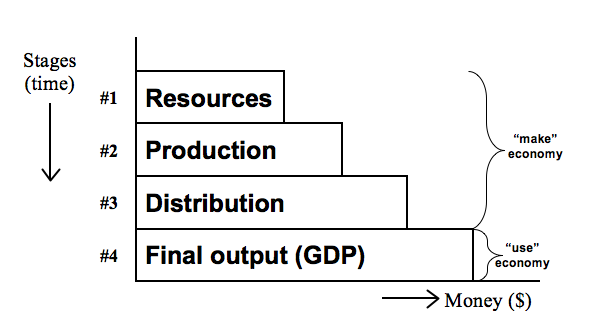

While I was waxing lyrical about the app economy yesterday afternoon, I did include the caveat that these companies won’t come to the forefront until the current macro clouds blow over. In addition, the app economy depends on a sound foundation in traditional industry. Mark Skousen’s delineation of the structure of production provides a nice framework for this. First, you have to extract natural resources through mining. Next, you have to manufacture goods using those natural resources. Third, you have to distribute those goods via trains, planes, ships and trucks. Only then can consumers purchase products for use.

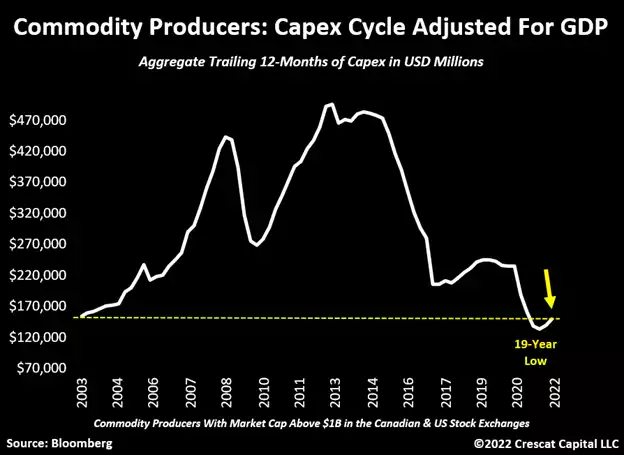

The hedge fund Crescat Capital has done great work showing the underinvestment in mining over the last decade or so. All the focus has been on tech and software to the neglect of natural resources. However – as I said in the introductory paragraph – the digital/app economy depends on a strong foundation in traditional industry. And that provides an opportunity for investors.

Nothing is more fundamental than food. Obviously the app economy is irrelevant if you’re starving. Farm equipment manufacturer Deere (DE) reported earnings earlier this morning and their results show that there is money to be made right now in farming. 1QFY23 (ending January 29, 2023) revenue was +32% and Diluted EPS +124%. They increased their FY23 net income guidance to $9 billion or ~$30/share. At Thursday’s close of $402.96, that works out to 13x forward earnings. An absolute steal. DE shares are currently +2% in the premarket.