Many investors look at economic indicators to gauge what’s ahead for stocks, but price is always the final arbiter. Here is one stock that’s more heavily intertwined in the global economy that any other, it’s also the biggest Dow component.

What’s most likely the most economically sensitive company in the world? Here are three clues:

- You probably carry it in your wallet

- In 2008 it become the largest IPO in U.S. history (surpassed by Alibaba in 2014)

- It is the most influential component of the Dow Jones Industrial Average

VISA (NYSE: V)

According to a 2008 Nilson report, Visa held a 38.3% market share of the credit card market place and 60.7% of the debit card market place in the U.S.

In 2009, Visa processed 62 billion transactions worth $4.4 trillion globally.

When consumers spend money, Visa makes money. When Visa makes money, the economy must be doing well. But, when Visa shares head lower, it may foreshadow trouble for the economy and the stock market.

Here are three must know facts about Visa:

- The Visa chart is showing a breakdown below a 3-year support line. Additional support is around 206. Resistance is around 219. Investors should know that Visa doesn’t issue cards or extend credit. Visa only provides the Visa-branded products and charges for processing transaction. Visa is not on the hook for delinquent or unpaid bills, but a decreasing volume of transactions (shy consumer) does affect its bottom line.

- There’ve been many calls for a market top, bubble burst and outright market crash. No doubt this QE rally is quite aged, but the final leg higher seems still ahead.

The older bull markets get, the more selective investors become. In their search for value, investors tend to flock towards large cap stocks. Which are perceived to be safer in a late stage bull market. Visa should (once this correction is finished) benefit from this large cap preference.

- Unlike most other major market indexes, the Dow Jones is price-weighted. With a price tag of $210, Visa is the biggest component of the Dow Jones (NYSEArca: DIA).

Visa’s price affects the Dow Jones more than any other stock.

Visa is not just an economically sensitive company, its stock is also a big player on Wall Street.

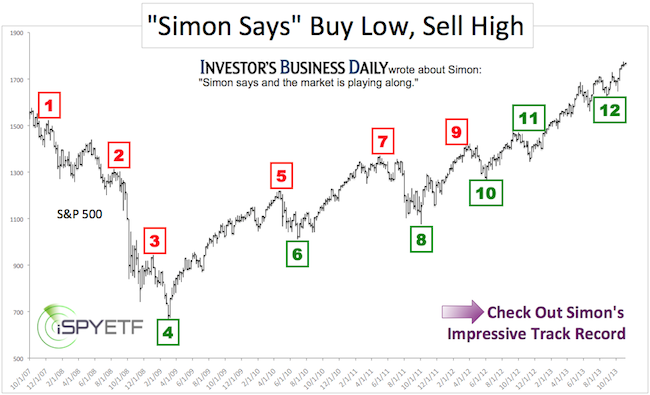

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.