Buying climaxes are said to be a sign of distribution, indicating that stocks are moving from strong to weak hands. As such, buying climaxes often foreshadow trouble. What does the recent surge of buying climaxes mean?

Along with the Dow Jones and S&P 500, more than 500 individual stocks recorded new 52-week highs last week.

However, like the Dow and S&P, most stocks weren’t able to hold on to their lofty price tags.

12% of S&P 500 (SNP: ^GSPC) stocks had buying climaxes. This is the highest reading since January 27, and the second highest reading of the year.

A buying climax takes place when a stock makes a 52-week high, but closes the week with a loss.

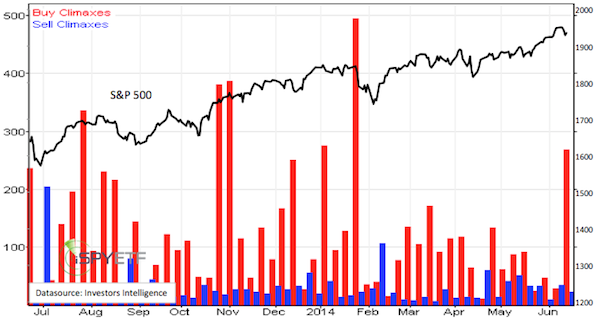

According to Investors Intelligence, which tracks buying/selling climaxes, buying climaxes are a sign of distribution and indicate that stocks are moving from strong hands to weak ones.

The chart below, which plots buying/selling climaxes against the S&P 500 (NYSEArca: SPY), harmonizes with the assessment of Investors Intelligence.

An increased amount of buying climaxes often results in a flattening of the up trend or price weakness.

However, none of the buying climax spikes in recent years has resulted in a major market top (even though many pundits have been calling for just such a major top).

What does this cluster of buying climaxes mean for stocks?

Here’s a detailed S&P 500 forecast based on the three key forces that drive the market.

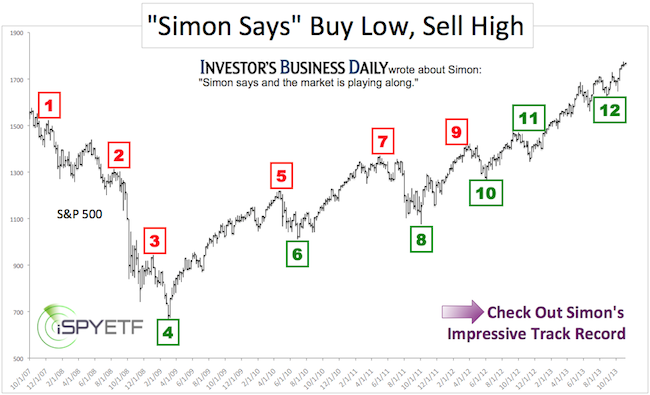

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.