Note: I’ll post a summary for last week later today.

The key report next week is the November employment report to be released on Friday. Other key reports include November auto sales on Monday, the November ISM manufacturing index, and the November ISM service index.

The November employment report will probably be negatively impacted by Hurricane Sandy, but November auto sales probably saw a boost from the storm.

The Q3 Flow of Funds report will be released on Thursday.

The FDIC is expected to release the Q3 Quarterly Banking Profile this week.

—– Monday, Dec 3rd —–

10:00 AM ET: ISM Manufacturing Index for November.

10:00 AM ET: ISM Manufacturing Index for November.

Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in October. The PMI was at 51.7%, up from 51.5% in September. The employment index was at 52.1%, down from 54.7%, and the new orders index was at 54.2%, up from 52.3%. The consensus is for be PMI to be unchanged at 51.7. (above 50 is expansion).

10:00 AM: Construction Spending for October. The consensus is for a 0.4% increase in construction spending.

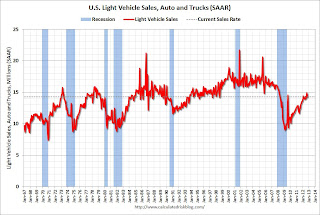

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 15.0 million SAAR in November (Seasonally Adjusted Annual Rate) from 14.2 million in October (October sales were impacted by Hurricane Sandy).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

TrueCar is forecasting:

The November 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 15.2 million new car sales, up from 13.5 million in November 2011 and up from 14.3 million in October 2012

—– Tuesday, Dec 4th —–

10:00 AM: Trulia Price Rent Monitors for November. This is the index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

—– Wednesday, Dec 5th —–

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 125,000 payroll jobs added in November. This is the second report using the new methodology, and the report last month (158,000) was fairly close to the BLS report for private employment (the BLS reported 184,000 private sector jobs added in November).

10:00 AM: Manufacturers’ Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1% decrease in orders.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a decrease to 53.6 from 54.2 in October. Note: Above 50 indicates expansion, below 50 contraction.

—– Thursday, Dec 6th —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 380 thousand from 393 thousand.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

—– Friday, Dec 7th —–

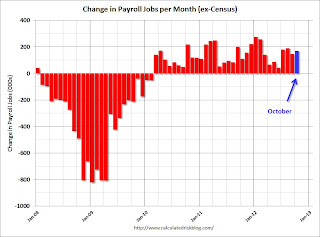

8:30 AM: Employment Report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November; there were 171,000 jobs added in October. The October reference period was before Hurricane Sandy, and the impact from Sandy will show up in the November report.

8:30 AM: Employment Report for November. The consensus is for an increase of 80,000 non-farm payroll jobs in November; there were 171,000 jobs added in October. The October reference period was before Hurricane Sandy, and the impact from Sandy will show up in the November report.

The consensus is for the unemployment rate to increase to 8.0% in November, up from 7.9% in October.

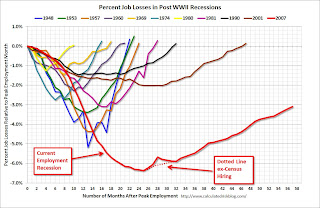

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

The economy has added 5.4 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.9 million total jobs added including all the public sector layoffs).

The economy has added 5.4 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.9 million total jobs added including all the public sector layoffs).

There are still 3.45 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

9:55 AM: Reuter’s/University of Michigan’s Consumer sentiment index (preliminary for December). The consensus is for sentiment to increase slightly to 83.0.

3:00 PM: Consumer Credit for October. The consensus is for credit to increase $10.0 billion.