This was a light week for economic data. The key release was the December trade report showing a smaller than expected trade deficit, and suggesting upwards revisions to the Q4 GDP report. From Brad Plumer at the WaPo: Good news! The economy probably didn’t shrink last quarter, after all

[N]ew trade data released Friday suggests that the U.S. economy actually grew between October and December.

When the Bureau of Economic Analysis initially calculated fourth-quarter GDP, it assumed that the U.S. trade deficit had actually widened … As a result, many analysts expect the government to show positive growth when the BEA revises its numbers next month. Capital Economics projects that the U.S. economy actually grew at a 0.2 percent annualized pace in the fourth quarter of 2012, while Macroeconomic Advisers is expecting 0.5 percent growth.

Not a big change, but probably a change in the sign! (minus to positive)

Other data was also positive: the 4-week average of initial weekly unemployment claims dropped to the lowest level in almost five years, and the ISM service survey showed expansion.

Not much data, but mostly positive.

And here is a summary of last week in graphs:

• Trade Deficit declined in December to $38.5 Billion

The Department of Commerce reported:

[T]otal December exports of $186.4 billion and imports of $224.9 billion resulted in a goods and services deficit of $38.5 billion, down from $48.6 billion in November, revised. December exports were $3.9 billion more than November exports of $182.5 billion. December imports were $6.2 billion less than November imports of $231.1 billion.

The trade deficit was much smaller than the consensus forecast of $46.0 billion.

This graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The decrease in the trade deficit in December was due to both a decline in petroleum and non-petroleum products.

Oil averaged $95.16 in December, down from $97.45 per barrel in November. But most of the decline in the value of petroleum imports was due to a sharp decline in the volume of imports.

Notes: The trade deficit might have been skewed by the LA port strike that started in late November and ended in early December. This does suggest an upward revision to Q4 GDP.

• ISM Non-Manufacturing Index indicates expansion in January

From the Institute for Supply Management: January 2013 Non-Manufacturing ISM Report On Business®

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

The January ISM Non-manufacturing index was at 55.2%, down from 55.7% in December. The employment index increased in January to 57.5%, up from 55.3% in December. Note: Above 50 indicates expansion, below 50 contraction.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly above the consensus forecast of 55.0% and indicates slightly slower expansion in January than in December.

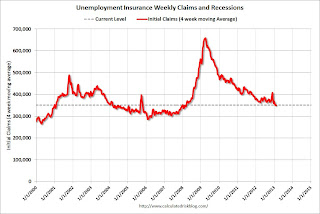

• Weekly Initial Unemployment Claims at 366,000

The DOL reported:

The DOL reported:

In the week ending February 2, the advance figure for seasonally adjusted initial claims was 366,000, a decrease of 5,000 from the previous week’s revised figure of 371,000. The 4-week moving average was 350,500, a decrease of 2,250 from the previous week’s revised average of 352,750.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 350,500.

Weekly claims were above the 360,000 consensus forecast, however the 4-week average is at the lowest level since early 2008.