The 50 day moving average is important in that it calculates the intermediate trend of any given financial instrument. A close beneath it means that we watch to see if the intermediate trend is slowing. Multiple closes beneath the average likely means the intermediate trend is not only slowing but in danger of rolling over and becoming a down trend.

So today’s close beneath the 50 day moving average could be very important, or not. In this case, it is really not that important.

The reason it is not that big of a deal is because the S&P 500 had been trading above its 50 day moving average for 74 days, before closing beneath it. 74 days above the 50 day average means the trend has been strong. Yes, it is likely now slowing, but we shouldn’t expect for the momentum that has been built up over those 74 days to come to a crashing halt.

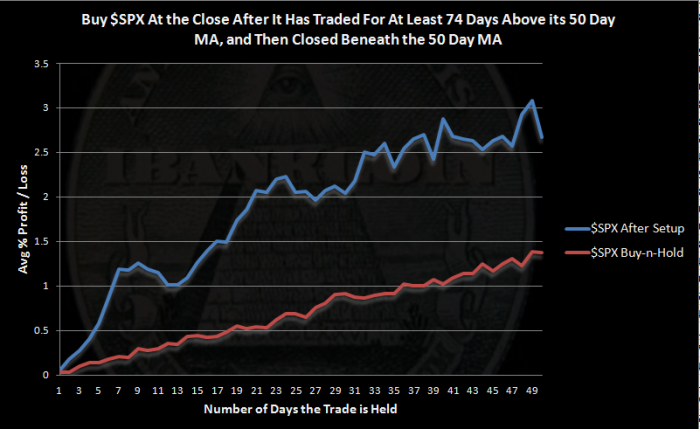

Perhaps a visual would better demonstrate what we should expect to occur…

The Rules:

- Buy $SPX at the close after it has traded above its 50 day moving average for at least 74 days and then closes beneath it.

- Sell $SPX at the close X days later.

- First $SPX trade is on 12.7.1928.

- No commissions or slippage included.

The Results:

This setup has tended to generate almost double the average return of buy and hold over a 50 day time frame.

And sample size, while not huge, should be large enough for the results to be considered reliable. There were 38 trades made (add one more for the trade made today), and all of them were able to be held the full 50 days. 74.36% of those trades were higher than the purchase price, 50 days later.

The buy-n-hold results were generated by cutting all $SPX data into 50 day segments and then averaging all of those segments.

The Bottom Line:

Momentum is powerful. It does not typically just stop overnight. While I believe the current trend is slowing and we are likely to see a correction, there is still time to adjust. Trends do not turn off and on like a light switch, yet we often use moving averages to turn off and on our trading strategies.