The Mortgage Bankers Association’s (MBA) monthly Loan

Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis

points from 0.60% of servicers’ portfolio volume in the prior month to 0.55% as of March 31, 2023.

According to MBA’s estimate, 275,000 homeowners are in forbearance plans. Mortgage servicers have

provided forbearance to approximately 7.8 million borrowers since March 2020.In March 2023, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points

to 0.26%. Ginnie Mae loans in forbearance decreased 10 basis points to 1.18%, and the forbearance

share for portfolio loans and private-label securities (PLS) decreased 10 basis points to 0.68%.“As the COVID-19 national emergency draws to a close, the number of loans in forbearance continues to

drop,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage performance

remains strong with the percentage of borrowers who were current on their mortgage payments and

post-forbearance workouts increasing in March.”Adds Walsh, “MBA’s forecast still calls for a recession in 2023, which may change the current

performance levels, but credit quality is generally good and many borrowers facing financial hardship

can now access enhanced loss mitigation options that resulted from successes of pandemic-related

policies.”

emphasis added

Click on graph for larger image.

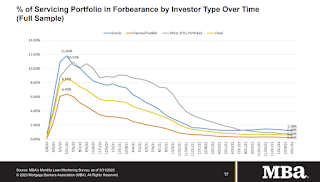

This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.55% in March from 0.60% in February.

At the end of March, there were about 275,000 homeowners in forbearance plans.