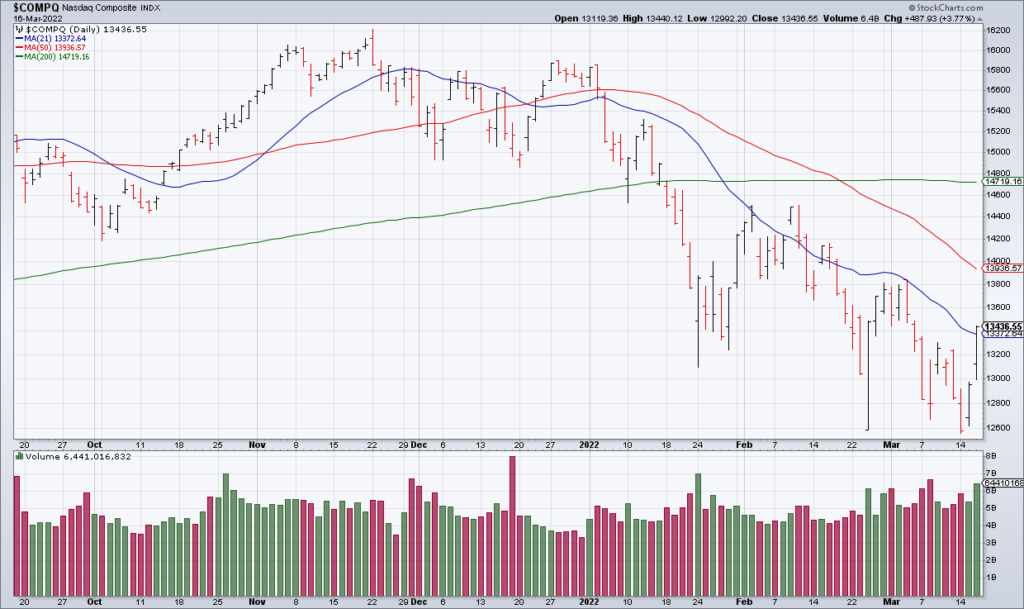

Two powerful rallies from oversold conditions on Tuesday and Wednesday have put the bulls back in control and a consolidation day Thursday – by which I mean a decline of less than 1% in the NASDAQ – wouldn’t change that. With the NASDAQ Futures currently off 40 basis points (7:25am EST), that appears to be what we’re going to get – at least at this stage.

Wednesday’s rally was powerful with heavy NYSE + NASDAQ volume of 12.7 billion shares. 10.9 billion of that – 86% – was on up volume or higher prices than the previous transaction. Shorts scrambled to cover their bearish bets and other investors were emboldened to get into the market.

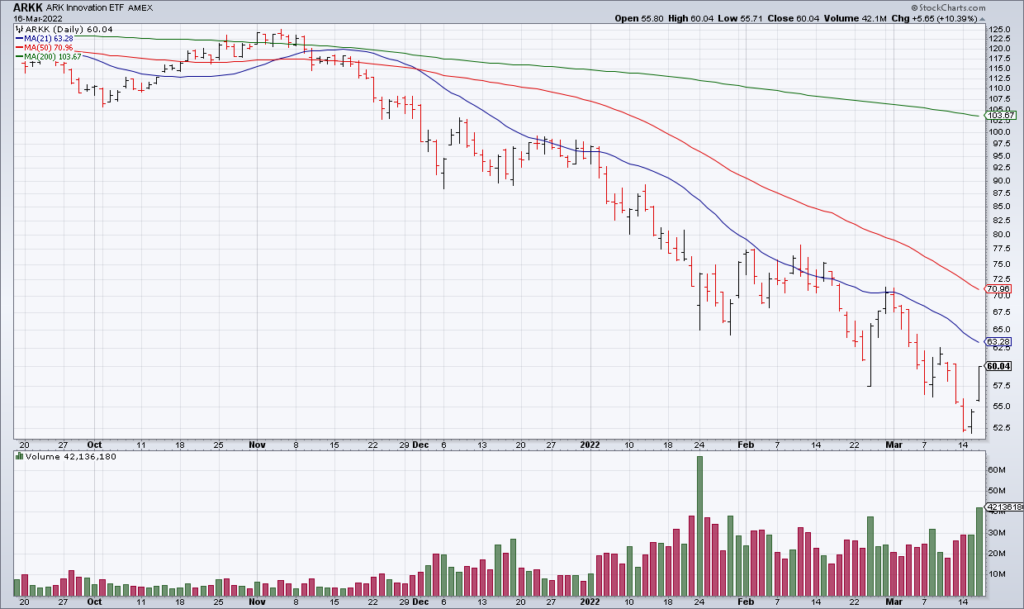

Oversold sectors like early stage growth and China got huge bounces. ARKK was +10.39% on 2x average volume and the Chinese Internet ETF (KWEB) was +40% on 5x average volume.

However, as you can see in the chart at the top of the blog, the NASDAQ has not been able to get much beyond its 21 DMA as represented by the blue line this year. While I heard a number of bottom calls yesterday, the trend is still down at the moment and the burden of proof is on the bulls.