I recently discussed the current German recession, which is accompanied by a very strong labor market. In a recent post, Tyler Cowen provides a summary of Czechia’s recent recession, which shows the same pattern. In another post, he links to a Jason Furman tweet on the puzzling pattern of US growth in income/output:

Unlike many other countries, the official (NBER) definition of recession does not involve two negative quarters, but lots of people wrongly believe it does.

I’m interested in another question—why do we care about recessions?

I cannot be certain, but I suspect that many people fall for the following logical fallacy:

A implies X

A is strongly correlated with B

B implies X

I think I know why we care about recessions. Recession are generally associated with lousy labor markets. The high unemployment of the 1930s was such a severe social problem that it put macroeconomics on the map as an important field of inquiry, and as an area of interest to government policymakers.

In the US, recessions are highly correlated with two declining quarters of GDP. But the correlation is not perfect. There was clearly a recession in 2001, but we did not experience two consecutive negative quarters. There was clearly a boom in early 2022, but we did experience two negative quarters.

I suspect that many people are making the following logical fallacy:

We all know that recessions are traditionally associated with really bad labor markets (true). Thus past recessions have been important events (true). Recessions are almost always correlated with two negative quarters (true). Thus future cases of two negative quarters will be important events (false).

Here I’m dodging the question of whether two negative quarters are “actually a recession”, which is about as uninteresting a question as one could imagine. Who cares?

[Actually, I can think of an even dumber question: Is economics a science? Watch me move right along at the cocktail party when I hear that one.]

I’ll tell you who cares about recessions—dumb people who believe that words have magical powers. “If only I could convince you that this is a recession!” Yawn.

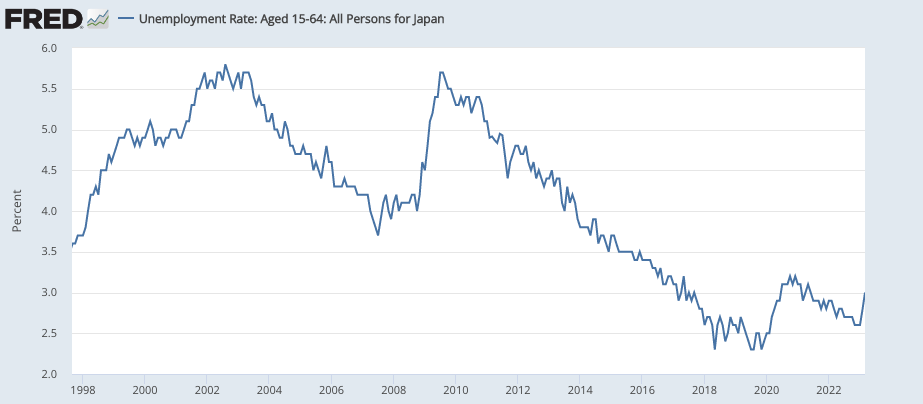

It’s not that I think you are wrong; it’s that I don’t care. Japan had a bunch of recessions in the 2010s. Do I care? No, none of them showed up in the labor market:

It’s incredibly uninteresting to see a slow growth economy alternate between slightly positive quarters and slightly negative quarters.

The entire world is now becoming more like Japan, with ever slower trend GDP growth rates. In the future, there’ll be lots more of these “recessions” with booming labor markets.

This is why the “Will there be a recession?” debate is so dumb. I don’t care whether the US experiences a recession; I’m simply not interested. The interesting question is whether the US will experience the sort of recession that we experienced in the past, where the unemployment rate always rose by at least 2 percentage points.

Now that’s an interesting question.

The German and Czechia recessions are so boring that the news media should not have wasted any ink reporting on these two events. No one cares.

PS. Another really dumb topic is “greedflation”. I’ve stopped even reading the articles. Josh Hendrickson brilliantly nails the underlying problem here:

This brings me inevitably back to so-called “greedflation.” This story is an attempt by people to treat every bout of inflation like isolated cases that require the fresh eyes of a new detective.

It’s even worse. Lots of economists also think we need to treat every recession like isolated cases requiring detective work. It’s (almost always) the falling NGDP, stupid. (Covid in 2020 was the exception that proves the rule.)

PPS. BTW, US productivity and output growth was overstated in 2020 and is now being understated. The longer run figures are more accurate.