The debate on whether gold and silver should be used as an alternative currency will continue and deepen as people realise how fiat currencies are set to be devalued in the coming months – potentially sharply.

Today’s AM fix was USD 1,425.00, EUR 1,092.54 and GBP 935.04 per ounce.

Friday’s AM fix was USD 1,414.00, EUR 1,080.46 and GBP 920.63 per ounce.

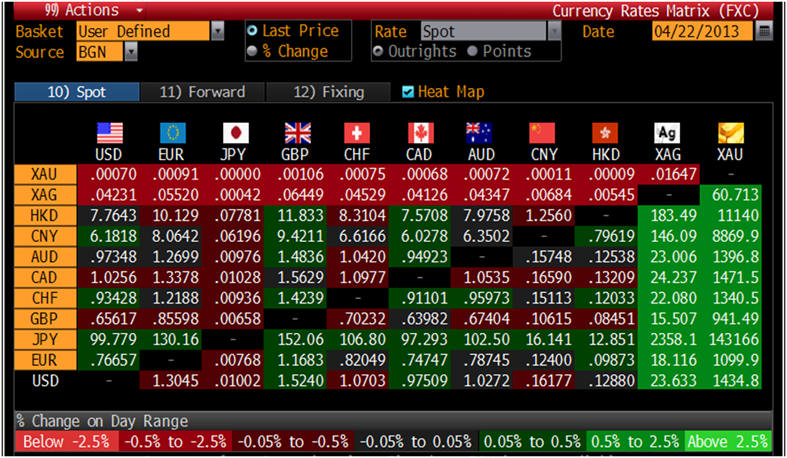

Cross Currency Table – (Bloomberg)

Gold climbed $12.90 or 0.93% on Friday to $1,400.90/oz and silver finished up 0.04%. Gold and silver both traded down for the week at 5.86% and 11.39%.

The state of Arizona may become the second state to use gold and silver coins as legal tender.

Last week, Arizona lawmakers passed a bill that makes precious metals legal tender. Arizona is the second state after Utah to allow gold coins created by the U.S. Mint and private mints to be used as currency. More than a dozen states have legislature underway to pass similar measures.

The move was launched by people who fear the Federal Reserve is not tackling the federal deficit and is thus debasing and devaluing the dollar. Some even fear, that if the Fed continues on the existing path it could lead to hyperinflation.

Miles Lester, who represents a group called Arizona Constitutional Advocates, said during a recent public hearing on legal-tender legislation that “the dollar is on its way out. It’s not a matter of if; it’s a matter of when.”

The upcoming U.S. FOMC meeting next week is April 30th and May 1st and will be closely watched by investors.

Supporters of the legislation look forward to a day when citizens can make purchases from debit cards linked to gold depositories.

Gold in USD, 1 Month, by 30 minutes – (Bloomberg)

Opponents point to the volatility of gold and silver as currency after the fall in price that occurred last week. However proponents point out that the fall in gold prices last week was due to the speculative raid of Wall Street banks who the Federal Reserve is supporting and works closely with.

Using gold and silver as currency would protect people from inflation, currency debasement, predatory banks and an increasingly volatile and vulnerable financial system.

Utah has had the law on the books for the past 2 years and is working on a system for using the precious metals as currency.

Gold in Euros, 1 Month, by 30 minutes – (Bloomberg)

The Arizona Senate Bill 1439 would allow the holder of gold or silver coins or bullion to pay a debt.

However, the coins must be issued by the U.S. government or approved by a court, like an American Eagle Coin. Oddly the government does not require that persons or business must use or accept gold or silver as legal tender in contravention of the U.S. Constitution.

The sponsor of the bill, Republican Sen. Chester Crandell, would need a final state Senate vote after approval by the House, and if passed the law would not take effect until 2014.

Crandell said, “The whole thing came from constituents”.

Gold in British Pounds, 1 Month, by 30 minutes – (Bloomberg)

The debate on whether gold and silver should be used as an alternative currency will continue and deepen as people realise how fiat currencies are set to be devalued in the coming months – potentially sharply.

A 5-10% allocation to physical bullion in your possession or in allocated accounts remains crucial to all wishing to protect their wealth from wealth confiscation. Whether that be by inflation or by pension, brokerage account or deposit confiscation – all of which have been seen in recent months and will be seen again.

This entry was posted in Headlines on April 22, 2013 by Mark OByrne.