This is a theme I’ve been discussing for a number of years now – the way the design of the Euro most benefits the current account surplus nations (primarily Germany) and hurts the current account deficit nations. The commentary below is from a recent Albert Edwards note out of Societe Generale.

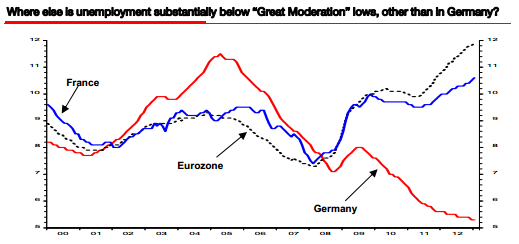

As you can see, there’s an unbelievable divergence in the unemployment rate in Germany when compared to the rest of Europe. That’s not surprising given the fact that Germany can continue to run a substantial current account surplus as the single currency keeps them quite competitive with other nations, but sucks the life out of the current account deficit countries who have no floating exchange rate or internal rebalancing mechanism.

Here’s more from Edwards:

“Most economic analysis concludes, probably correctly, how much more costly it would be for either a creditor or debtor nation to leave the eurozone system compared to struggling on within it. Indeed for Germany, despite becoming increasingly irritated by having to dip their hands into their rapidly fraying pockets, the crisis in the eurozone has been accompanied by the lowest unemployment rates since before re-unification in 1990 (see chart below we wont rehearse the very valid argument that Germany enjoys an

extreme currency undervaluation within the eurozone umbrella). For the German worker with 5.3% unemployment it is a case of crisis, what crisis? But the argument about whether a country will leave the eurozone will not ultimately be an economic decision. Leaving the eurozone will be a decision based on the politics of depression.”

The post The Eurozone Unemployment Rate Divergence appeared first on PRAGMATIC CAPITALISM.