There seems to be a widespread view that employment is a lagging indicator of changes in the business cycle. But it’s not clear why.

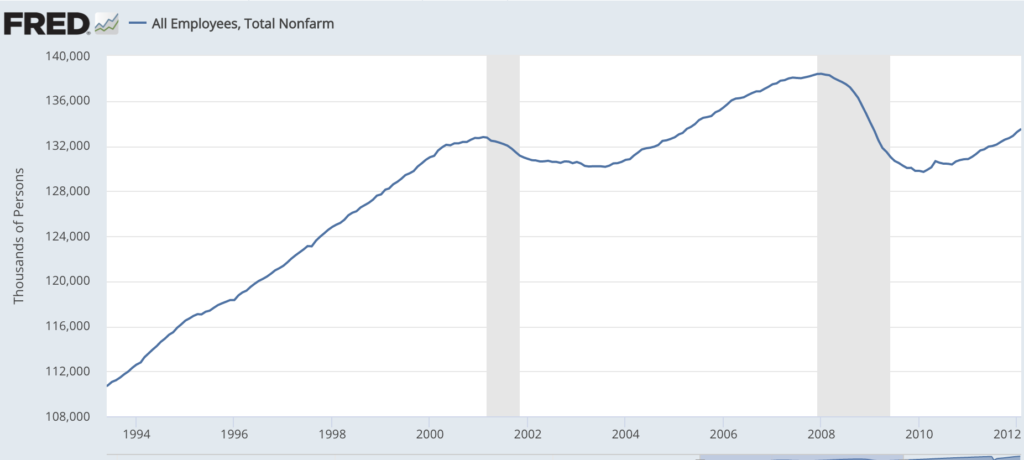

In March of 2020, payroll employment fell immediately as the economy was hit by Covid. While that was an unusual case, the 2007-09 recession was not much different. Payroll employment peaked in January 2008, just one month into the downturn. More importantly, the growth rate of payroll employment slowed sharply in the 6 months before the onset of recession. Between June and December 2007, only 323,000 jobs were created, which is far below trend.

The same pattern occurred prior to the previous recession, which began in March 2001. Payroll employment grew by only 642,000 in the 10 months between May 2000 and March 2001. Total payroll employment actually peaked in February 2001, a month before the business cycle peak.

Thus when there is no unexpected shock like Covid, it seems as though employment growth tends to slow well before the onset of recession. This is important, as the current rate of growth in employment is still far above trend. If the previous pattern were to hold this time around, then we would be at least 6 to 10 months from the onset of recession, even if employment growth immediately fell to below the trend rate of growth (which is probably no more than 100,000/month.). Now consider that Bloomberg has argued that a US recession is 100% certain by October of this year. Maybe so, but how do they know this?

I am skeptical of claims that we can predict recessions, and I don’t put a lot of weight on the pattern observed in previous business cycles. But I’m a bit puzzled that people tend to view employment as a lagging indicator. Where does this view come from? It certainly seems to have been a leading indicator in the two recessions that preceded Covid.