NOTE: Every week or two I wrote a Client Note for my clients. I post most but not all of the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

I noticed something strange with the market internals on Friday and Monday. Even though the S&P squeezed out new highs, breadth was quite poor. Declining stocks outnumbered advancing stocks 2040 to 1011 on Friday and 2122 to 1030 on Monday on the NYSE.

This divergence between the overall averages and the market internals caught my attention. It gelled with something I had been noticing. Many stocks that I follow have been performing poorly even though the overall averages are keeping up. For example, United Rentals (URI) and Viacom (VIAB) are two underperformers I sold recently after they peaked out a few months ago and have been mostly straight down since then.

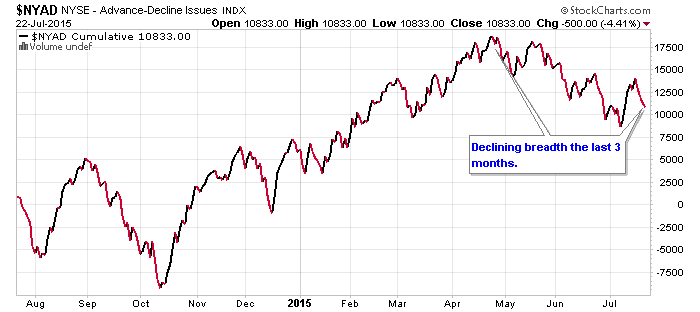

A look at the cumulative NYSE Advance-Decline line shows this trend started 3 months ago. Breadth is very important so let me take a minute to explain what this chart shows. Every day a certain number of stocks advance, a certain number decline and a certain number are unchanged. For example, today (Wed 7/22), 1329 securities on the NYSE advanced, 1839 declined and 86 were unchanged, according to the WSJ’s Market Data Center. Decliners outnumbered advancers by 510. Therefore, breadth for today was -510. The cumulative NYSE Advance-Decline line starts at 0 at a certain point in time, in this case one year ago, and then sums each days breadth onto the cumulative total moving forward.

What this charts shows then, importantly, is that more stocks are declining than advancing over the last 3 months. This can be so even though the market averages are hanging in there due to differences in market capitalization. The S&P 500 is a market cap weighted index so a few big stocks can carry the index and mask underlying weakness – which seems to be exactly what is happening.

Breadth is a very important market internal because it shows how broad participation in a move is. In this case, participation is not as strong as a bull would like it to be. This is just another reason I am increasingly cautious on this aging bull market and starting to take profits.

Greg Feirman

Founder & CEO

Top Gun Financial (www.topgunfp.com)

A Registered Investment Advisor

(916) 224-0113

Follow me on Twitter, like me on Facebook and invest like me with Covestor!