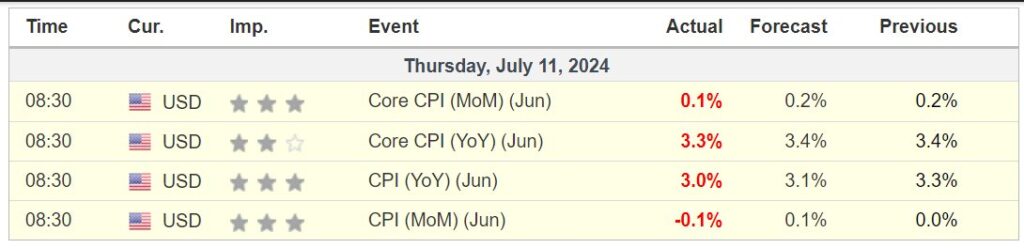

The June CPI came in soft Thursday morning raising expectations of a Fed rate cut in September to about 85%. In an interesting reaction to the report, investors are selling the leading stocks in the Nasdaq-100 (QQQ) and rotating into smaller stocks represented by the Russell 2000 (IWM) and S&P Equal Weight (RSP) on the premise that rate cuts will benefit them more. This is only the second day since 1979 when the Russell is up more than 3% while the S&P is down; the other was October 10, 2008 (Source: Bespoke Investment Group). The question is if this is the start of the broadening out of the bull market as the lack of breadth has been top of mind for many investors.

While bulls will interpret today’s action as a broadening out of the bull market, fundamentals suggest that smaller companies serving the asset poor are not primed to participate. On Tuesday morning, consumer products maker Helen of Troy (HELE) significantly lowered FY25 revenue and earnings guidance in conjunction with their 1QFY25 earnings report. “Consumers are even more financially stretched and are even further prioritizing essentials over discretionary items”, said CEO Noel Geoffroy (for more see Spencer Jakab, “Is This A Canary In The Consumer Coal Mine?”, WSJ Thursday July 11). Shares are off more than 30% this week due to the report. This comes on the heels of POOL Corp’s (POOL) warning two weeks ago that new pool construction could be down 15-20% this year after a disappointing peak swimming pool season (late May to early June).

What does it all mean? The two tier stock market – QQQ vs all the rest – is correlated with the two tier economy – the financial asset rich vs the working class poor. Those who are financial asset rich – primarily represented by the Baby Boomers – are doing just fine as they can maintain their spending due to the outstanding performance of stocks and real estate. However, the asset poor and the companies who sell to them are struggling. If my contention that the fundamentals don’t support today’s rally in smaller stocks due to deteriorating fundamentals is correct, then the stock market – and by extension the economy – rests on seven mega-cap tech stocks that are supporting the spending of the asset rich. Those stocks are currently in a massive bubble and when they roll over – and they will soon – so will the global economy.