With September out of the way, most economists now expect a December tapering event. Steen Jakobsen, chief economist at Saxo Bank in Denmark is not one of them.

Via email, Steen writes …

More QE, Less growth, Less Inflation and Less Upside

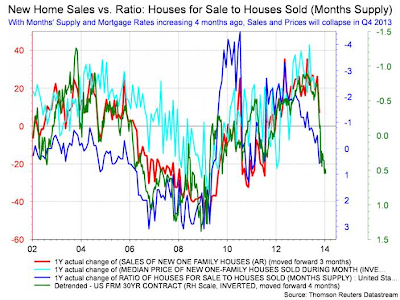

I have mentioned a few times how I see the fourth quarter having a dramatic slow-down effect, mainly due to unemployment rising, but also due to a serious drop in US housing activities. Please see the chart below. It clearly shows not only why housing will fall (correlation with a lag of mortgage rates) but also why we will see more quantitative easing (QE) rather than less.

With Months’ Supply and Mortgage Rates Increasing, Sales and Prices Will Collapse in Q4 2013

Tapering will not happen in October or in 2013 for that matter. Not a single economic vector in our model is pointing up. All indicate less growth, less inflation and less upside. The problem? The market is still talking recovery, despite the US this year being barely able to muster 1.5 percent growth after 2.5 percent last year. If this is recovery, I don’t want to experience recession.

Non-Tapering Changed Fixed Income’s Relative Value Over Equities

Again, we are increasingly confident about our 2.25 percent 10-year US bond rate call by the end of Q4-2013 versus 2.65 percent now. The Federal Open Market Committee’s fixed income put issued by the Fed’s recent non-tapering act has changed the relative value of fixed income over equities. This story has only just begun.

Alpha-wise, increasingly my Gold calls still see 1525/75 before falling again, and finally I continue to play the US dollar short as the path of least resistance will be a lower US dollar to help refuel emerging market currencies.

Housing Bulls Increasingly Optimistic

Curiously, housing bulls in the US are increasingly optimistic.

For example Bloomberg reports Blackstone Said to Gather $2 Billion for Real Estate. It’s important to note that Blackstone is raising money for European real estate (but it also has huge US commitment as well).

More to the point, I find the following Seeking Alpha headline rather amusing: It’s Not Too Late To Capitalize On The Real Estate Recovery.

That title reminds me of my 2005 post “It’s Too Late“

When you start seeing advertisements saying “It’s not too late”, or “Act now before it’s too late”, invariable the bulk of the gains have already been had, and the top is extremely close at hand, if not already gone.

One and Done Tapering?

That was a reasonably bold call by Steen. Another possibility is a “one and done” trivial amount of tapering in December. That is along the lines of what I expected in September.

For further discussion, please see …

- The Morning After; Price Discovery is Zero; PUT on the Bond Market? Is Inflation Really Under 2%?

- Fed Bizarro World; One-Sided Risk Assessment; The $64 Trillion Question

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com