The net worth of households and nonprofits rose to $148.8 trillion during the first quarter of 2023. The value of directly and indirectly held corporate equities increased $2.4 trillion and the value of real estate decreased $0.6 trillion.

…

Household debt increased 2.2 percent at an annual rate in the first quarter of 2023. Consumer credit grew at an annual rate of 4.3 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.5 percent.

The first graph shows Households and Nonprofit net worth as a percent of GDP.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2023, household percent equity (of household real estate) was at 69.6% – down from 70.1% in Q4, 2022. This is close to the highest percent equity since the early 1980s.

Note: This includes households with no mortgage debt.

Mortgage debt increased by $45 billion in Q1.

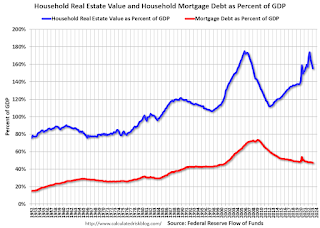

Mortgage debt is up $1.82 trillion from the peak during the housing bubble, but, as a percent of GDP is at 47.3% – down from Q4 – and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, decreased in Q1 – after peaking in Q2 2022 – and is well above the average of the last 30 years.