To say that this QE bull market is persistent would be an understatement. Stocks have rolled over bearish setups again and again. In fact, such bearish forecasts, promoted by the media, are a key reason why the bull is still alive.

On September 27, 2013, I wrote an article titled “QE haters are driving stocks higher.” It started out like this:

“Stubborn bearish sentiment is one of the key reasons why stocks continue to rally, essentially giving bears the finger. Bears can’t stop the QE liquidity waves. Perhaps it’s time to stop fighting them and learn how to surf them. Bears, if you are looking for someone to blame for having been on the wrong side of the trade – look in the mirror.”

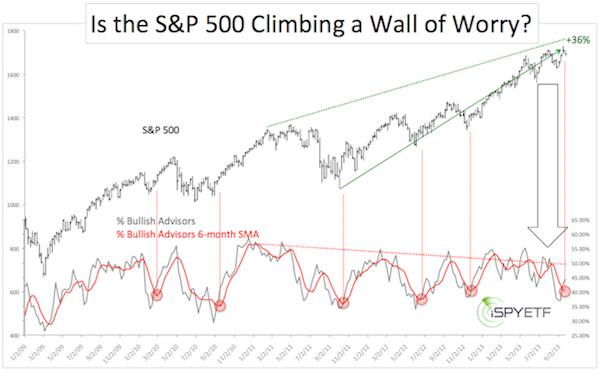

The same article featured the chart below, which shows the S&P 500 (SNP: ^GSPC) rising and the number of stock market bulls falling. Yes, this could be considered a ‘wall of worry,’ and we know what markets do with a wall of worry (they climb it).

From September 27, 2013 to today, the S&P 500 has tagged on 250 points.

Fast forward to May 2014. Here’s what the media said:

- CNBC: “This chart says we’re in for a 20% correction” – May 1

- CNBC: “I’m worried about a crisis bigger than 2008: Dr Doom” – May 8

- MarketWatch: “Stocks are telling you a bear market is coming – May 15

- Bloomberg: “Tepper: ‘Hold cash, market’s dangerous’” – May 15

Since May the S&P 500 (NYSEArca: SPY) has rallied as much as 100 points. There’s a pattern developing: Fear mongering = higher stock prices.

Here’s what the media says today:

- Barron’s: Just how overbought is the S&P 500? – June 10

- MarketWatch: 3 reasons why the Dow shouldn’t be at 17,000 – June 10

- CNBC: Cramer: Prepare for stock declines – June 11

- CNBC: This chart shows the market to be a ‘ticking time bomb’ – June 12

Persistently bearish media sentiment continues to extend this bull market’s life span. Will the S&P 500 rally another 100, 200 or 300 points from here?

Such a move would certainly fool the financial press (which the market loves to do), but there’s one reason why stocks, despite the media’s fear mongering, may take a breather here.

The 2014 S&P 500 forecast projected a more significant high at 1,950, which is where trade stalled this week. Why is S&P 1,950 significant?

The details of the original 2014 S&P 500 forecast at a recent update are available here:

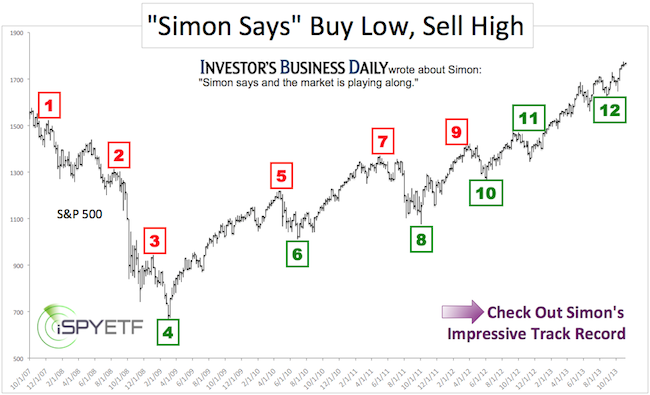

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.