Bank of Japan to Adopt 2% Inflation Target

Bloomberg reports Yen Falls to Lowest Since 2010 on Stimulus

The yen reached the weakest since June 2010 versus the dollar after Japanese Prime Minister Shinzo Abe’s government said it will spend 10.3 trillion yen ($116 billion) in new stimulus efforts that tend to weaken a currency.

The yen headed for a ninth weekly decline, the longest losing streak since 1989, on speculation the Bank of Japan (8301) is also preparing measures to spur growth.

Japan’s government will spend about 3.8 trillion yen on disaster prevention and reconstruction, and 3.1 trillion yen on stimulating private investment and other measures, the Cabinet Office said in a statement.

The Bank of Japan is set to adopt the 2 percent inflation target advocated by Abe, doubling its existing goal of 1 percent, without setting a deadline for achieving it, according to people familiar with discussions within the central bank. They requested anonymity because the talks are private. The BOJ meets on Jan. 21-22.

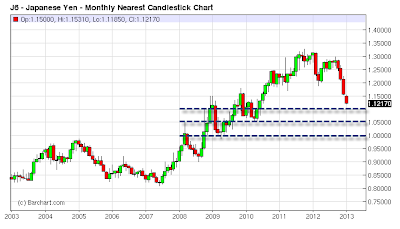

Yen Monthly Chart

click on chart for sharper image

Where to From Here?

From a technical standpoint, there is support at 1.10, at 1.05, and again at 1.00. Short-term, I would expect it to bounce at one of those levels, perhaps all three, as anti-yen sentiment is extreme.

Bear in mind, the ultimate fate of the Yen depends on what Japan does, not what Japan says.

Advocating a 2% inflation target and actually taking measures to achieve that target are two different things. From my perspective, prime minister Shinzo Abe seems determined to do just that.

Moreover, there will be changes at the central bank, and you can expect those changes to be more dovish, weakening the Yen. The counterpoint is that the Japanese central bank has actually been far more conservative than the Fed, ECB, and the Central bank of China.

Certainly, the Fed and ECB have pulled some pretty dramatic stunts, but speculation now is the Fed may be concerned about the growing size of its balance sheet. (For a discussion, please see Yield Curve: Where To From Here? Extreme Complacency in Face of Bernanke Shift).

Japan is in serious trouble in regards to demographics and balance of trade issues. Here are a couple of posts that layout the case in detail.

Coming Devaluation of the Yen

- End of the Debt Supercycle and a Coming Massive Devaluation of the Yen; Most Difficult Time to Invest; The Belief Bubble

- Interview with Kyle Bass on Gold, Hugely Profitable Asymmetric Bets on US Subprime and Europe, and his next Asymmetric Bet on Japan

The counter-argument, proposed by my friend Pater Tenebrarum, is The Yen – What Everybody Knows Probably Isn’t Worth Knowing.

The question is: what does “everybody” know (or even believe)?

I happen to believe Shinzo Abe is serious. Perhaps he isn’t. Perhaps the Bank of Japan remains more sensible than Western-world counterparts. Again, I have my doubts.

Any indication (even if incorrect), that Japan is talking but won’t really act could send the Yen higher.

Moreover, anti-yen sentiment is so extreme now, that there could be a short-term bounce for technical reasons, even if Japan follows through on its threats.

Long-term, I see no reason to change my belief the Yen is in serious trouble.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

“Wine Country” Economic Conference Hosted By Mish

Click on Image to Learn More