Today we’re going to take on one of the biggest investing myths there is—and expose this so-called “gospel” for the dangerous falsehood it really is.

It goes like this: diversification protects you from big losses in a downturn, but that “shield” costs you in the form of income and missed gains.

Well, I’m here to tell you that this statement couldn’t be more wrong. The truth is, you can have both.

I’ll tell you how in a moment. Then I’ll show you 6 unsung funds that hand you instant diversification plus market-beating gains and a special extra bonus: a dividend yield that triples up the payout on the average S&P 500 stock.

That’s right: a retirement-friendly 6% cash payout! Enough to hand you $2,500 a month on a $500,000 investment.

I know this sounds like a tall order, but it’s 100% achievable, even, dare I say, easy.

But before we go further, let’s spell out exactly what we mean by “diversification.”

For a lot of people, it simply means buying a fund that holds a lot of stocks, like the SPDR S&P 500 ETF (SPY). The thinking goes something like this: “I’ve got 500 stocks, so there’s no way I can lose a ton of cash, right?”

Wrong.

The problem is that this isn’t real diversification. Sure, you’ve got stocks in 500 companies—but you’re still holding only stocks. And the reality is that stocks go down more than any other investment during rough economic times.

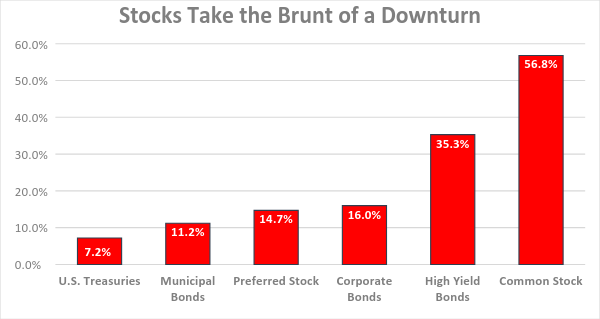

In the chart below, we’ve got 6 asset classes that would give you a diversified portfolio if you held all of them. They are: US Treasuries, municipal bonds, preferred stocks, corporate bonds, high-yield (or “junk”) bonds and common stocks.

(You can go even further and add international exposure—including in the one part of the world I pounded the table on in my October 25 article—but for simplicity, we’ll keep the focus on the good old U.S. of A. today.)

Source: Contrarianoutlook.com; all calculations are from recent peak to bottom prices during downturns from 1979–2017.

As you can see, the maximum loss from the highest level is massive for common stocks—a whopping 56.8% drop!

It’s no surprise that Treasuries see the smallest loss, since federal government bonds are the safest investment on earth. Municipal bonds are pretty close, so their similar decline makes sense. And corporate debt instruments—preferreds and bonds—are snugly in the middle, with junk bonds the worst of them all.

Again, no surprises here.

But what you should really pay attention to is how adding these different asset classes together protects your portfolio from a huge loss. Even if you don’t cash out during a bear market, like a lot of retirees were forced to in 2007–09, you still face an uphill battle to recover those losses.

Why? Because a 50% portfolio loss means you’ll need a 100% gain to make up for it! And if your stock portfolio fell 56.8%, you’d need 131.5% just to get back to where you started!

This is exactly why savvy investors don’t just buy stocks; you need a lot of different asset classes to protect your hard-earned—and hard-saved—cash.

Deciphering the Diversification Riddle

So let’s go ahead an address the question of diversification and the size of our return now—because the answer isn’t as straightforward as you’d think.

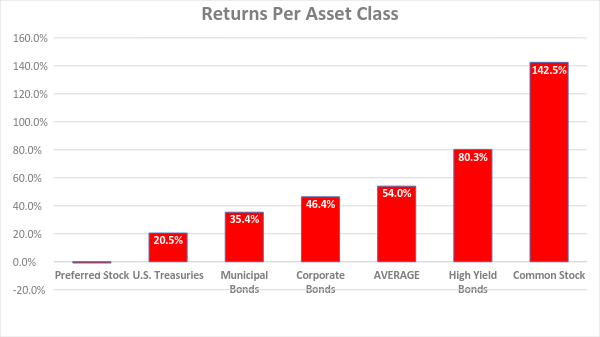

If you just buy passive index funds, the answer is, yes, diversification will depress your return. To demonstrate this, let’s go back to the indexes for these 6 asset classes and see how they’ve performed over the last 8 years.

The Clear Winner: Stocks

With gains more than double the average of our other 5 asset classes, the S&P 500 was the clear winner. So if you bought equal amounts of each of these assets in 2010 and held them to today, your profits would be 54%—much lower than you’d get from stocks alone:

Source: Contrarianoutlook.com

So if you just diversify by tracking the indexes, you’re going to leave a lot of money on the table. That’s the price of smaller declines during bear markets.

But before you start questioning whether you should diversify into these other 5 investments at all, read on, because there’s a better answer—one that gives you the market-beating gains, income and downside protection I mentioned off the top.

I’m talking about…

The CEF Alternative

The answer to the diversification riddle is simple: skip the indexes and go back to the good old-fashioned strategy of picking winning funds managed by superior teams.

If that sounds outdated, keep in mind that this approach not only yields a more diversified portfolio but also a superior return relative to just buying the indexes. It also delivers a higher income stream, to the tune of $2,500 a month on a $500,000 investment!

This, by the way, is why billionaires and professional investment managers prefer this approach to the passive index fund craze the middle class is being herded into.

And the best way to do it is through closed-end funds, or CEFs. (If you’re unfamiliar with these funds, click here to check out my complete primer on them—including how they can triple your income and give your gains a continuous yearly boost.)

CEFs are a small group of funds that provide a large income stream while delving into other investments that go well beyond stocks. And the best ones offer superior returns, too.

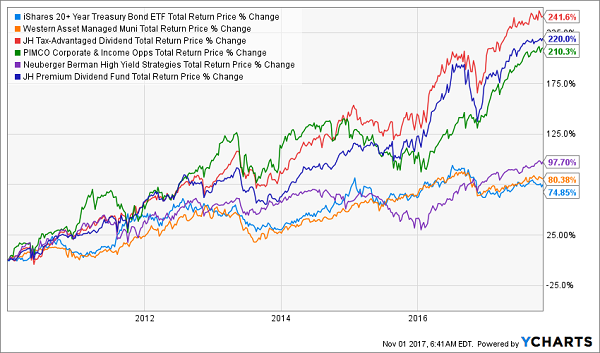

To prove this, I’ve taken a top-notch fund from each asset class and blended them into a diversified portfolio.

These funds are: the Western Asset Managed Municipals Fund (MMU) for muni bonds, the JH Tax-Advantaged Dividend Fund (HTD) for stocks, the PIMCO Corporate & Income Opportunity Fund (PTY) for corporate bonds, the Neuberger Berman High Yield Strategies Fund (NHS) for junk bonds and the JH Premium Dividend Fund (PDT) for preferred stocks.

There isn’t a CEF for US Treasuries, so to pick up that part of the portfolio, we’ll add the iShares 20+ Year Treasury Bond ETF (TLT). That gets us a 6-fund portfolio with exposure to all the major asset classes the smart money focuses on.

Now, if we had bought these 6 funds 8 years ago, what kind of returns would we have bagged?

The answer: big ones.

Massive Returns Across the Board

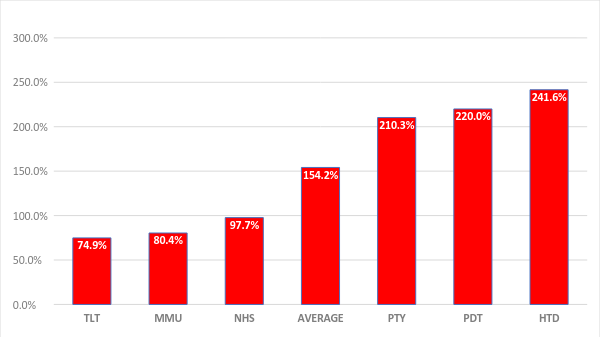

This “best-of-breed” portfolio includes 3 funds that crush S&P 500 index funds, and all 6 funds beat their indexes. On average, this portfolio delivered a 154.2% total return!

Source: Contrarianoutlook.com

Not only is our diversified CEF investment giving us the diversity we need to avoid the extreme crashes that strike common stocks, but we’re also getting a superior return—154.2% versus the S&P 500’s 142.5%.

We’re also getting a superior cash flow from this portfolio, too. On average, these funds pay a 6% dividend yield, so we’re getting a bigger income stream than the S&P 500 while also facing a lower risk of a major loss.

The bottom line? Not only is diversification an important defense, but it can also be an incredible offense that boosts your wealth.

Just Released: My Top 4 CEFs for 2018 (BIG 30%+ profits ahead!)

The 5 CEFs I just told you about are all near the top of the class—which is why I’m considering adding them to my CEF Insider service’s 35-fund Watch List now—but they don’t quite qualify yet.

To get there, they’ll need higher dividends, for starters, like my just-released 4-pack of top funds for 2018. These 4 “sleeping giants” boast outsized 7.4% dividends, on average!

And that’s not all: all 4 also trade at better discounts to their net asset value now!

We don’t have to get into the weeds here; that just means these 4 funds’ market prices are way below the value of the assets they actually own! That’s a bizarre situation that simply can’t continue.

When investors come to their senses, they’ll bid those bizarre discounts shut … and propel us to 22%+ gains in 2018—and that doesn’t include the 7.4% in CASH you’ll pocket from their dividends!

But these 4 hidden gems are already starting to see their discounts narrow. There’s not much time! You NEED to click here and make sure you get the names of all 4 of these 7.4% yielders now!