermind reports its forecast, but I need to investigate further before I reach any conclusion. For the moment, I put more weight on TIPS spreads.

PPS. It’s not clear why the economy overheated in late 2021, but I suspect one reason is that the Fed abandoned its FAIT regime. There doesn’t seem to be any commitment to push inflation below 2%, as required by FAIT. Someone needs to ask Powell why that is.

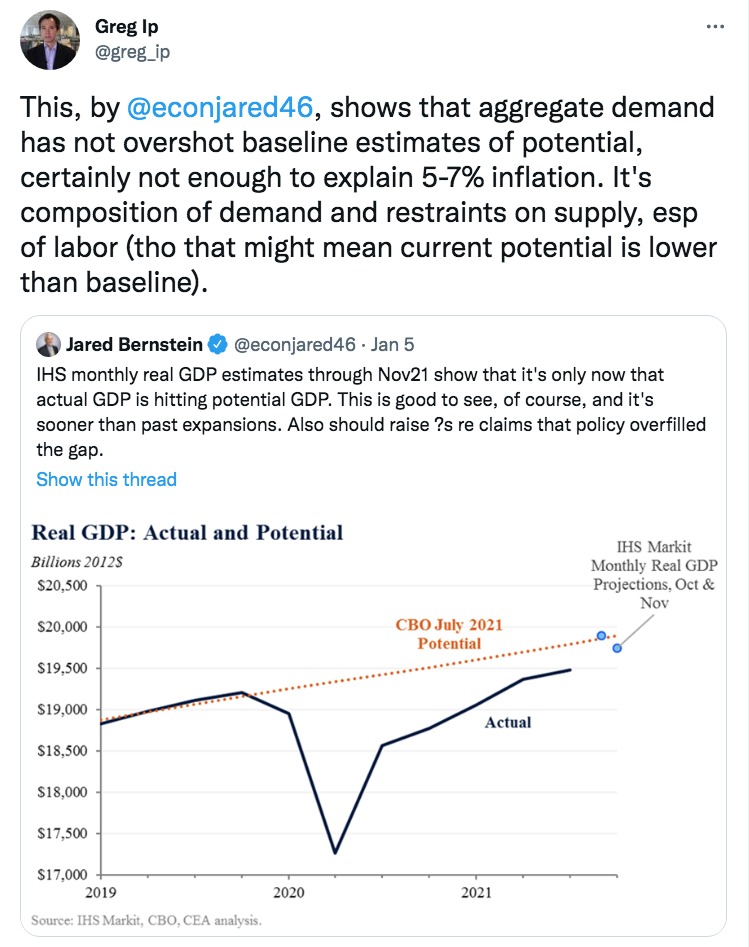

PPPS. Greg Ip makes the common mistake of assuming that RGDP is a measure of aggregate demand. It isn’t. Nominal GDP measures aggregate demand. (Consider RGDP and NGDP in Zimbabwe.) This leads him to wrongly conclude that the high inflation wasn’t caused by excess demand. Supply problems certainly played a role, but so did excess demand.