Bank CEOs live in multi-million dollar mansions near Wall Street, Warren Buffett lives in a 56-year old house in Nebraska. Bank CEOs not only need Warren Buffet to polish their image, but being lumped in with Buffett has other benefits.

Huge amounts of Federal Reserve money can ‘buy’ profitability, but not popularity. Just ask Wall Street.

Bailed out conglomerates like Chase, Goldman Sachs, AIG, Bank of America or Wells Fargo are making money hand over fist, but they are not winning any popularity contests.

Fat cat bank CEO’s live in multi-million dollar mansions near Wall Street. In contrast, Warren Buffett still lives in his Nebraska home, purchased for $31,500 in 1958.

The average person can relate to Buffett more easily than James Dimon or Lloyd Blankfein.

Ironically, as the biggest component of the Financial Select Sector SPDR ETF (NYSEArca: XLF), Buffett’s Berkshire Hathaway (NYSE: BRK-B) is lumped in with Wells Fargo, JPMorgan Chase, Bank of America and the usual suspects.

Berkshire accounts for 8.79% of the XLF ETF and carries more weight than any other financial sector constituent. And XLF may need Buffett’s help.

The Financial Sector SPDR ETF (NYSEArca: XLF) is at an important juncture right now.

We looked at the similarities between the June and August breakouts (green bubbles) on August 22 (XLF Financial ETF Breaks above Resistance to New 6-year High).

The blue boxes highlight the parallels between the two patterns:

- Triple top (red dots)

- Selloff (red arrows)

- Eventual break to new highs (green arrows) on elevated volume (green boxes)

My August 22 conclusions was that: “XLF would enjoy limited upside, a consolidation period and another pullback. Resistance right around 23.05 is likely to act as support in the days/weeks to come.”

Support at 23.05 held on September 25, 26 and 29, but broke today. Support will now turn into resistance, and the path is down as long as trade stays below resistance.

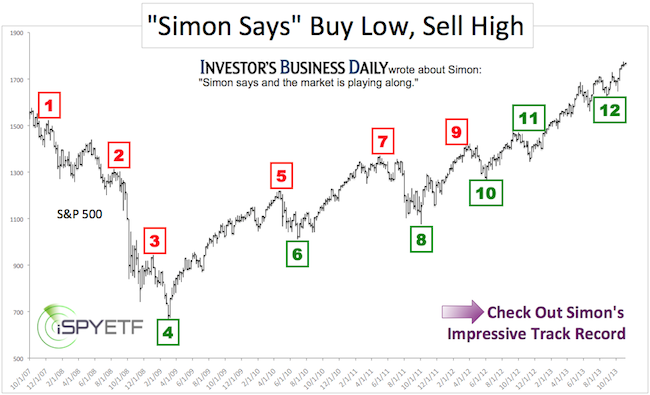

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.