The Bureau of Economic Analysis (BEA) produces two measures of national output which, in theory, should be equivalent. In practice, however, there are often substantive differences.

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

emphasis added

Unfortunately, in 2020, one of those low probability events happened (pandemic), and that led to a recession in 2020.

2) Significant policy error. Two examples: not reaching a fiscal agreement and going off the “fiscal cliff” probably would have led to a recession, and Congress refusing to “pay the bills” would have been a policy error that would have taken the economy into recession.

We’ve seen several policy errors, mostly related to immigration and trade during the previous administration, but none that would lead the economy into a recession.

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a “soft landing”, and frequently the result is a recession.

And this most common cause of a recession is the current concern. Since inflation picked up, mostly due to the pandemic (stimulus spending, supply constraints) and due to the invasion of Ukraine, the Fed has embarked on a tightening cycle to slow inflation.

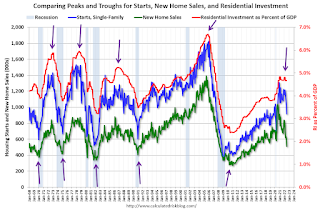

The arrows point to some of the earlier peaks and troughs for these three measures – and the most recent peak.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single-family starts turned down last year, but that was partly due to the huge surge in sales during the pandemic – and then rebounded somewhat. Now both new home sales and single-family starts have turned down in response to higher mortgage rates. Residential investment has also peaked.

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid ’60s when the Vietnam buildup kept the economy out of recession. Another exception was in late 2021 – we saw a significant YoY decline in new home sales related to the pandemic and the surge in new home sales in the second half of 2020. I ignored that pandemic distortion.

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This is now happening, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.