Currently Illinois state constitution requires a flat tax on income. Even with the flat tax, Democrats have hiked taxes again and again, on individuals and corporations.

The results speak for themselves – Illinois population is shrinking. Illinoisans exited the state for Indiana, Wisconsin, and Texas.

For details please see Jobs Bowl: Illinois vs. Texas and Indiana.

Blank Check Proposal for More Tax Hikes

Not content with the damage they have already caused, “Progressives” want even more. Now they want to modify the Illinois constitution to take more out of your pocket.

Via email from Kristina Rasmussen at the Illinois Policy Institute …

Legislators are being asked to consider a constitutional amendment that would replace Illinois’ flat income tax with a progressive tax, sometimes referred to as “graduated” or “variable rate” tax. Others incorrectly call it a “fair tax” – but it is nothing of the sort.

What exactly should these families cut from their household budget to make room for more government? The mortgage payment? Food? Utilities? Retirement savings?

Proponents of a progressive tax hike are deliberately misleading the public by pretending that the current income tax rate of 5 percent, which reverts to 3.75 percent at the end of 2014, continues on in perpetuity.

Of course, the proponents of a tax hike are not interested in an honest policy discussion. They want to minimize perceived costs to deceive voters. The easiest way to do that is to pretend that current law doesn’t give every Illinoisan real tax relief next year.

We won’t let them get away with this illusion.

One thing is for sure: Regardless of the final rate-and-bracket structure, a progressive tax will slam communities like those within DuPage County. This is because they’re “rich” relative to other areas in Illinois in the same way that the owner of a Honda Accord is “rich” compared to the owner of a Ford Focus.

Kristina Rasmussen

Executive Vice President

Progressive Picking-Your-Pocket Numbers

Rep. Naomi Jakobsson, D-Champaign, is the brainchild of one “Progressive” proposal. Here are the Numbers.

Worse Proposals

Recall that Corollary Number Five of the “Law of Bad Ideas” says that no idea is so bad it cannot be made worse.

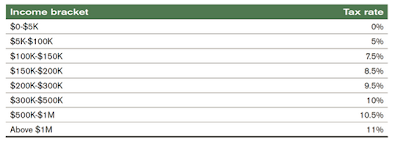

Sure enough: Another progressive tax plan, this one developed by the union-funded Center for Tax and Budget Accountability, increases the tax rate for anyone who earns more than $5,000 to as high as 11%!

How Much More Will You Pay?

How much higher will your taxes be under a progressive tax?

Visit Unfair Illinois to find out.

The above link has a Facebook feature but you do not have to use it. I didn’t, but I did sign the petition.

Why Will it Stop There?

Here’s my question: Whatever this costs now, why would it stop there?

Flat out, I will tell you it won’t. Anyone being honest knows it won’t. The massive “temporary” tax hike Quinn passed will go away, and the Progressives still want more and more and more.

Here’s corollary number six to the “Law of Bad Ideas“: Bad ideas lead to more bad ideas to fix problems caused by previous bad ideas.

What’s the Real Problem?

If you want to understand the real problem, please see Monetarism, Abenomics, QE, and Minimum Wage Proposals: One Bad Idea Leads to Another, and Another.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com