A brief excerpt:

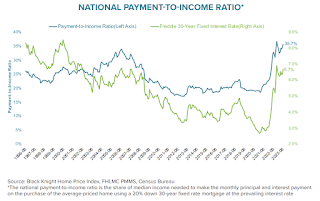

National Payment to Income Ratio Increased to Near Record

This was as of June 22nd when mortgage rates (according to the Freddie Mac PMMS), were at 6.67%. Rates have increased since then, and it is likely the payment-to-income ratio is now at a new record high.

Black Knight on the payment to income ratio:

• After a modest improvement in early 2023, home affordability has worsened in recent months fueled by both rising home prices and rising interest rates

• As of June 22, with 30-year rates at 6.67%, it required $2,258 per month in principal and interest to make the monthly payment on a median-priced home with 20% down and a 30-year mortgage, the highest such payment on record, marginally higher than the $2,234 required back in October

• Factoring in current income levels, that means 35.7% of the median household income would need to be allocated to the monthly payment of a median-priced home, making June the second least affordable month in the past 37 years

emphasis added

There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/