Inquiring minds are digging into social security trends including the numbers of beneficiaries, average costs, total costs, number of workers, and the ratio workers to beneficiaries.

First, let’s take a look at the CNS News report Social Security Ran $47.8 Billion Deficit in Fiscal Year 2012.

The Social Security program ran a $47.8 billion deficit in fiscal 2012 as the program brought in $725.429 billion in cash and paid $773.247 for benefits and overhead expenses, according to official data published by Social Security Administration.

The Social Security Administration also released new data revealing that the number of workers collecting disability benefits hit a record 8,827,795 in December–up from 8,805,353 in November.

With that backdrop, let’s look at the actual data to see the underlying trends.

Data Notes

- Social Security data from Social Security Online.

- Employment data from St. Lois Fed Total Nonfarm Employees.

Social Security Beneficiaries December 2012

| OASI Trust Fund | ||

|---|---|---|

| Retired Workers & Dependents | Retired Worker | 36,719,288 |

| Spouse | 2,280,332 | |

| Child | 612,087 | |

| Subtotal | 39,611,707 | |

| Survivors | Child | 1,907,097 |

| Aged Widow(er) | 3,937,958 | |

| Young Widow(er) | 153,628 | |

| Disabled Widow(er) | 255,472 | |

| Parent | 1,427 | |

| Subtotal | 6,255,582 | |

| Total OASI | 45,867,289 | |

| DI Trust Fund | ||

| Disabled Worker | 8,827,795 | |

| Spouse | 162,881 | |

| Child | 1,900,220 | |

| Total DI | 10,890,896 | |

| Total OSASI + DI | 56,758,158 | |

Social Security Beneficiaries, Costs, Employment

| Year | Beneficiaries | Average Monthly Benefit | Total Annual Cost | Employment | E/B Ratio |

|---|---|---|---|---|---|

| Dec-67 | 22,979 | $73.92 | $20,383,201,682 | 66,900 | 2.9114 |

| Dec-68 | 23,886 | $85.24 | $24,432,839,002 | 69,245 | 2.8989 |

| Dec-69 | 24,709 | $86.47 | $25,638,687,737 | 71,240 | 2.8832 |

| Dec-70 | 25,701 | $101.35 | $31,257,463,769 | 70,790 | 2.7544 |

| Dec-71 | 26,817 | $113.22 | $36,435,282,006 | 72,108 | 2.6888 |

| Dec-72 | 28,066 | $138.70 | $46,712,482,840 | 75,270 | 2.6819 |

| Dec-73 | 29,514 | $143.99 | $50,996,092,215 | 78,035 | 2.6440 |

| Dec-74 | 30,576 | $163.02 | $59,813,483,661 | 77,657 | 2.5398 |

| Dec-75 | 31,862 | $179.29 | $68,549,741,469 | 78,017 | 2.4486 |

| Dec-76 | 32,835 | $194.95 | $76,815,361,682 | 80,448 | 2.4500 |

| Dec-77 | 33,923 | $211.16 | $85,958,416,484 | 84,408 | 2.4882 |

| Dec-78 | 34,453 | $229.86 | $95,032,473,435 | 88,674 | 2.5738 |

| Dec-79 | 35,013 | $258.37 | $108,555,575,502 | 90,669 | 2.5896 |

| Dec-80 | 35,526 | $300.75 | $128,213,644,374 | 90,936 | 2.5597 |

| Dec-81 | 35,930 | $340.84 | $146,956,770,724 | 90,884 | 2.5295 |

| Dec-82 | 35,778 | $372.10 | $159,755,010,234 | 88,756 | 2.4808 |

| Dec-83 | 36,034 | $393.15 | $170,001,091,973 | 92,210 | 2.5590 |

| Dec-84 | 36,439 | $412.21 | $180,244,135,062 | 96,087 | 2.6370 |

| Dec-85 | 37,027 | $429.35 | $190,768,953,436 | 98,587 | 2.6626 |

| Dec-86 | 37,683 | $438.76 | $198,407,802,022 | 100,484 | 2.6665 |

| Dec-87 | 38,171 | $461.35 | $211,323,314,397 | 103,634 | 2.7150 |

| Dec-88 | 38,613 | $484.01 | $224,268,374,172 | 106,871 | 2.7678 |

| Dec-89 | 39,141 | $511.89 | $240,431,129,294 | 108,809 | 2.7799 |

| Dec-90 | 39,825 | $544.52 | $260,224,095,454 | 109,120 | 2.7400 |

| Dec-91 | 40,587 | $568.55 | $276,908,006,552 | 108,262 | 2.6674 |

| Dec-92 | 41,504 | $588.90 | $293,296,976,201 | 109,416 | 2.6363 |

| Dec-93 | 42,243 | $607.48 | $307,943,241,597 | 112,204 | 2.6561 |

| Dec-94 | 42,882 | $628.14 | $323,229,663,108 | 116,055 | 2.7064 |

| Dec-95 | 43,386 | $648.77 | $337,772,228,816 | 118,208 | 2.7246 |

| Dec-96 | 43,736 | $672.81 | $353,113,695,411 | 121,002 | 2.7666 |

| Dec-97 | 43,971 | $692.82 | $365,565,297,977 | 124,357 | 2.8282 |

| Dec-98 | 44,246 | $707.39 | $375,585,941,872 | 127,359 | 2.8785 |

| Dec-99 | 44,595 | $730.53 | $390,940,040,819 | 130,533 | 2.9270 |

| Dec-00 | 45,415 | $767.35 | $418,187,686,581 | 132,481 | 2.9171 |

| Dec-01 | 45,877 | $795.69 | $438,050,881,510 | 130,720 | 2.8493 |

| Dec-02 | 46,444 | $815.05 | $454,253,081,458 | 130,175 | 2.8028 |

| Dec-03 | 47,038 | $840.62 | $474,497,794,254 | 130,259 | 2.7692 |

| Dec-04 | 47,688 | $871.80 | $498,889,778,321 | 132,316 | 2.7746 |

| Dec-05 | 48,434 | $915.71 | $532,222,768,675 | 134,814 | 2.7834 |

| Dec-06 | 49,123 | $955.53 | $563,260,007,133 | 136,882 | 2.7865 |

| Dec-07 | 49,865 | $987.03 | $590,618,750,824 | 137,982 | 2.7671 |

| Dec-08 | 50,898 | $1,054.38 | $643,995,009,294 | 134,379 | 2.6401 |

| Dec-09 | 52,523 | $1,064.41 | $670,869,765,261 | 129,319 | 2.4621 |

| Dec-10 | 54,032 | $1,074.33 | $696,579,633,240 | 130,346 | 2.4124 |

| Dec-11 | 55,404 | $1,122.89 | $746,557,638,566 | 132,186 | 2.3858 |

| Dec-12 | 56,758 | $1,152.79 | $785,163,217,034 | 134,021 | 2.3613 |

Notes for Above Table

Employment and beneficiary numbers are in thousands.

Total annual cost is monthly benefit * 12 * number of beneficiaries

Average Monthly Social Security Benefit

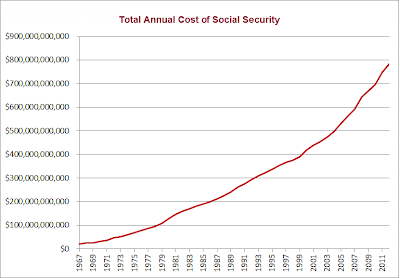

Total Annual Cost of Social Security 1967-Present

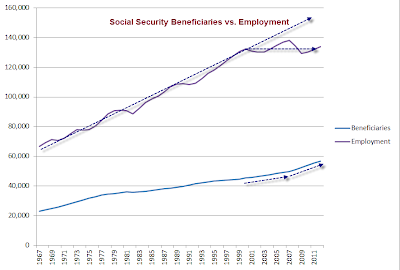

Social Security Beneficiaries vs. Total Non-Farm Employment

Ratio of Workers to Social Security Beneficiaries

Social Security Benefits Analysis

- The ratio of workers to beneficiaries peaked in 1999 at 2.927 to 1.

- The ratio of workers to beneficiaries was 2.361 to 1 at the end of 2012.

- The ratio of workers to beneficiaries is falling fast and will continue to fall fast for a decade as the baby boomer population ages.

- The average payout and the number of payouts are both rising fast

- Total Social Security payouts (a multiplication of two rising numbers) are on an unsustainable exponential growth path.

The system is currently running a deficit. Trends say that deficit is going to worsen with each passing year unless benefits are cut and/or taxes are hiked.