In Rudi Dornbusch’s exchange rate model, a tight money policy causes a currency to appreciate sharply, overshooting its long run equilibrium value. From that point on, it is expected to gradually depreciate over time.

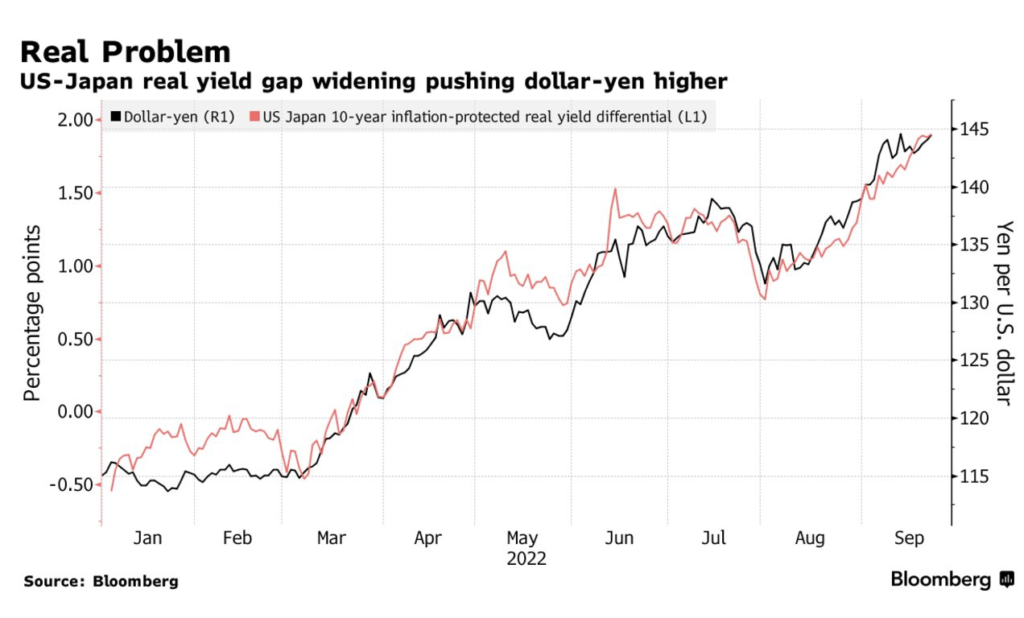

Recent trends in the dollar/yen exchange rate provide an almost textbook example of Dornbusch overshooting. This graph is from Bloomberg:

The 10-year nominal bond yield differential is even more striking, more than 300 basis points. Because of the interest parity condition, that means the yen is expected to appreciate by more than 3%/year over the next decade. And because monetary policy has little effect on the long run expected real exchange rate, a tight money policy in the US that causes higher interest rates must force the spot dollar much higher, so that it can be expected to fall back to something closer to its long run equilibrium over time.

Note that “never reason from a price change” still applies. If a country sees its interest rates rising merely due to higher inflation expectations (not tight money), then there is no reason for its currency to appreciate in the spot market. For example, look at countries like Turkey and Argentina. This is presumably why the FT graph shows the real interest rate differential.

A more timely example might be the UK, where rising bond yields triggered by an announced tax cut (seen as recklessly expansionary) were associated with a depreciating pound. I’m often critical of the “fiscal theory of the price level” (in the US context), but the recent market reactions to Truss’s policy initiative do match that model.

Bloomberg also reports that the Japanese government is trying to prevent yen appreciation:

Japan intervened to prop up the yen for the first time since 1998, after its central bank sparked further declines in the currency by sticking with ultra-low interest rates as its global peers hiked.

The yen rose as much as 2.5% against the dollar, pulling back sharply from the lows of the day when it had breached a key psychological level of 145, as top currency official Masato Kanda said Thursday the government was taking “decisive action.”

This seems misguided. Every time that Japan shows any sign of breaking out of the low inflation trap, the Japanese government does something to push the yen higher. What are they afraid of?

PS. A graph showing the nominal interest rate differential and the exchange rate would look quite similar. What would a NeoFisherian make of such a graph?