Inquiring minds are digging into the Philadelphia Fed Manufacturing Survey for January 2013.

Business outlook Survey, Current and 6 Months From Now

| Philadelphia Fed Business Outlook Survey | January vs. December | Six Months From Now vs. January | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dec Index | Increase | No Change | Decrease | Jan Index | Dec Index | Increase | No Change | Decrease | Jan Index | |

| What is your evaluation of the level of general business activity? | 4.6 | 24.4 | 45.4 | 30.2 | -5.8 | 23.7 | 42.9 | 38.1 | 13.8 | 29.2 |

| New Orders | 4.9 | 26.8 | 42.2 | 31.1 | -4.3 | 28.3 | 45.1 | 36.1 | 12.5 | 32.5 |

| Shipments | 14.7 | 26.0 | 41.2 | 25.6 | 0.4 | 28.0 | 49.1 | 35.4 | 10.2 | 38.9 |

| Unfilled Orders | -2.0 | 12.2 | 70.4 | 13.2 | -1.0 | 2.7 | 13.3 | 64.7 | 10.4 | 2.9 |

| Delivery Times | -6.0 | 8.5 | 73.4 | 10.5 | -2.0 | 2.5 | 6.0 | 71.3 | 14.4 | -8.5 |

| Inventories | -7.8 | 9.1 | 74.4 | 15.6 | -6.5 | -2.5 | 18.9 | 50.8 | 21.2 | -2.3 |

| Prices Paid | 23.5 | 20.1 | 71.0 | 5.4 | 14.7 | 45.8 | 38.0 | 51.2 | 3.7 | 34.3 |

| Prices Received | 12.4 | 7.9 | 83.0 | 9.0 | -1.1 | 25.6 | 28.9 | 57.8 | 7.2 | 21.7 |

| Number of Employees | -0.2 | 10.6 | 70.5 | 15.8 | -5.2 | 11.2 | 22.2 | 59.8 | 11.6 | 10.7 |

| Average Employee Workweek | 0.4 | 9.1 | 72.5 | 17.4 | -8.3 | 14.4 | 19.9 | 63.2 | 11.0 | 8.9 |

| Capital Expenditures | — | — | — | — | — | 10.4 | 23.3 | 50.7 | 17.3 | 6.0 |

Observations

- The business conditions index is solidly in the red following an increase in December

- New orders are in contraction

- Prices received is in contraction

- Shipments are treading water

- The only component solidly in the green is prices paid. This is indicative of a margin squeeze on producers who cannot pass on costs.

Unwarranted Future Optimism

Please note the current index is -5.8 but future expectations rose from 23.7 to 29.2. That rise is indicative of unwarranted rampant optimism that will not pan out. Here’s five reasons.

- The economy is slowing already and payroll tax hikes will subtract .8% or more from GDP.

- Cuts from sequestration (probably minimal but possibly not) will also subtract from GDP.

- GDP is barely treading water already (see Global PC Shipments Decline 6.4%; Best Buy Sales Flat; Toys R Us Sales Decline 4.5%; 4th Quarter GDP Estimate Reduced to .8% from 1.5%).

- There is no pent-up demand for autos or much of anything else after this three-year Fed-sponsored boom.

- Europe is a basket case and China is slowing, so growth from exports is unlikely.

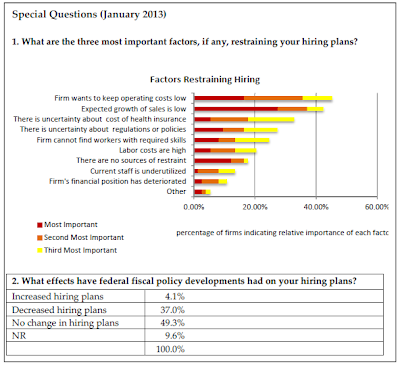

Hiring Plans Special Questions

click on chart for sharper image

Top Three Reasons for Hiring Reluctance

- Over 40% of respondents said they are reluctant to hire because they want to keep operating costs low.

- Over 40% of respondents said they are reluctant to hire because expected growth of sales is slow.

- Over 30% of respondents said they are reluctant to hire because of Obamacare

Note that only 4.1% of firms increased hiring plans while 37% decreased hiring plans. Curiously, future optimism is high, but hiring plans don’t match.

I suggest hiring plans are a better indicator.

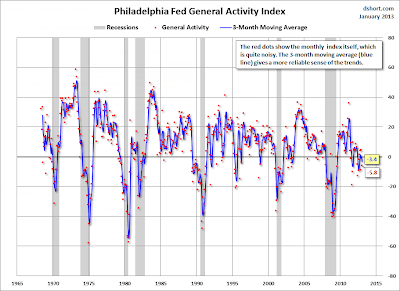

3-Month Moving Average Suggests Recession

Here is a chart from Doug Short at Advisor Perspectives that will help put the Philadelphia Fed index in proper historic perspective.

click on chart for sharper image

Doug writes “The average absolute monthly change across this data series is 7.9, which suggests that the 10.4 point change from last month carries additional significance.“

I would add, the November and December data point are suspect and likely related to Obamacare and other artifacts shifting production into 2012 from 2013.

Regardless, please extend an imaginary line from -5.8 across the chart.

Adding fuel to the recession-debate fire, note that 7 out of 8 times the 3-month moving average hit that low, the economy was already in recession. The one miss was mid-1990s.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com