In yet another sign of market over-exuberance, the Wall Street Journal reports Share Repurchases Are at Fastest Clip Since Financial Crisis.

Corporations bought back $338.3 billion of stock in the first half of the year, the most for any six-month period since 2007, according to research firm Birinyi Associates. Through August, 740 firms have authorized repurchase programs, the most since 2008.

The growth in buybacks comes as overall stock-market volume has slumped, helping magnify the impact of repurchases. In mid-August, about 25% of nonelectronic trades executed at Goldman Sachs Group Inc., excluding the small, automated, rapid-fire trades that have come to dominate the market, involved companies buying back shares. That is more than twice the long-run trend, according to a person familiar with the matter.

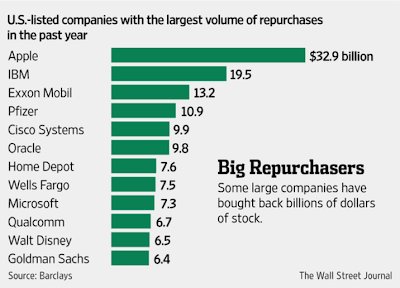

Large Repurchases in 2014

Rewarding Investors – Not

Contrary to the above graphic (and common wisdom), companies do not reward investors by buying back shares at inflated prices. Companies bought back the most shares in 2007, right before the crash, and the least shares at the most opportune time in 2009.

In practice, insiders buy low and sell high, and pocket cash from options all the way up. Insider activity is exactly the opposite of how companies treat shareholders.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com