After the US economy showed a growth of 2.9% in the third quarter, topping the expectations of 2.5% investors became more convinced that the Fed will raise the interest rates this year. Even though stock futures had a positive reaction to the data released on October 28 in pre-market trading, in intraday trading both Dow Jones and S&P 500 inched down.

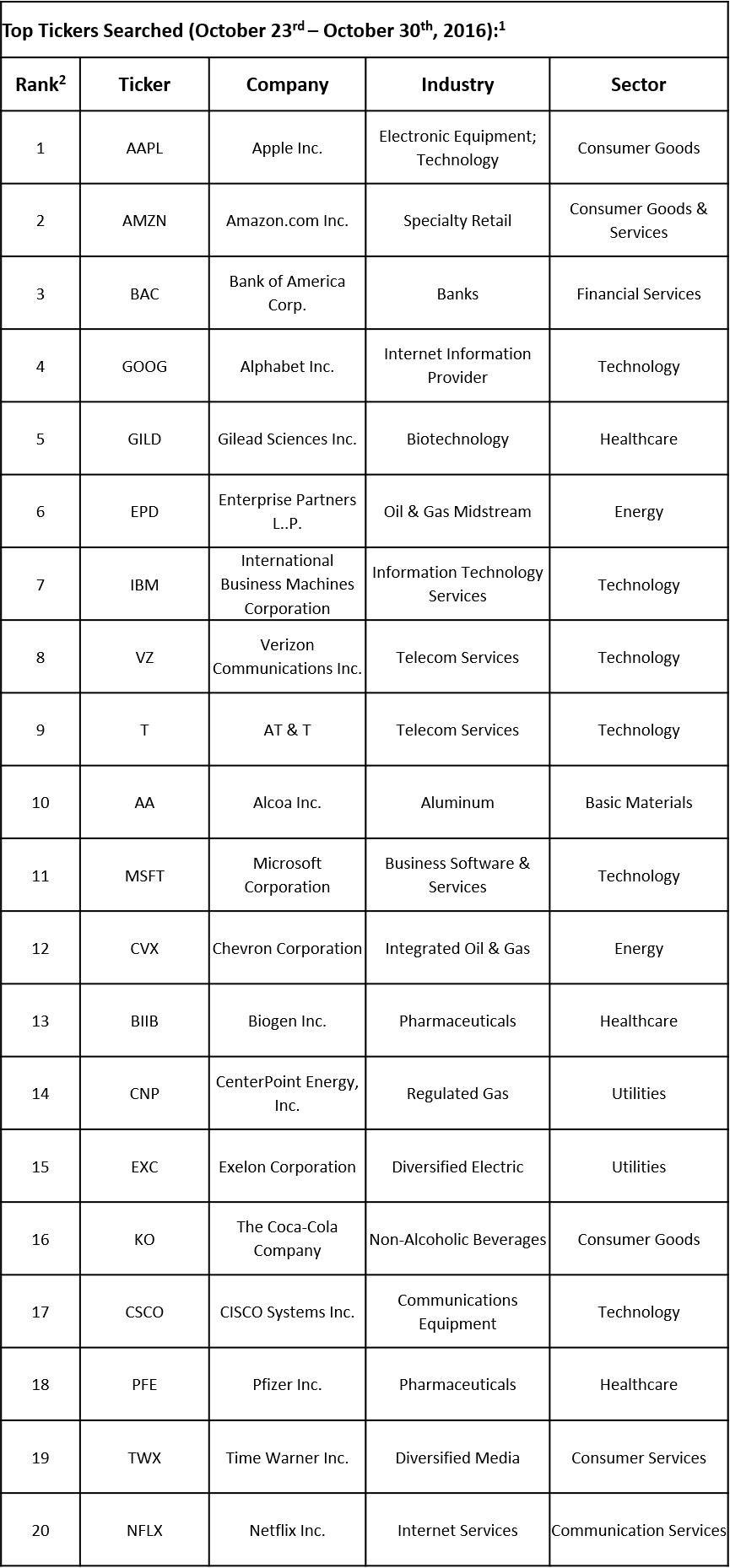

Nevertheless, the spotlight is focused on the earnings season as it could be seen by looking at TrackStar’s last-week compilation of the 20 most searched tickers among financial advisors. Affected by disappointing results by a number of companies, S&P 500 lost around 0.70% between Monday and Friday, while Dow Jones ended the week slightly in the green.

Click here to receive this data on a weekly basis.

The data presented by TrackStar, the official newsletter of Investing Channel’s Intuition division, showed Apple Inc (NASDAQ:AAPL) and Amazon.com, Inc. (NASDAQ:AMZN) as the most searched tickers in the trading week between October 24 and October 28. Both stocks reported their financial results last week and both disappointed investors, who sent the stocks lower on the back of the results. Alphabet Inc. (NASDAQ:GOOG) also captured the attention of financial advisors and ranked on the fourth spot in connection with its financial results. From the energy sector, a newcomer to the top-20 list was Enterprise Partners L..P. (NYSE:EPD), which released results close to in-line with expectations.

Since it ranked as the most popular ticker and was in the spotlight not just because of its financial results, but also for another reason, in this article we will discuss Apple Inc (NASDAQ:AAPL) in more detail. Apple’s stock lost around 3% last week, which offset its year-to-date gains to 4.50%. The main reason for the decline were the financial results posted on Tuesday after the closing bell. Even though Apple managed to top both EPS and revenue estimates, it also showed the third straight quarter of an annual revenue drop, which was a disappointment for investors. The company posted EPS of $1.67 on revenue of $46.9 billion for the fourth quarter of fiscal 2016, only slightly above the consensus estimates of $1.66 and $46.94 billion, respectively. The revenue slid by 8.9% year-on-year, a slightly lower decline compared to 14.5% and 12.8% reported in the past two quarters. In terms of outlook, Apple expects revenue between $76 billion and $78 billion for the first fiscal quarter.

The sales of iPhones, a key metric that is watched in Apple’s quarterly reports, showed a figure of 45.5 million units, which was higher than estimates of 44.8 million, but was also 5% down from the figure it had reported for the same quarter of fiscal 2015. Nevertheless, the figure provided more hope for investors that the latest iPhone 7 may help Apple turn smartphone sales around and the bet is that the company will be able to boost the sales in the upcoming holiday season. Even though, Samsung had to scrap its Galaxy Note 7, Apple will still have to compete with Google’s recently-released Pixel phone. With Google’s entrance in a more direct competition with Apple and uncertainty over Samsung’s next move after the Note 7 fiasco, will likely increase investors’ and market experts’ attention towards the smartphone industry in the coming months.

Another reason why Apple was in the spotlight was its October 27 event, where it presented a new version of its MacBook Pro, the key feature of which is a thin touch display above the keyboard called the Touch Bar, which replaces the function keys and includes the TouchID, allowing users to log in via fingerprint sensor. The Touch Bar will display an array of controls that can be changed depending on user’s necessities. The price of the new MacBook starts at $1,799 for a 13-inch version, while the 15-inch version will start at $2,399. Apple is also offering upgraded MacBook’s without the Touch Bar. Even though Mac sales represent just 11% of Apple’s total revenue, MacBooks are and will always be a key element of Apple’s ecosystem.

CLICK HERE to subscribe to TrackStar and receive this data directly in your inbox!

Intuition is a global research, education, technology and creative solutions business, from InvestingChannel, Inc., that invests in intelligence to make the art of human-driven communication and decision-making more intuitive in financial services.

1Disclaimer: This newsletter is for information purposes only and opinion based on a financial advisor data across a selection of websites. Investors should be cautious about any and all investments and are advised to conduct their own due diligence prior to making any investment decisions.

2Rank is determined solely by highest amount of ticker searches by financial advisors in the given week across a selection of websites through our database