Earlier:

• Summary for Week Ending Dec 14th

This will be a very busy week for economic data. There are three key housing reports to be released this week: December homebuilder confidence on Tuesday, November housing starts on Wednesday, and November existing home sales on Thursday.

For manufacturing, the December NY Fed (Empire state), Philly Fed, and the Kansas City Fed surveys will be released this week.

The third estimate of Q3 GDP will be released on Thursday, and the November Personal Income and Outlays report will be released on Friday.

—– Monday, Dec 17th —–

8:30 AM: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 0, up from minus 5.2 in November (below zero is contraction).

—– Tuesday, Dec 18th —–

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 47, up from 46 in November. Although this index has been increasing sharply, any number below 50 still indicates that more builders view sales conditions as poor than good.

—– Wednesday, Dec 19th —–

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

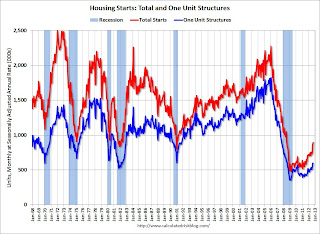

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Single-family starts decreased slightly to 594 thousand in October.

The consensus is for total housing starts to decline to 865,000 (SAAR) in November, down from 894,000 in October.

During the day: The AIA’s Architecture Billings Index for November (a leading indicator for commercial real estate).

—– Thursday, Dec 20th —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 359 thousand from 343 thousand last week. If correct, this would put the 4-week just above the low for the year.

8:30 AM: Q3 GDP (third estimate). This is the third estimate from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, up slightly from the 2.7% second estimate.

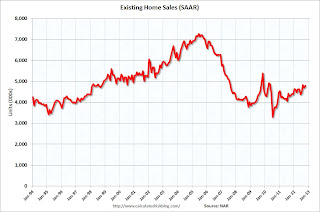

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR).

The consensus is for sales of 4.90 million on seasonally adjusted annual rate (SAAR) basis. Sales in October 2012 were 4.79 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 5.05 million SAAR.

A key will be inventory and months-of-supply.

10:00 AM: Philly Fed Survey for December. The consensus is for a reading of minus 2.0, up from minus 10.7 last month (above zero indicates expansion).

10:00 AM: Conference Board Leading Indicators for November. The consensus is for a 0.2% decrease in this index.

10:00 AM: FHFA House Price Index for October 2012. This was original a GSE only epeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.3% increase in house prices.

—– Friday, Dec 21st —–

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% increase in durable goods orders.

8:30 AM ET: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income in November, and for 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:55 AM: Reuter’s/University of Michigan’s Consumer sentiment index (final for December). The consensus is for a reading of 75.0.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2012

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The consensus is for a reading of -3, up from -6 in November (below zero is contraction).