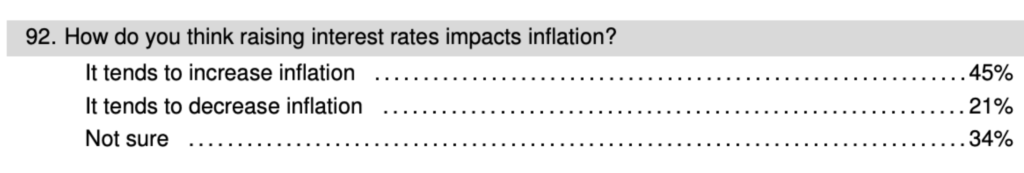

Economists are split between mainstream economists who believe that higher interest rates are disinflationary and NeoFisherians who believe that higher interest rates are inflationary. The public is also split on the issue:

I’m in the “not sure” camp, or more precisely “it depends”. If the higher interest rates are caused by a monetary policy change that causes the spot exchange rate to appreciate (as in Dornbusch overshooting), then it’s deflationary. If the higher rates are caused by a monetary policy that causes the spot exchange rate to depreciate, then it’s inflationary.

Most economists believe that higher interest rates are deflationary, at least in the US. So why does the public disagree? I see two possible explanations:

1. Maybe the public is NeoFisherian. They notice that inflation is higher when interest rates are higher (1960s, 1970s), and lower when interest rates are lower (1930s, 2010s.)

2. Maybe the public is thinking about the fact that higher interest rates make it more costly to finance the purchase of cars, homes, etc. In other words, they define “inflation” differently from the way economists define inflation.

Any other theories?

PS. Can we safely ignore public opinion on monetary policy? That’s one thing I am sure about. The answer is YES. Most of the public (not you guys) doesn’t have even a clue as to what monetary policy is.