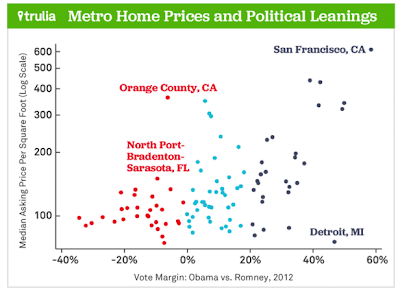

Here’s an interesting article thanks to Jed Kolko, Chief Economist at Trulia Trends via Washington Post Wonkblog: The most expensive housing markets in the U.S. are also the most liberal.

The relationship between housing affordability and politics in the US is startlingly strong as these charts by Jed Kolko shows.

Median asking price in dollars per square foot is on the vertical axis. Margin for Obama over Romney in the 2012 election is on the horizontal axis.

With the exception of Orange County California, all of the high priced counties voted for Obama.

The Washington Post notes ….

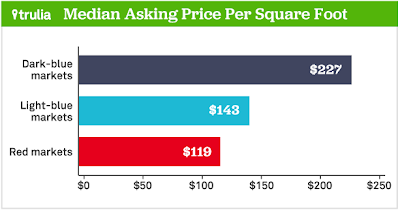

Nine of the 10 bluest markets had median home asking prices above $130 per square foot. All of the 10 reddest markets had prices below that. In the dark blue markets, housing cost almost twice as much ($227 per square foot) as in the red ones ($119). In metro Washington — this is not just the District — the average home asking price was about $177.

Trulia notes …

Households in blue markets tend to have higher incomes. But those higher incomes are not enough to offset higher home prices. Our middle-class affordability measure, which reflects the share of homes for sale within reach of a median-income household, is significantly lower in bluer markets. Furthermore, blue markets have lower homeownership and greater income inequality than red markets.

Sorted Data

Trulia made the data available. I sorted by price per square foot high to low. Here are the results.

| U.S. Metro | Vote margin: Obama vs Romney, 2012 (positive #s = blue markets; negative #s = red markets) | Price decline in housing bust, peak to trough (FHFA) | Year-over-year price change, Sept. 2014 (Trulia) | Median asking price per square foot, $, Oct. 2014 (Trulia) |

|---|---|---|---|---|

| San Francisco, CA | 58% | -23% | 9.9% | 613 |

| Honolulu, HI | 39% | -11% | 4.1% | 439 |

| San Jose, CA | 42% | -26% | 8.6% | 430 |

| Orange County, CA | -6% | -33% | 4.8% | 363 |

| Long Island, NY | 6% | -20% | 2.9% | 350 |

| Oakland, CA | 50% | -39% | 11.9% | 342 |

| Los Angeles, CA | 42% | -35% | 6.9% | 334 |

| New York, NY-NJ | 49% | -18% | 4.3% | 320 |

| Ventura County, CA | 7% | -39% | 12.4% | 305 |

| San Diego, CA | 8% | -35% | 1.8% | 296 |

| Fairfield County, CT | 11% | -21% | -0.5% | 237 |

| Middlesex County, MA | 27% | -13% | 7.8% | 236 |

| Boston, MA | 25% | -17% | 4.5% | 229 |

| Peabody, MA | 16% | -18% | 4.0% | 212 |

| Seattle, WA | 35% | -26% | 8.9% | 197 |

| Bethesda-Rockville-Frederick, MD | 34% | -22% | 2.6% | 189 |

| Sacramento, CA | 9% | -48% | 10.1% | 188 |

| Edison-New Brunswick, NJ | 3% | -22% | 6.2% | 180 |

| Miami, FL | 24% | -47% | 14.0% | 180 |

| Washington, DC-VA-MD-WV | 37% | -25% | 3.2% | 177 |

| Riverside-San Bernardino, CA | 4% | -50% | 10.6% | 164 |

| Providence, RI-MA | 25% | -26% | 2.8% | 162 |

| Baltimore, MD | 18% | -22% | -1.1% | 161 |

| Portland, OR-WA | 23% | -25% | 7.5% | 157 |

| Denver, CO | 13% | -8% | 9.4% | 152 |

| North Port-Bradenton-Sarasota, FL | -10% | -50% | 9.6% | 150 |

| New Haven, CT | 22% | -21% | -0.6% | 146 |

| Worcester, MA | 9% | -23% | 4.9% | 146 |

| Philadelphia, PA | 31% | -11% | 4.3% | 146 |

| Fort Lauderdale, FL | 35% | -48% | 6.9% | 143 |

| Hartford, CT | 23% | -14% | -0.4% | 143 |

| West Palm Beach, FL | 17% | -49% | 11.7% | 138 |

| Springfield, MA | 32% | -14% | 2.5% | 137 |

| Albany, NY | 16% | -6% | -0.7% | 135 |

| Tacoma, WA | 11% | -32% | 7.5% | 134 |

| Charleston, SC | -5% | -21% | 7.7% | 134 |

| Cape Coral-Fort Myers, FL | -17% | -56% | 9.8% | 133 |

| Newark, NJ-PA | 21% | -20% | 1.9% | 133 |

| Fresno, CA | 2% | -49% | 8.5% | 133 |

| Austin, TX | 7% | -4% | 9.9% | 130 |

| Lake County-Kenosha County, IL-WI | 9% | -27% | 11.3% | 130 |

| Chicago, IL | 32% | -28% | 10.0% | 129 |

| Salt Lake City, UT | -21% | -22% | 4.7% | 129 |

| Virginia Beach-Norfolk, VA-NC | 11% | -19% | 4.4% | 129 |

| Bakersfield, CA | -17% | -52% | 8.2% | 126 |

| Minneapolis-St. Paul, MN-WI | 12% | -26% | 10.0% | 125 |

| Phoenix, AZ | -11% | -51% | 3.8% | 123 |

| Wilmington, DE-MD-NJ | 24% | -20% | 3.8% | 123 |

| Warren-Troy-Farmington Hills, MI | 3% | -37% | 7.8% | 117 |

| Camden, NJ | 24% | -23% | 0.6% | 116 |

| Richmond, VA | 5% | -20% | 2.7% | 116 |

| Milwaukee, WI | 5% | -15% | 5.8% | 116 |

| Pittsburgh, PA | -1% | -2% | 6.9% | 116 |

| Allentown, PA-NJ | 2% | -21% | 2.6% | 114 |

| Las Vegas, NV | 15% | -61% | 9.0% | 113 |

| Raleigh, NC | 6% | -9% | 4.2% | 113 |

| Dallas, TX | -10% | -6% | 7.7% | 112 |

| Tucson, AZ | 7% | -38% | 1.4% | 111 |

| Orlando, FL | 8% | -48% | 7.7% | 110 |

| Albuquerque, NM | 13% | -17% | 0.6% | 110 |

| Nashville, TN | -16% | -9% | 5.6% | 109 |

| Jacksonville, FL | -19% | -38% | 7.0% | 109 |

| Colorado Springs, CO | -21% | -12% | 4.0% | 107 |

| San Antonio, TX | -8% | -4% | 4.5% | 107 |

| Tampa-St. Petersburg, FL | 3% | -43% | 5.0% | 106 |

| Houston, TX | -12% | -4% | 10.7% | 106 |

| New Orleans, LA | 0% | -11% | 7.5% | 102 |

| Palm Bay-Melbourne-Titusville, FL | -13% | -50% | 13.1% | 100 |

| Cincinnati, OH-KY-IN | -16% | -10% | 9.0% | 100 |

| Baton Rouge, LA | -12% | -3% | 1.3% | 100 |

| Charlotte, NC-SC | 2% | -16% | 7.0% | 99 |

| Oklahoma City, OK | -27% | -3% | 4.0% | 98 |

| St. Louis, MO-IL | 7% | -12% | 4.3% | 98 |

| Knoxville, TN | -34% | -8% | 2.1% | 98 |

| Birmingham, AL | -20% | -13% | 11.5% | 96 |

| Buffalo, NY | 14% | -2% | 3.1% | 96 |

| Atlanta, GA | 1% | -26% | 11.1% | 95 |

| Louisville, KY-IN | -3% | -6% | 11.0% | 94 |

| Fort Worth, TX | -23% | -6% | 6.4% | 94 |

| Columbus, OH | 7% | -10% | 6.5% | 94 |

| Omaha, NE-IA | -10% | -5% | 5.4% | 93 |

| Greenville, SC | -30% | -8% | 5.9% | 92 |

| Kansas City, MO-KS | -3% | -12% | 6.6% | 92 |

| Lakeland-Winter Haven, FL | -7% | -46% | 11.1% | 92 |

| Gary, IN | 21% | -11% | 6.8% | 91 |

| Little Rock, AR | -11% | -4% | -6.0% | 90 |

| Tulsa, OK | -32% | -4% | 7.3% | 90 |

| Syracuse, NY | 17% | -3% | 4.1% | 90 |

| Memphis, TN-MS-AR | 12% | -14% | 4.6% | 89 |

| Greensboro, NC | 1% | -10% | 2.6% | 89 |

| El Paso, TX | 32% | -8% | -0.9% | 88 |

| Rochester, NY | 11% | -2% | 2.0% | 87 |

| Grand Rapids, MI | -9% | -22% | 9.1% | 87 |

| Cleveland, OH | 24% | -18% | 4.1% | 86 |

| Akron, OH | 13% | -16% | 6.9% | 84 |

| Columbia, SC | 2% | -11% | -0.9% | 83 |

| Toledo, OH | 21% | -20% | 12.5% | 81 |

| Indianapolis, IN | -8% | -7% | 7.8% | 80 |

| Detroit, MI | 47% | -40% | 11.4% | 75 |

| Dayton, OH | -7% | -13% | 8.8% | 74 |

Congratulations to California

- California has seven of the top-ten least-affordable metro areas.

- New York managed two top-ten least affordable spots.

- Massachusetts garnered three top-fifteen slots.

Congratulations (of sorts) go to California.

Top 10 Cities by Population in 2013

| City Rank | City | Population | Cost per Sq Foot | Cost Ranking |

|---|---|---|---|---|

| 1 | New York, New York | 8,405,837 | 320 | 8 |

| 2 | Los Angeles, California | 3,884,307 | 334 | 7 |

| 3 | Chicago, Illinois | 2,718,782 | 129 | 42 |

| 4 | Houston, Texas | 2,195,914 | 106 | 66 |

| 5 | Philadelphia, Pennsylvania | 1,553,165 | 146 | 29 |

| 6 | Phoenix, Arizona | 1,513,367 | 123 | 47 |

| 7 | San Antonio, Texas | 1,409,019 | 107 | 64 |

| 8 | San Diego, California | 1,355,896 | 296 | 10 |

| 9 | Dallas, Texas | 1,257,676 | 112 | 57 |

| 10 | San Jose, California | 998,537 | 430 | 3 |

I created the above table by combining City Size data with Trulia data.

Top 10 Red vs. Blue

Of the 10 largest cities in the US, five voted for Obama and five for Romney.

The Texas cities (Houston, San Antonio, Dallas) and the Arizona cities (Phoenix and San Antonio) voted for Romney.

The highest ranking red city in the list was Phoenix. It placed 47 out of 100 in cost, with a median cost per square foot of $123 vs. San Jose, California with a median cost of $430 per square foot.

Correlation or cause? Liberal policies, union work rules, and building restrictions (or lack thereof) are all likely to play.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com