VXX and its sister fund VXZ were the first Exchange Traded Notes (ETNs) available for volatility trading in the USA. To have a good understanding of how Barclays Bank PLC iPath S&P 500 VIX Short-Term Futures ETN works you need to know how it trades, how its value is established, what it tracks, and how Barclays makes money running it.

How does VXX trade?

- For the most part VXX trades like a stock. It can be bought, sold, or sold short anytime the market is open, including pre-market and after-market time periods. With an average daily volume of 50 million shares its liquidity is excellent and the bid/ask spreads are a penny.

- It has a very active set of options available, with five weeks’ worth of Weeklys and close to the money strikes every 0.5 points.

- Like a stock, VXX’s shares can be split or reverse split— 4:1 reverse-splits are the norm and can occur once VXX closes below $25.

- VXX can be traded in most IRAs / Roth IRAs, although your broker will likely require you to electronically sign a waiver that documents the various risks with this security. Shorting of any security is not allowed in an IRA.

How is VXX’s value established?

- Unlike stocks, owning VXX does not give you a share of a corporation. There are no sales, no quarterly reports, no profit/loss, no PE ratio, and no prospect of ever getting dividends. Forget about doing fundamental style analysis on VXX.

- The value of VXX is set by the market, but it’s closely tied to the current value of an index (S&P VIX Short-Term Futurestm) that manages a hypothetical portfolio of the two nearest to expiration VIX futures contracts. Every day the index specifies a new mix of VIX futures in that portfolio. For more information on how the index itself works see this post or the VXX prospectus.

- The index is maintained by the S&P Dow Jones Indices and the current value of VXX if it were perfectly tracking the index is published every 15 seconds as the “intraday indicative” (IV) value. Yahoo Finance publishes this quote using the ^VXX_IV ticker.

- Wholesalers called “Authorized Participants” (APs) will at times intervene in the market if the trading value of VXX diverges too much from the IV value. If VXX is trading enough below the index they start buying large blocks of VXX—which tends to drive the price up, and if it’s trading above they will short VXX. The APs have an agreement with Barclays that allows them to do these restorative maneuvers at a profit, so they are highly motivated to keep VXX’s tracking in good shape.

What does VXX track?

- Ideally VXX would track the CBOE’s VIX® index—the market’s de facto volatility indicator. However since there are no investments available that directly track the VIX Barclays chose to track the next best choice: VIX futures.

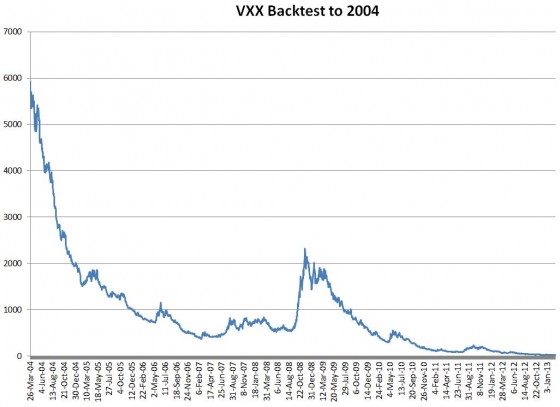

- Unfortunately using VIX futures introduces a host of problems. The worst is horrific value decay over time. Most days both sets of VIX futures that VXX tracks drift lower relative to the VIX—dragging down VXX’s value at the average rate of 5% to 10% per month. This drag is called roll or contango loss.

- Another problem is that the combination of VIX futures that VXX tracks does not follow the VIX index particularly well. On average VXX moves only 55% as much as the VIX index.

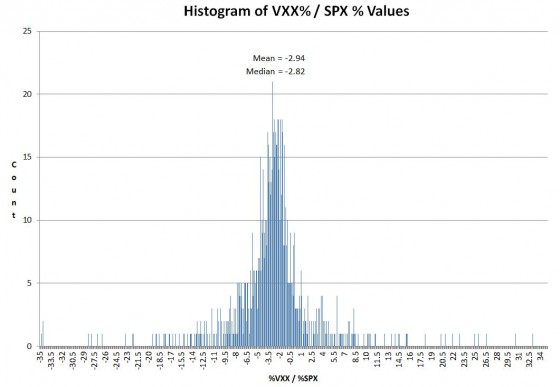

- Most people invest in VXX as a contrarian investment, expecting it to go up when the equities market goes down. It does a respectable job with the VXX averaging percentage moves -2.94 times the S&P 500, but16% of the time VXX has moved in the same direction as the S&P 500. The distribution is shown below:

- With lethargic tracking to the VIX, erratic tracking with the S&P 500 and heavy price erosion over time, owning VXX is usually a poor investment. Unless your timing is especially good you will lose money.

How does Barclays make money on VXX?

- Barclays collects a daily investor fee on VXX’s assets—on an annualized basis it adds up to 0.89% per year. With current assets at $1.15 billion this fee totals around $10 million per year. That’s certainly enough to cover Barclays’ VXX costs and be profitable. But even if it was all profit it would be a tiny 0.1% percent of Barclays’ overall net income— which was $10.5 billion in 2012.

- From a public relations standpoint VXX is a disaster. It’s frequently vilified by industry analysts and resides on multiple Worst ETF Ever lists. You’d think Barclays would terminate a headache like this or let it fade away, but they haven’t done that even though 2 reverse splits—which suggests that Barclays is making more than $10 million a year with the fund.

- Unlike an Exchange Trade Fund (ETF), VXX’s Exchange Traded Note structure does not require Barclays to specify what they are doing with the cash it receives for creating shares. The note is carried as senior debt on Barclays’ balance sheet but they don’t pay out any interest on this debt. Instead they promise to redeem shares that the APs return to them based on the value of VXX’s index—an index that’s headed for zero.

- If Barclays wanted to fully hedge their liabilities they could hold VIX futures in the amounts specified by the index, but they almost certainly don’t because there are cheaper ways (e.g., swaps) to accomplish that hedge. If fact it seems likely Barclays might assume some risk and not fully hedge their VXX position. According to IndexUniverse’s ETF Fund Flows tool, VXX’s net inflows have been $5.99 billion since inception in 2009—and it is currently worth $1.15 billion. So $4.8 billion dollars has been lost by investors and an equivalent amount by Barclays if they were hedged at 100%. If they were hedged at say 90% they would have cleared a cool $480 million over the last 4 years in addition to their investor fees. Barclay’s affection for VXX might be understandable after all.

VXX is a dangerous chimeric creature; it’s structured like a bond, trades like a stock, follows VIX futures, and decays like an option. Handle with care.